Microgrid market in North America to be driven by the rising occurrence of natural calamities, industry valuation to exceed USD 7 billion by 2024

Publisher : Fractovia | Published Date : 2018-09-21Request Sample

Microgrid market in North America has been gaining traction for quite some time now, so much so that microgrids have been predicted to transform from a niche application focused on military bases and remote communities to tools meant for grid modernization. In fact, experts estimate that microgrid installed capacity in North America will surpass 3 GW by 2024, a growth that will be driven by the rising prevalence of renewable energy use, advantages of microgrid deployment and compelling natural catastrophes that have underlined the benefits of using microgrids.

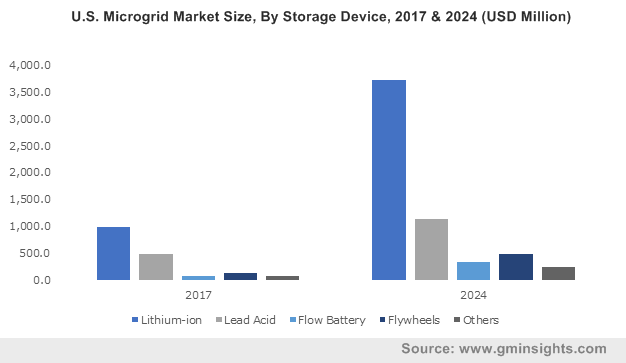

U.S. Microgrid Market Size, By Storage Device, 2017 & 2024 (USD Million)

The extent of growth for the microgrid market in North America can be depicted through the recent announcement by Go Electric which declared the securing of $4 million from WindSail Capital Group. Go Electric is an advanced microgrid developer that focuses on building microgrid solutions for commercial, industrial, military and mobile purposes while the Boston based WindSail Capital Group is an investment firm that deals in energy innovation and sustainability. Such a substantial investment by WindSail Capital comes on the heels of increasingly frequent and disruptive weather events that have led to renewable energy industry strengthening its focus on resilience and maintenance of commercial and industrial operations in spite of the electric grid downtime. Companies like Go Electric are therefore pouring in increased investments as they are developing turnkey microgrid solutions that let customers continue operations and take advantage of the grid services market.

Speaking of natural disasters, in the aftermath of Superstorm Sandy some time ago, some of the Manhattan buildings that had their own microgrid systems stood out in sharp contrast to the darkened skyline, underlining the potential of microgrids. More recently, Hurricanes Harvey and Irma have again driven home the ability of microgrids to develop islands of power when the wider grid has failed. According to expert estimates more than 300,000 people were left without power due to the ravages of Hurricane Harvey. Yet, in Texas, many H-E-B grocery stores remained open as they already had microgrids installed. As a result, a recent poll showed that though only 13% of utilities, manufacturers and network operators are fully operational in the microgrid sector in North America at present, 28% are actively engaging while 39% are in early stages of exploring microgrid opportunities, clearly indicating the vast expansion microgrid market will register in North America over 2018-2024.

Not only natural calamities but various other factors are likely to fuel microgrid market in North America over the ensuing years, chief among which will be the fact that cost of solar PV module as well as energy storage solutions have significantly declined in the last 10 years. Cost of solar PV module has dropped by more than 75% and a similar trajectory has been noted in energy storage solutions. Also, the reliability of microgrid solutions in North America has increased with growing deployment of distributed energy resources. With more distributed energy resource assets and microgrids becoming more accessible resources, microgrid market in North America is expected to register greater traction. The rising deployment of renewable energy resources and the closure of fossil fueled power plants has also caused a surge in demand for electric grid resiliency, a demand adequately satiated by microgrids that have emerged as cost-effective alternative to upgrading electricity transmission lines.

The declining cost of solar PV and reduction of cost for associated energy storage, microgrid design and control systems will drive the growth of microgrid market in North America. With new players entering the industry landscape and end users being offered more choice, competition will be increased further, and new business models will emerge to reduce costs in the microgrid market. Regulatory framework is also expected to catch up with the industrial expansion of microgrid market in North America and betterment of electricity grid regulations will ease major challenges that the microgrid market faces at present. New regulations will replace outdated ones that were not designed to facilitate microgrids and came before advancements of decentralized power generation helping the better understanding of microgrid benefits.

Companies are aiming to explore their options of which customer segment and which markets will prove to be most beneficial when it comes to deriving value. North America is emerging as one of the regions that has demonstrated the greatest promise of opportunity for the growth of the microgrid industry. With renewable energy directives being rolled out and consumers looking for more reliable power supply, microgrid market in North America is expected to register expansive growth over 2018-2024.