Lubricant Packaging Market to accrue colossal proceeds from automobiles, APAC to retain its leadership position in the industry over 2017-2024

Publisher : Fractovia | Published Date : 2017-10-16Request Sample

One of the most acclaimed India-based behemoths, Balmer Lawrie, may have just taken a leap to strengthen its stance in lubricant packaging market. The company recently declared its mega-plan of investing close to INR 150 to INR 200 crores in logistics and industrial packaging businesses. With lubricants being one of six verticals encompassed by the firm, its decision of expanding its overall production capacity across all its business segments would prove to have a borderline yet significant impact on lubricant packaging industry. Balmer Lawrie’s long-term expansion plans possibly target at realizing improved revenue from its key business operations, as it aims to touch the turnover benchmark of INR 8000 crore in the next half a decade, heavily consolidating its position in lubricant packaging market. This business space, as claimed by a lubricant packaging market research report, held a valuation of close to USD 11 billion in 2016.

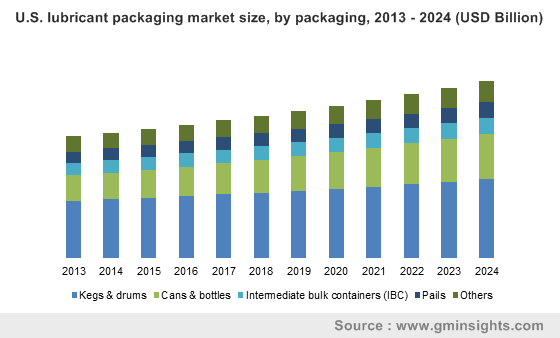

U.S. lubricant packaging market size, by packaging, 2013 - 2024 (USD Billion)

Lubricant packaging industry, ever since its inception has relied on the strategy of innovating newer, advanced products. An intrinsic combination of quality material and metal have led to intermediate bulk containers, cans, bottles, pails, and kegs and drums primarily forming the packaging landscape of lubricant packaging market. As companies strive to bring about the much-demanded diversity in packaging products, it is noteworthy to mention that Mold Tek Packaging, one of the most prominent players in the highly consolidated lubricant packaging market, had already prepped up for manufacturing innovative products much ahead of its time. Having captured a major share in the paints domain, Mold Tek forayed in lubricant packaging industry in 1998. The company supplied plastic pails to well-known names along the likes of Valvoline, ExxonMobil, Shell, and Castrol. Mold Tek’s product line replaced the traditional metal products for quite a while, as the company’s packaging products were endowed with extraordinary features such as a locking system, temper-proof seals, pull up spout, and more, which were patented in the year 2007, marking their official entry in lubricant packaging market.

Lubricant packaging market outlook from automobiles: The end-use segment with immense potential

The automotive sector is one of the most remunerative domains that utilizes lubricants on a mammoth scale, given that they are used to prevent wear and tear of automobile engine components such as shaft, piston, and connecting rods, in addition to reducing friction. Engine oils in fact, are used as lubricants in internal combustion engines of cars, trucks, and other lightweight and heavyweight vehicles, thereby augmenting lubricant packaging market share from the automobile sector. The global production volume of motor vehicles surpassed 95,270,000 in 2016, and has been forecast to increase at a steady pace across myriad geographies. The rising automobile sales and post-purchase maintenance thus, necessitate the requirement of variety packaging on a large scale, making the automobile domain one of the most lucrative end-use spaces of lubricant packaging market. In fact, estimates claim automobile to have been the dominant segment of lubricant packaging industry in 2016, as experts forecast the segment to grow at a CAGR of more than 3% over 2017-2024.

The predominance of automobiles over other end-use domains of lubricant packaging market such as metal fabrication, chemicals, and power generation is quite vividly coherent from the fact that a surplus proportion of product innovations are intended toward being deployed in the automotive zone. For instance, just recently, Lube-Tech, a renowned Golden Valley based company partaking in lubricant packaging industry share has announced the launch of an oil pouch for the C-TEC2 synthetic engine oil branded by Arctic Cat. Apparently, the company believes this product to be the first of its kind that would penetrate the U.S. power sports industry. Having collaborated with Glenroy, Inc. to engineer and develop the stand-up pouch, Lube-Tech, in tandem with Arctic Cat, aimed to produce a durable package that would reinforce the environment friendly and high-performance features of the new engine and oil, be consumer-friendly, convenient, and provide high barrier protection characteristics for securing the integrity of the synthetic oil blend. In consequence, this stand-up pouch with superior waste reduction and shelf impact is anticipated to cause quite a storm in lubricant packaging market, enabling other players to follow suit.

Toward the end of Q2 2017, one of the most acclaimed names in lubricant packaging industry, Scholle IPN, announced the accomplishment of a milestone for their packaging product. The company’s patented flexible bag-in-box package for automotive oil, which debuted in 2008, apparently crossed a mammoth 25 million in production volume this year. This precedent affirms that the automotive sector would indeed continue to remain one of most profitable growth avenues for lubricant packaging market, as power generation nears a close second.

The profitability quotient of this business sphere is directly proportional to the expansion across its principal end-use sectors. Pertaining to the widespread deployment of lubricants such as process oils, general-purpose oils, and engine oils in major end-use domains such as oil & gas, automobile, power generation, and metal fabrication, the global demand for flexible, efficient, strong, and environment-friendly packaging for lubricants has been on a steady rise lately – which has had a substantial impact on the revenue graph of lubricant packaging market. Furthermore, these sectors have also been demanding eco-friendly and sustainable packaging on a large scale, in accordance with the norms mandated by regulatory bodies for environmental safety, which has led to lubricant packaging industry players competing fiercely amidst one another to innovate a leading-edge portfolio of products. In effect, on the grounds of robust industrialization and the ill-effects of flimsy plastic packaging on the environment, lubricant packaging market size has been predicted to cross a valuation of USD 15 billion by 2024.