Medical Styrenic Polymer Market to witness remarkable growth prospects from medical instruments, Asia Pacific to be one of most profitable growth grounds over 2017-2024

Publisher : Fractovia | Published Date : 2017-07-21Request Sample

The trend of replacing conventional medical devices with styrenic polymers have set the wheels of medical styrenic polymer market in motion. This polymer can be easily processed and is widely used in manufacturing light weight and advanced medical devices. Conventional medical devices that are used in a majority of hospitals are made of metals, glass, and ceramics. However, these days, they are being replaced by polymers due to the several advantages they offer over their counterparts. Styrenic polymer is an ideal material as it is light in weight, water resistant, easily disposable, versatile, aesthetical, and cost effective. Growing applications of this polymer in the development of medical devices and pharmaceutical packaging has provided a significant impetus to medical styrenic polymer industry share. A report on medical styrenic polymer market compiled by Global Market Insights, Inc., predicts the industry to record a CAGR of 7% over 2017-2024. It further foresees this business space to generate revenue of over USD 4.5 billion by 2024.

Accounting for more than 40% of the overall medical styrenic polymer market, North America seized the highest industry share in 2016. Advancing healthcare standards and regulations in the region have led to a shifting trend of using plastic medical devices and equipment over metallic ones. As these devices are easy to process and do not have any dangerous implications on the human health and environment, they are being extensively used in manufacturing of medical equipment, which has spurred the regional styrenic polymer market.

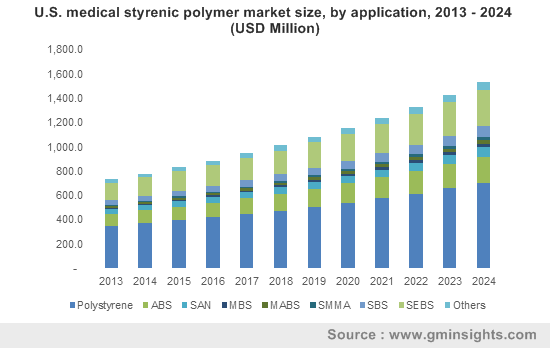

U.S. medical styrenic polymer market size, by application, 2013 - 2024 (USD Million)

Stringent regulations imposed against the use of PVC in the production of medical devices and equipment have heightened the demand for these polymers. PVC was the most commonly used plastic and gained immense popularity during its initial run, owing to its low manufacturing cost and high durability. However, it soon started facing antagonism from the regulatory bodies, as its manufacturing and disposal raised concerns over environmental safety, which in turn, paved the way for experimenting with the use of styrenic polymers for various applications. In consequence, medical styrenic polymer market started gaining considerable traction by favoring the use of styrenic polymers over toxic PVCs in medical applications. The superior properties of this product have thus led to their usage in medical containers, medical instruments, medical packaging, and IV solution bags, thereby contributing toward the diversification of the application scope of medical styrenic polymer market. The medical instruments sector accounted for the highest market share in 2016, and is projected to record an annual growth rate of 7.5% over 2017-2024. Styrenic polymers also find applications in manufacturing medical fabrics such as patient gowns, operating gowns, masks, surgical or orthopedic drapes, and dressings, thereby enabling a promising growth path for medical styrenic polymer industry.

Styrenic polymers have excellent thermal and electrical insulation characteristics, owing to which they find major applications in medical packaging and IV solution bags. They are also used as a packaging material for drugs, instruments, syringes, etc., as they safeguard the product from any infectious diseases. Moreover, regulations pertaining to health and hygiene in the hospitals have further stimulated medical styrenic polymer industry growth. Rising demand for IV solution bags for storing medications, electrolytes, fluids, etc. have also favored the growth of medical styrenic polymer market.

The most common styrenic polymers used for medical device manufacturing & packaging include styrene butadiene styrene [SBS], acrylonitrile butadiene styrene [ABS], styrene methyl–methacrylate [SMMA], polystyrene, and methyl-methacrylate acrylonitrile butadiene styrene [MABS]. Amongst these, polystyrene accounted for more than 50% of the overall medical styrenic polymer industry share in 2016. The versatile properties of polystyrene make it quite useful in manufacturing various medical devices that need fairly rigid plastics, opacity, and range of color variations. Styrene methyl-methacrylate is another product segment which is derived from the combination of styrene and polymethyl methacrylate. The ease of processing ability coupled with the crystal clarity of PMMA is set to bring forth excellent growth prospects for this product. ABS is among the fastest growing segments of medical styrenic polymer market as the product caters to the diverse requirements of the medical industry. Its unique properties including high-quality gloss, excellent finish, and superior resistance to heat & chemicals will generate huge growth potential for this segment. Thus, medical styrenic polymer industry share from ABS is most probable to record an annual growth rate of 8% over 2017-2024.

With the growing demand for using environment friendly technology, medical styrenic polymer industry is likely to experience high growth prospects. The medical industry still lags behind the other sectors as far as the ‘go green’ trend is concerned. However, many changes have come aboard in recent times, pertaining to which medical styrenic polymer market will experience substantial gains, with regards to its massive application scope.

Asia Pacific medical styrenic polymer market is estimated to be the fastest growing regional business in terms of product acceptance, by 2024. Rising medical infrastructure and improved healthcare ethics have proliferated the utility scope of styrenic based polymer medical devices in myriad applications. A significant rise is seen in the spending capacity of consumers, which has further propelled the use of low toxicity and environment friendly materials, thereby driving the regional medical styrenic polymer industry.

The top six players of the global medical styrenic polymer market catered to more than 45% of the total business share in 2016. On these grounds, it can be presumed that this business sphere is fairly consolidated. Prominent industry manufacturers have been investing generously in R&D activities and have been bringing forth a range of flexible products to suit several medical applications. Chi Mei Corporation, Styrolution, Ineos Abs USA, Saudi Basic Industries Corporation (SABIC), Kraton Polymers LLC, Americas Styrenics LLC, and Chevron Phillips Chemical Company LLC are the key medical styrenic polymer industry participants manufacturing and supplying styrenic polymer products across the globe.