Lithopone market to witness lucrative proceeds from rubber applications

Publisher : Fractovia | Published Date : 2019-07-08Request Sample

The widespread application landscape of lithopone market is supplementing its growth since the last few years. Lithopone serves as a white pigment like opacifier in paper, plastic, rubber production. Owing to some of its specific properties, it is extensively used in paint and coatings domain. Given the projected expansion of this sector due to rising construction activities and escalating urbanization trends, lithopone market size will proliferate in the years to come.

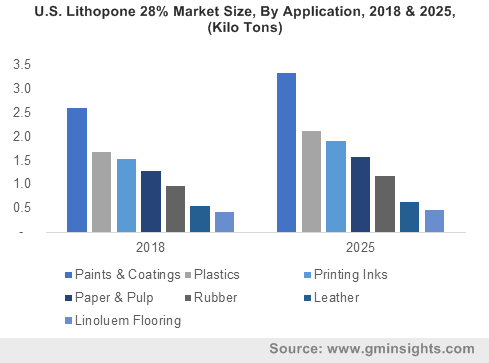

U.S. Lithopone 28% Market Size, By Application, 2018 & 2025, (Kilo Tons)

Recently, coating specialist company Nippon Paint Coating Philippines, Inc. announced the launch of its new protective coating line to satisfy the consumer demands. The firm has more than 70 Nippon Paint companies spread throughout Asia, each company operating together with a strong Pan-Asia presence. Many other construction and paint and coatings companies are undertaking various strategies to extend their global footprint and consumer base. Strategic growth tactics deployed by these companies will increase lithopone market share over the coming years.

Regionally speaking, the number of construction firms operating in the UK has continued to rise, increasing by 6.2% compared with the previous year, with 314,590 firms operating in Great Britain in 2017. This will also lead to an increase in construction activities and simultaneously augment the regional lithopone market share due to considerable rise in the demand for paints and coatings.

Increasing infrastructural projects and commercial construction in the UK will foster the requirement of paints, stimulating UK lithopone market share from paints and coatings application that is forecast to surpass $4.5 million by the end of 2025.

Lithopone has a wide application base, due to its ability to better polymerization brightener effects, and is therefore used to enhance polymer and plastic based goods. Intensifying plastics demand for manufacturing electronic goods, including laptops, television sets, and remotes, will foster product demand, increasing lithopone industry size.

In 2017, plastic production in the world was nearly 348 million tons, out of which Europe contributed for around 64.4 million tons and China being the world’s largest plastic producer, contributed to around 29.4% of world’s plastic production. Rising consumption of plastics in the electronics sector is helping lithopone industry thrive successfully.

Stringent government norms to conserve environment and increase awareness among people pertaining to sustainability will drive lithopone demand. Globally, most governments have banned plastic bags and have instructed to use paper bags or bio bags to decrease carbon footprints in nature. These regulations have been proved to be a positive impetus for accelerating lithopone market growth as the product also helps to improve paper porosity, enhancing paper bags quality to carry goods.

Paper has witnessed increasing global demand owing to the government mandates. In the past 20 years, the use of paper products has amplified from 92 million tons to 208 million, representing a growth of 126 percent. About 69 million tons of paper and paperboard are used in the U.S. each year. More than 2 billion books, 350 million magazines, and 24 billion newspapers are published every year. The application of lithopone in paper production will be consolidated by the increasing demand of paper, thereby augmenting industry outlook.

Lithopone has also found applications in the rubber industry, which helps to increase its market size. Citing the significance of the rubber sector in China, the expansion of the manufacturing industry, especially considering motor vehicles and industrial machinery, will augment lithopone market share. Production of tires in China will continue to rise, since the region is the largest automotive market worldwide, and will create greater demand for higher-priced tires, thus influencing lithopone industry revenue.

According to the National Bureau of Statistics, in China, in March 2019, domestic synthetic rubber production was 503,000 tons, up 2.9% year-on-year. In January-March, domestic synthetic rubber production was 1.352 million tons, up 1.1% year-on-year. The increasing demand of rubber owing to the requirement in different sectors will propel the remuneration share of industry. China lithopone market size from rubber application is anticipated to surpass $3 million by 2025.

Expansion of rubber and plastic production in China, Europe, and numerous other geographies will substantially escalate the growth graph of lithopone market. Increasing usage of paper for making paper bags and rising product application in paint and coatings will drive the industry profits. Estimates claim global lithopone market size to surpass $235 million by 2025.