China Marine Lubricants Market to observe remarkable push over 2017-2024, sustainability notion to drive the industry demand

Publisher : Fractovia | Published Date : 2017-02-06Request Sample

Endorsed with a deluge of business benefactors, marine lubricants market is set to garner remarkable proceeds from a plethora of investments underlining the competitive landscape. As per a recent new snippet, Royal Dutch Shell, the renowned energy giant, has recently ramped up its investment in the business sphere with the opening of a massive lubricant plant at Tuas, in Western Singapore. Reportedly, the integrated lubricant & grease production facility would be able to produce approximately 390 kilotonnes or 430 million litres of greases and lubricants annually, which, as claimed by the experts, is enough to bring a transformation in the engine oil of more than 12000 cars, every year. Allegedly, with the launch of its third largest lubricant production plant globally, the Netherland based oil giant is planning to toehold their position in Singapore marine lubricants industry.

U.S. Marine Lubricants Market Size, By Application, 2016 & 2024 (USD Million)

Citing another relevant instance depicting the signs of penetration of marine lubricants industry, Gazprom Neft, the renowned oil and gas conglomerate, has apparently made itS foray in marine lubricants business with the inauguration of Gazpromneft Ocean brand. Reportedly, under the banner of the brand, the company would boast of a product portfolio that includes a range of almost 15 lubrication oils for engines operating on various types of fuels and all sorts of vessels. While as of now, for the record, the products would be manufactured at Moscow and Omsk lubricants plants, the long-term business strategy of Gazprom Neft is to expand its product storage facility and production location next year, in order to ensure a smooth supply to major ports. These aforementioned alliances are expected to influence the competitive hierarchy of marine lubricants industry, where the strategic landscape would not only be characterized by renowned biggies but also SMBs.

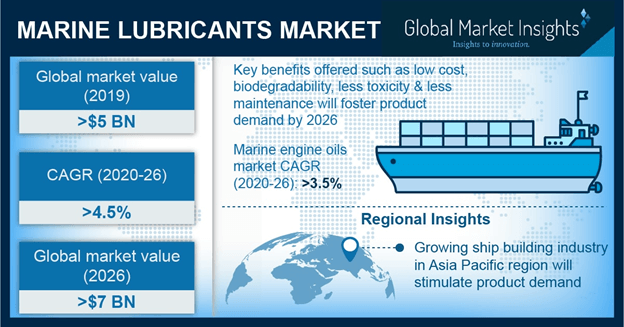

Speaking of the commercialization potential of marine lubricants industry, it is claimed to be nothing but humongous. The increasing number of international maritime trade activities along with the significant growth in the shipbuilding sector over the recent years can be placed as a testament to the declaration. As per a report brought forth by the UNCTAD (United Nations Conference on Trade and Development) in 2015, around 70% of the global trade by value and 80% by volume were carried out by sea routes. It has been further claimed in the report, that the percentage is even higher in case of developing economies. In tandem with this, it is prudent to mention that ship building business in APAC belt has observed a steady rise lately- another fundamental factor that can be credited for the regional marine lubricants market expansion.

China’s shipbuilding sector, in particular, has already gained a renewed traction in 2017, with estimates claiming remarkable growth prospects both from completed orders as well as new shipments. Statistics depict, Chinese shipyards has executed orders amounting almost 35.15 million dead weight metric tonnes in the first three quarters of the year, recording a sharp rise of almost 41% CAGR over 2016-2017. For the record, the regional shipbuilding industry reached approximately USD 32 billion (212.5 billion yuan) in 2017, with a net profit of almost 1.1 billion yuan over the span of first nine months of the year. These statistics quite coherently justify the growth potential of marine lubricants industry in the region. If experts are to be relied on, China marine lubricants market is forecast to traverse a profitable roadmap in the years ahead, with an estimated CAGR of 4% over 2017-2024.

With Germany at the forefront, Europe is claimed to be another strong contender in global marine lubricants industry. Compliance with bilateral trading agreements that are being signed among the countries under its veil is expected to increase foreign trade demand in Europe, which by extension will impel Europe marine lubricants industry. Increasing demand for recreational boating activities in Germany including sailing, campaigning, boat racing, and water sport games is expected to complement the business growth. In fact, as per estimates, Germany marine lubricants market share from recreational activities alone would record a volume coverage of 18 kilotons by 2024. Overall Europe industry is slated to record a y-o-y growth of 3% over 2017-2024.

The latest trend emerging in marine lubricants market is the shifting preference toward bio-based lubricants, primarily backed by the hazardous impact of synthetic products. In addition, the enforcement of stringent regulatory norms with regards to Sulphur dioxide and nitrogen emission control is further providing a significant impetus to bio-based lubricants demand. Furthermore, the competitive landscape of marine lubricants industry space is anticipated to witness mergers & acquisitions that would influence the profitability quotient and expand the customer base phenomenally. As per Global Market Insights, Inc., overall marine lubricants market size is expected to exceed a valuation of USD 5.9 billion by the end 2024.