A regional overview of the metallic stearates market: APAC to emerge as a prominent revenue pocket over 2018-2024

Publisher : Fractovia | Published Date : 2018-09-27Request Sample

The presence of a broad application scope and well-established manufacturing processes have propagated the global metallic stearates market, which was valued at over USD 3 billion in 2017, with massive earnings from the segments like food, construction, pharmaceutical and rubber. The widespread uses of metal soaps are derived from them being suitable as lubricants and release agents in pharmaceuticals, having gelation properties ideal for cosmetics, oil binding property needed in producing cements, among several other reasons. The metallic stearates industry has witnessed extensive adoption by distinct market segments to develop products having improved chemical and physical properties, with resistance to various conditions. The Asia-Pacific (APAC) has emerged as a highly lucrative market for metallic stearates, with the rapidly growing economic status of countries in the region presenting enormous opportunities for growth.

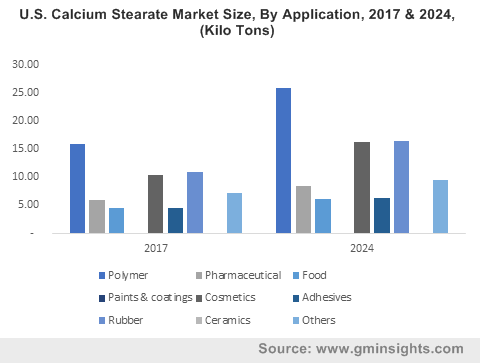

U.S. Calcium Stearate Market Size, By Application, 2017 & 2024, (Kilo Tons)

Brief overview of the Asia-Pacific metallic stearates market with respect to the growth of different industry verticals:

Construction

The construction segment in APAC is characterized by the exponentiating population and the fast growing disposable income, encouraging governments to undertake vast infrastructure projects and allowing builders to develop expansive residential and commercial projects. A number of building materials are needed to be hydrophobic to offer long-term protection against sun, snow, rain and growth of mould. The metallic stearates market has profited from the availability of highly water-repellant metal soaps to be mixed with building materials like plaster, cement and in making pipes and other integral components. Several vital projects in APAC demonstrate the continuous boom of the construction sector and the subsequent propulsion of the metaling stearate industry.

The Chinese government, for instance, has expended billions on the construction of the Xiangong new area project, spanning 80 square miles. The Xiangong development is expected to house about 4.5 million people and will consist of houses, offices, universities and is aimed at diverting the congestion away from nearby Beijing. Separately, Singapore-based construction company KSH Holdings won a USD 195 million contract to build 17-storey apartment blocks at Riverfront Residences Singapore. The Riverfront Singapore scheme will comprise nine blocks of 17-floor buildings, 21 units of strata-landed houses which total up to around 1,470 residential units, expected to complete by 2022 and is termed as being one of the biggest in the country.

Further, Japanese multinational Sumitomo Corp had reportedly entered a 50-50 partnership with India’s Krisumi Corporation in early 2018 to build a two-phase construction project spread over an area of 65 acres in Gurgaon, India. The venture will involve building 5,000 residential apartment units, offices, mall and educational institution. Signifying a tremendous earning potential for the construction industry and the APAC metallic stearates market, the Gurgaon project is valued at USD 2 billion.

Ceramics

The metallic stearates industry also gains traction from the ceramics sector, given that stearates are vital in manufacturing specific ceramic and plaster products for the construction sector, such as tiles, roofs and interior components. APAC holds a significant position in the global ceramics segment, supported by the growing construction and industrial sectors. The materials provide better bonding when mixed in ceramics and help to avoid the formation of lumps, reinforcing the metallic stearates market penetration in the APAC region. Expounding the industry prospects, Vietnam had opened the largest ceramic tile plant in South East Asia with a total annual output of 24 million square meters and is the sixth-largest ceramic tile producer in the world. The ceramic tile industry of India is also estimated to record a turnover of USD 6.87 billion by 2020, mainly driven by domestic consumption and exports to Europe and the Middle East, suggesting a major boost to the metallic stearates market in the region.

Pharmaceuticals

Pharmaceutical drug manufacturers use metallic stearates for their thixotropic, lubricating and gelation abilities while producing tablets to restrict the absorption of water by the pharmaceutical powders, and also as excipients for drugs. Prevalence of various diseases and the growing health concerns in the APAC region will generate increased demand for pharmaceuticals and bolster the metallic stearates market. The Indian pharmaceutical industry was valued at approx. USD 27.57 billion in FY206 and is project to grow at an augmented rate over the coming years.

India is also the largest provider of generic drugs and had exported over USD 16.8 billion worth of pharmaceuticals in FY2017. With a higher rate of pharmaceutical demand in the region arising from the need to cater to the growing geriatric population and the rising occurrence of numerous chronic disorders, the APAC metallic stearates market will garner immense remunerations from the pharmaceutical segment.

All in all, with the upsurge in the consumption of pharmaceuticals and ceramic products as well as the never-ending infrastructure construction activities taking place in key economies, global metallic stearates market is anticipated to cross a valuation of USD 7 billion by 2024.