Muconic Acid Market to witness steady progression over 2017-2024, textile sector to majorly drive the application landscape

Publisher : Fractovia | Published Date : 2017-11-21Request Sample

Over the years, muconic acid market has been depicted by a series of strategic capacity augmentation, modernization programmes, and joint ventures undertaken by prominent industry players, which has overtly contributed substantially to the commercialization of this industry. Kurskhimvolokno for instance, has recently announced its capacity expansion plans to cater to the growing textile industry across the globe, for the textile industry is the most prominent end-user of muconic acid. For the record, Kurskhimvolokno is a major subsidiary of OJSC KuibyshevAzot Group of Companies, a renowned leader in the global chemicals industry and the highest producer of nylon yarn and caprolactam in Russia, leading the European muconic acid industry landscape. The firm has teamed up with one of the foremost german textile machinery manufacturers, Trützschler, to build new extrusion lines to produce industrial and technical yarns of enhanced quality to satisfy the requirements of efficient end applications. Speaking of yet another instance, Amyris Inc., a U.S. based synthetic bio-products manufacturer, had recently disclosed its intent to accentuate its production capability by almost 400% by the end of this decade. Concurrently, further prospective moves by other industry players are anticipated to have a favorable impact on the profitability landscape of muconic acid market, the revenue of which was estimated at USD 37 million in 2016.

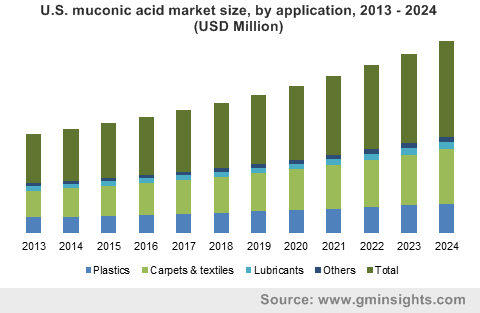

U.S. muconic acid market size, by application, 2013 - 2024 (USD Million)

One of the crucial factors responsible for the sturdy growth of muconic acid industry size is its widespread application arena. Muconic acid is widely utilized as a chemical intermediate to produce adipic acid, and caprolactam, which are precursors to plastics, textiles, synthetic fibers, and lubricants. The noteworthy growth rate of the aforementioned industry verticals is certain to open up lucrative avenues for the muconic acid industry in the forthcoming years. Out of the aforementioned derivatives of muconic acid, adipic acid has held the major portion of the overall muconic acid market share in the past few years and accounted for 50% of the total industry share in 2016. Adipic acid has found increasing usage in pharmaceuticals, agrochemicals and food additives. Furthermore, adipic acid is the prime ingredient used in producing Nylon- 6,6 which, in turn, is used extensively in textile industry. It would be prudent to mention the growth trajectory of the textile industry as well, which is poised to register a growth rate of 4% in the upcoming years, which would further propel the muconic acid industry size to garner considerable returns over the forecast period.

Meanwhile, plastics industry has emerged as another significant application segment of muconic acid market in the recent times, with plastics being excessively used in diverse end-use industries for packaging, manufacturing polymers, bioplastics, PET. Apparently, the demand for plastics by the burgeoning packaging industry would eventually drive the muconic acid industry trends in the forthcoming years.

While the muconic acid market is bound to grow steadily in the immediate future, it would be prudent to take account of the impediments that would hinder the advancement of muconic acid industry in the longer run. The major challenges include rising environmental regulations across the globe to restrict the usage of plastic materials in almost every industry and increasing government initiatives being directed toward the same.

However, persistent R&D endeavors undertaken by myriad market players to produce muconic acid through biological processes would positively influence muconic acid market size. To cite an instance, professors of Iowa State University have recently developed a new way to convert sugar into nylon by combining a genetically engineered strain of yeast which ferments glucose into muconic acid.

In terms of revenue, North America is likely to witness significant growth momentum by 2024 owing to its humongous and mature automobile industry and in extension being the biggest user of lubricants.

Global muconic acid market can be termed as moderately saturated with key players operating in the business include Toronto Research Chemicals, Amyris Inc., Myriant Corporation, Alfa Aesar, TCI, Sigma-Aldrich Corporation, Thermo Fisher among others. With continuous R&D initiatives, technology upgradation and expansion of distribution infrastructure being implemented by market players, muconic acid market size is predicted to surpass $60 million by 2024, as per a research report by Global Market Insights, Inc.