Methyl isobutyl ketone (MIBK) market to register appreciable proceeds from rubber processing chemicals applications, surging agricultural investments and tyre exports to propel the industry

Publisher : Fractovia | Published Date : 2019-05-30Request Sample

Endowed with a profound application landscape spanning automotive, construction, chemicals and pharmaceutical sectors, methyl isobutyl ketone market has procured commendable proceeds in the last few decades. The product is used as a chemical intermediate solvent for the manufacturing of paints, rubber, medicines, industrial cleaners and other chemicals. It is extremely efficient in dissolving resins used in inks, paints, lacquers and other surface coatings, and is also used as an extractant for antibiotics and other pharmaceutical products. Additionally, MIBK is used as a rubber processing chemical for the production of tyres for automotive vehicles.

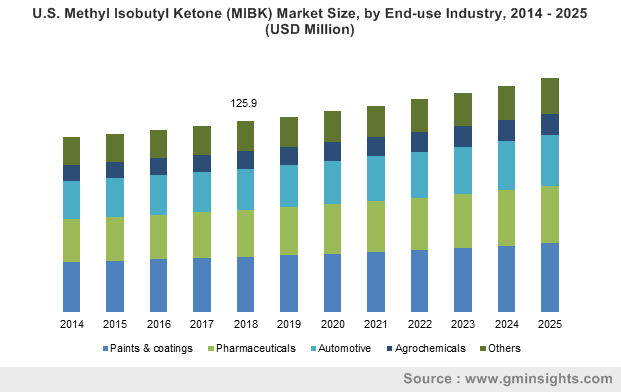

U.S. Methyl Isobutyl Ketone (MIBK) Market Size, by End-use Industry, 2014 – 2025 (USD Million)

The rubber processing chemicals segment of the methyl isobutyl ketone market is expected to witness rapid growth on account of swelling demands from the tyre in the automotive sectors along with growing application across diverse industries. MIBK is used to produce target molecules such as rubber antiozonants which are later utilized in the tyre production. The promising shift towards radial tyres has also led to increased product traction lately. Furthermore, growing investment to boost production of tyres is likely to boost the rubber processing chemical segment, augmenting the methyl isobutyl ketone market growth graph. For instance, in 2018, India’s largest commercial vehicle tyre maker, Apollo Tyres invested around $1 billion, solely to overtake MRF Ltd. across other segments, excluding two-wheelers, and to support its vision of crossing the Rs 20,000 crores revenue mark by 2020.

In addition to the tyre and automotive sectors, rubber processing chemicals are also gaining traction across medical, aerospace, electric & electronics, and footwear industries. Moreover, there is growing rubber use in floor coverings, roofing materials, sound insulators, and sealants in the construction industry as well. Indeed, estimates cite that MIBK industry size from rubber processing chemicals application will surpass USD 90 million by the end of 2025, thus indicating lucrative growth prospects ahead.

Proliferating automotive and agrochemical sectors to drive the APAC methyl isobutyl ketone market growth

With rapid surge in industrialization, the Asia Pacific methyl isobutyl ketone market is expected to witness high product demand from end-user sectors like agrochemicals, automobiles and rubber industries. The progress is mainly slated to be showcased across emerging markets like China, India and South Korea where growing production and sales/export of automotive products such as rubber tyres have surged significantly over the past few years. In fact, according to reports, tyre export from India is expected to hit USD 1.85 billion by the end of 2018-19. While, as per the Department of Commerce reports, between April to September 2018 alone, tyre exports were recorded to reach USD 920.9 million in the country. This surging growth is associated with easy accessibility of raw materials and low labor cost that has in turn enhanced the regional methyl isobutyl ketone industry size.

In addition to the automotive sector, the methyl isobutyl ketone market has also garnered significant gains in the agrochemical space. The product is increasingly used in the production of insecticides and pesticides, that are commonly utilized across large scale commercial agricultural fields. This growth is considerably witnessed across India where, during 2017-18, food grain production was estimated at 284.83 million tons, according to India Brand Equity Foundation (IBEF).

Additionally, an increase in government spending in the agricultural sector to meet growing food demands will further foster the methyl isobutyl ketone market growth. For instance, the Government of India is aiming to take the country’s food grain production to 285.2 million tons in 2018-19. Under its SAMPADA scheme, the Indian government is planning to triple the food processing sector’s capacity from current 10% produce and commit to an investment of Rs 6,000 crore ($936.38 billion) for mega food parks in the country.

The methyl isobutyl ketone market will depict exponential growth over the coming years on account of diverse application in end-user industries. Proliferation in the automotive and construction industries across developing economies will push product demand. In addition, growing focus on deploying effective insecticides and pesticides across large scale agricultural fields to mitigate crop loss will also supplement market growth. By the end of 2025, methyl isobutyl ketone (MIBK) market size will surpass USD 800 million, claim experts.