Monolithic Ceramics Market to acquire remarkable revenue from electrical and electronics applications, APAC to drive the regional landscape

Publisher : Fractovia | Published Date : 2017-08-17Request Sample

Monolithic ceramics market has been one of the most burgeoning business fraternities considering its diversified application forum. The industry is strongly driven by extensive research and development activities and the presence of numerous medium to large scale manufacturers. Strategic partnerships and business acquisitions have always been the key growth strategies adopted by the market giants in order to expand the product portfolios and experience a better customer reach from reciprocal approaches. The acquisition of Ceradyne by 3M, the mining and manufacturing conglomerate in the year 2012, for instance, opened up a pool of opportunities for the former to deeply exploit monolithic ceramics industry space. With this integration, California based Ceradyne accessed 3M’s global reach, operational discipline, and product innovation tactics, while 3M on the other hand, got an opportunity to bring forth advanced ceramics systems in the industry via Ceradyne’s technical expertise. The industry is further projected to be strongly characterized by such alliances in the coming years. As per the estimates, monolithic ceramics industry is slated to register a CAGR of 7% over 2017-2024.

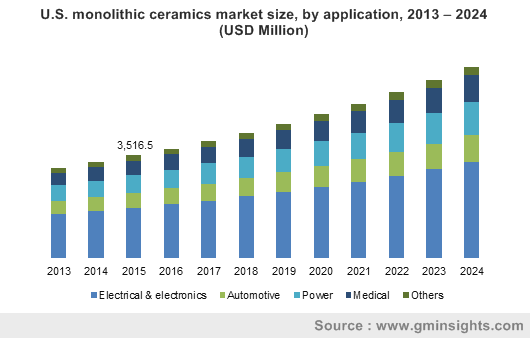

U.S. monolithic ceramics market size, by application, 2013 – 2024 (USD Million)

Monolithic ceramics market from electrical and electronics applications

Procuring more than 50% of the overall monolithic ceramics industry share in yesteryear, electrical and electronics is a profound application driving the market commercialization. Decoupling capacitors are extensively deployed across a wide range of semiconductor devices. Monolithic ceramics act as a dielectric in these fixed value capacitors. In fact, monolithic ceramics capacitors are widely used in microcomputers, microprocessors, FPGAs for proper operation of the devices. The number of monolithic ceramics capacitors used in semiconductor devices is huge. These capacitors play dual roles- firstly to supply power to the semiconductor devices and secondly to shunt the noise component to ground.

|

Electronic device |

Approximate number of monolithic ceramics capacitors used |

|

Notebook computer |

730 |

|

Digital TV |

1000 |

|

Digital Camcorder |

400 |

|

Car Navigation System |

1000 |

|

Mobile Phone |

230 |

Subject to some of its unique properties like high compressive strength, low thermal conductivity, high-temperature proficiency, and chemical inertness, monolithic ceramics industry demand from electronics and electrical sector is expected to upscale in the coming seven years, with a projected CAGR of 7.5% over 2017-2024.

Monolithic ceramics market from medical applications

Technological proliferations have led to an advancement in ceramics innovations, subject to which monolithic ceramics market has profoundly penetrated in the healthcare space recently. Monolithic ceramics are used in the manufacturing of medical devices pertaining to the diagnostics, radiology, implants, and surgical sectors. Bio inertness, thermal stability in sterilizing conditions, resistance to abrasion, and non-magnetizability are some of the functional properties that are fueling the demand for monolithic ceramics in the healthcare industry. Increasing health consciousness and rising disposable incomes of the consumers are some of the other profound factors driving monolithic ceramics market commercialization. Statistics depict, worldwide, global per capita healthcare spending in 2016 was almost around USD 1000 and is forecast to reach to USD 1650 by the end 2024. In this regard, it is important to note that and North America and Asia Pacific will experience a strong ground, with an estimated healthcare spending increasing by 6% and 4% respectively by the end of 2024. It is, therefore, no surprise for these two regions to witness a strong foothold in monolithic ceramics market. In fact, APAC held the largest revenue share in 2016 and is slated to cross USD 11 billion by 2024.

Numerous companies partaking in the monolithic ceramics industry have been unprecedently working toward development of product diversification. Murata Manufacturing Corp. in 2015 launched medical-grade monolithic capacitors especially for implanted clinical devices like cardiac pacemakers, insulin pumps, cochlear implants, and gastric electrostimulators. Reportedly, these capacitors are ideal to be used both in GCR series (critical circuits) and GCH series (non- critical circuits). This is undoubtedly Murata’s flagship in the monolithic ceramics industry. Some of the other prominent participants actively partaking in the monolithic ceramics industry developments include CoorsTek, Morgan Advanced Materials, Advanced Ceramics Manufacturing, Saint-Gobain Ceramics Materials, McDanel Advanced Ceramics Technologies, and Elan Technology.

The capital investments associated with the manufacturing of ceramics is likely to restrain the overall growth of monolithic ceramics market. Nonetheless, growing concerns over detrimental environmental conditions along with favorable governmental initiatives pertaining to greenhouse gas abatement is certain to complement the business landscape, subject to the fact that these ceramics are widely used in pollution control devices. Global Market Insights, Inc. claims this industry to surpass a valuation of USD 30 billion by 2024.