Middle East Cable Market Outlook: Increasing smart city initiatives across Middle East to augment the industry growth

Publisher : Fractovia | Published Date : 2017-02-06Request Sample

Rapid urbanization and industrialization across the Middle East region will propel the Middle East Cable Market Size significantly over the coming years. The middle east countries are relieving their economic dependency on gas and oil reserves gradually by focusing on tourism and transportation, which will considerably influence the middle east cable industry share. According to report by Global Market Insights, Inc., “Middle east cable market collected a revenue of USD 6.33 billion in 2015 and is anticipated to be worth more than USD 11.5 billion by 2023.” The smart city development projects across the regions such as Mohammad Bin Rashid City (UAE), King Abdullah Economic City (KSA), Basra New City (Iraq), and Lusail City (Qatar) will generate profitable demand for cables over the coming years. In addition, ongoing and planned infrastructure & construction developments, which is estimated to cost around USD 1 trillion by 2023 will further boost middle east cable industry trends noticeably.

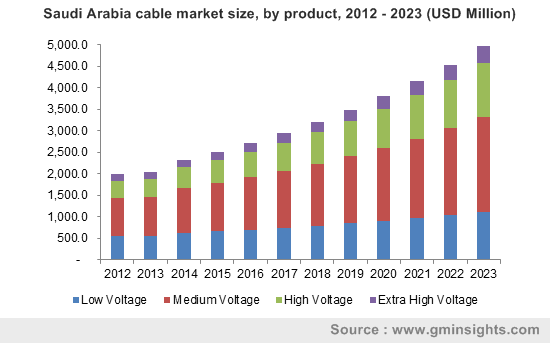

Saudi Arabia cable market size, by product, 2012 - 2023 (USD Million)

Key applications areas of the Middle East cable market are commercial and industrial sectors. Dynamically increasing infrastructure development activities will fuel middle East cable industry size across commercial application, which surpassed a revenue of USD 3.5 billion in 2015. The industrial applications will generate an annual growth rate of 8.5% over the coming period of 2016 to 2023.

Middle East cable product is primarily segmented into extra high voltage, high voltage, medium voltage, and low voltage cables. The medium voltage cable contributed extensively towards the market share in 2015 and is projected to exhibit a CAGR of more than 8% over the coming six years, owing to its growing demand across the railway industry. The low voltage cable worth USD 1.84 billion in 2015 and is expected to collect a revenue of more than USD 3 billion by 2023. The surging requirement of these cables for low power transmission areas such as electric rooms and internal wiring will influence middle east cable market considerably.

High voltage middle east cable industry accounted for over 20% total market share in 2015 and is estimated to register a CAGR of 10.5% over the coming six years, primarily driven by large number of ongoing & upcoming wind projects, where cables are used extensively.

Saudi Arabia cable industry size is predicted to witness a CAGR of 9% over the coming years of 2016 to 2023

Saudi Arabia market contributed majorly towards the regional revenue share and is anticipated to collect a revenue of USD 5 billion by 2023. The growing number of construction projects will drive middle east cable market size notably over the coming timeline.

UAE cable industry accounted for USD 1.6 billion in 2015 and will exhibit lucrative growth rate, owing to the escalating industrialization across this region.

The market players will significantly increase their investment in R&D activities over the coming years with an aim to improve their product and solution portfolio. Key middle east cable industry players include Riyadh Cables, Elsewedy Electric, Oman Cables, Saudi Cable Company, Ducab Finolex, Belden, Fujikura, Okonite Company, Encore Wire Corporation, Sumitomo Electric Industries, Furukawa Electric Co., Ltd., Prysmian Group, General Cable, and Southwire Company, LLC.