N-Hexyl alcohol market to garner substantial proceeds from the F&B sector: lucrative growth strategies adopted by industry contenders to augment the product demand over 2017-2024

Publisher : Fractovia | Published Date : 2018-04-09Request Sample

The end-use spectrum of N-Hexyl alcohol market is indeed highly versatile, comprising the cosmetic, personal care, and chemical sectors. The prevalence of this widespread end-use range can be credited essentially to the product’s increasing deployment for antibacterial and disinfecting purposes. Of late, chemical industries are increasingly using surfactants for separating dust and oil from a substrate. In fact, some chemical companies are continuously enhancing their portfolio in surfactants as well, with cost-effective and sustainable cleaning solutions. This strategy is certain to impel N-Hexyl alcohol industry, given the product’s extensive usage in industrial cleaning products.

Bearing testimony to the aforementioned statement, AkzoNobel has emerged as one of the popular chemical companies that has been consistently implementing new strategies to develop multifunctional products. The company has recently introduced a new surfactant for institutional, household, and industrial cleaning applications. In response, numerous N-Hexyl alcohol market giants have been focusing on manufacturing customized biodegradable products in order to comply with safety regulatory standards.

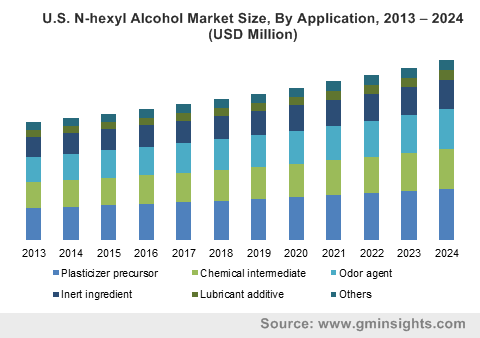

U.S. N-hexyl Alcohol Market Size, By Application, 2013 – 2024 (USD Million)

The growing food and beverage industry is one of the most profitable avenues for N-Hexyl alcohol market growth, driven by the demand for alcohol as a food additive. In fact, almost all types of flavoring ingredients comprise some alcoholic content, as it acts as a preservative and emulsifier. Hexyl alcohol for instance, is used in beverages, ice creams, baked goods, candy, gelatins and puddings. Quite overtly, it can be claimed that the increasing popularity of packaged and bakery food products is slated to boost N-Hexyl alcohol industry share. Furthermore, even wine manufacturing companies have been producing several alcoholic product grades pertaining to their medical benefits. In red wine produced from pre-mature grapes for example, there is a higher concentration of C6 alcohols - prominently 1-hexanol. Considering the extensive consumption of red wine across the globe, it is undeniable that N-Hexyl alcohol market share would receive a major boost ahead.

In addition to food additives, N-Hexyl alcohol is also used as plasticizer precursor – more like a packaging element for medicines, wrapping vials, and bottles. Taking into account increasing acceptance of plasticizer precursors, N-Hexyl alcohol industry giants are looking forward to increasing the overall product manufacturing. In this regard, these biggies have even been collaborating with prominent technology behemoths. For instance, a few months before, Evonik launched a new project with Siemens to produce cost-effective and eco-friendly specialty chemicals by 2021. With the help of new technologies, it is planning to increase the manufacturing of chemical products comprising hexanol and butanol, both of which are principally for food supplements and plastics.

Elaborating further, it is prudent to state that since the last few years, Evonik is continuously working to extend its product portfolio through capacity expansions and technology advancements. In 2015, the company made an effort to streamline the production of plasticizers alcohol at its German-based plant. The initiative helped Evonik amass substantial returns, owing to the extensive use of plasticizer alcohols in personal care products – particularly cosmetics. Evonik’s consistent efforts to revolutionize chemical product innovation and manufacturing has considerably strengthened its position in N-Hexyl alcohol market lately.

The fact that specialty chemicals are massively used in pharmaceutical, food, and packaging solutions has prompted the players in N-Hexyl alcohol industry to heavily expand their product portfolios. In addition, they are investing in the construction of new manufacturing plants as well. Merely a year earlier, for example, the South Africa based renowned chemicals and energy company, Sasol, made an investment in China to construct its new specialty chemical plant in Jiangsu Province. Through such capacity expansions, N-Hexyl alcohol industry firms are looking forward to expanding their regional presence.

Favorable growth strategies comprising new product development and technology collaborations are likely to majorly expand the scope of N-Hexyl alcohol market. It would be rather imperative to mention that the changing lifestyle of consumers across myriad geographies has also had a massive impact on N-Hexyl alcohol industry trends. This is because consumers now prefer to spend liberally on healthy food supplements and high-quality cosmetics and other personal care products on account of increasing disposable incomes. In essence, driven by the expanding food, personal care, and pharma spheres, N-Hexyl alcohol market size has been forecast to be pegged at more than USD 1.6 billion by the end of 2024.