Saudi Arabia to drive Middle East district cooling market landscape

Publisher : Fractovia | Latest Update: 2019-07-26 | Published Date : 2017-09-15Request Sample

With increasing investments in infrastructural developments across GCC countries, Middle East district cooling market size is sure to upscale in the coming years. Under right conditions, district cooling gains numerous advantages over conventional cooling especially in densely populated areas where air conditioning demand is notably high. Reliability, energy efficiency, and better environmental profiling are some of the major driving forces making district cooling the most obvious choice for air conditioning in Middle East countries.

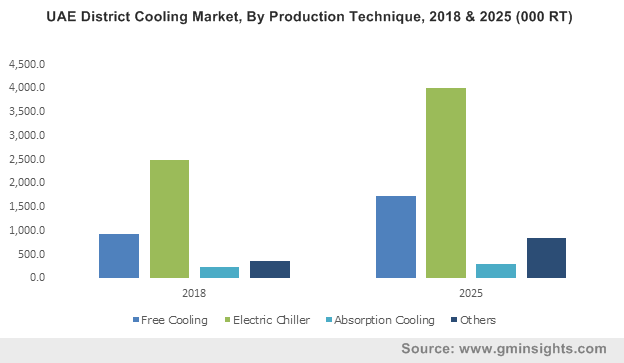

UAE District Cooling Market, By Production Technique, 2018 & 2025 (000 RT)

Analysts claim that if properly employed, district cooling could cover almost 30% of the total cooling requirements of GCC countries by 2030. As estimated, this would also eliminate the necessity of developing 20 GW power generating plant. With GCC countries expected to rapidly urbanize in the coming years, Middle East district cooling industry share is certain to increase commendably, saving the region’s economy from investing hefty amounts in new power stations.

The Dubai government is reported to increase the infrastructure spending by 27% than that it was allocated for the year 2016. As per records, the UAE Government has also announced to invest almost USD 4.62 billion toward infrastructural development till 2020. These statistics draw quite an evidence of the potential opportunities augmenting Middle East district cooling market trends in the forecast years.

A report compiled by Global Market Insights, Inc. claims that the overall Middle East district cooling industry will exceed a valuation of USD 14 billion by 2025. The projected figure is considerably larger than what the industry recorded in 2018, which is deemed to be a positive indicator for the growth of the overall market across GCC countries.

The regional government entities across this belt are taking vigorous efforts to unveil the economic potential of the overall Middle East district cooling market. Driven by the sustainable cooling technology trend, Middle East district cooling industry is set to exceed an appreciable installation capacity by the end of 2025. Unprecedented developments of high capacity projects such as Bahrain Bay DC plant, using sea water as cooling medium to limit the GHG emissions is further complementing the Middle East district cooling market outlook.

The Dubai government plays a pivotal role in clean energy mission. In 2014, the regional administration set a target of reducing the energy consumption in infrastructural activities up to 20% by 2030. The government of Abu Dhabi, along similar lines, with the Vision 2030 structured a program named Estidama, under which design, operation, construction, and performance of communities and buildings are regulated.

All these governmental targets aptly translate the commercialization potential of Middle East district cooling market from Dubai in the years ahead. In fact, in 2015, the regional government declared of addressing 40% of the country’s cooling demand from DC systems by 2030, which again reaffirms Dubai’s significant contribution in the overall Middle East district cooling industry.

Air conditioning across GCC countries is an expensive necessity, a factor that plays a crucial role behind Middle East district cooling market expansion. Estimates depict, air conditioning accounts for a major chunk (70%) of the peak period electricity consumption. It has been also estimated that the cooling demand in GCC countries by 2030 will nearly be triple than the present requirement. Addressing this demand will cost Middle East countries approximately USD 100 billion for developing new cooling capacity.

If experts’ estimation is to be relied on, by the end of 2030, air conditioning will cover 60% of the additional power requirements and the fuel required for powering the conventional air conditioning system would be 1.5 million barrels/ day. Looking at the present scenario, Middle East district cooling industry is sure to gain traction in the coming timeframe, subject to the fact that it offers more cost efficiency, comfort, and operational efficiency over long term when conventional cooling technology.

Regionally, Saudi Arabia is another outpacing region actively partaking in Middle East district cooling industry. Increasing commercial infrastructural activities in prominent cities like Riyadh and Mecca along with favorable regional government initiatives toward DC system deployment further validate the growth potential of Saudi Arabia district cooling industry over the coming years. Exemplary efforts undertaken by the regional government will undoubtedly influence Middle East district cooling industry dynamics.

Middle East district cooling industry is characterized by similar other biggies which include Emirates Central Cooling System (Empower), Emirates District Cooling (Emicool), and Logstor. These participants are increasingly focussing on product customization and expansion of product facilities at competitive pricing to maintain their business position. With an increasing number of initiatives by regulatory corporations and regulatory bodies, Middle East district cooling market is forecast to carve lucrative roadmap in the coming years.