U.S. neurovascular devices market to witness remarkable proceeds over 2018-2024, regional growth to be driven by the surging cases of brain aneurysm and ischemic strokes

Publisher : Fractovia | Latest Update: 2018-11-22 | Published Date : 2017-06-16Request Sample

Neurovascular devices market is witnessing an inflection point where unprecedented technological advancements and increased stringency of regulations are aptly bringing a transformation in the business model. Industry players have been emphasizing on both reliability and quality of products through the entire process of designing, manufacturing, and merchandizing. On a wider spectrum, three major rationales – a paradigm transition from a volume to an outcome-based approach, extensive proliferation of healthcare IT, and lastly, a strict regulatory oversight, are critically influencing the commercialization matrix of neurovascular devices industry.

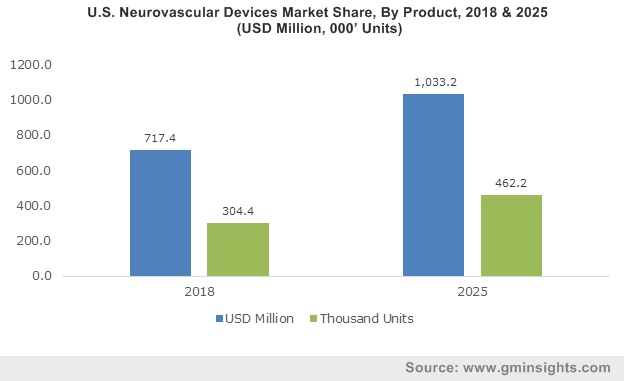

U.S. Neurovascular Devices Market, By Product, 2013 – 2024

Speaking of the growth potential of neurovascular devices market, it is indeed deemed to be humongous. The exponentially increasing stroke rate worldwide stands as a strong testimony to the aforesaid fact. Statistics related to stroke prevalence are indeed alarming, especially in the U.S. According to WHO, nearly 15 million people worldwide suffer from stroke every year. A major chunk of this figure comes from U.S. Data claims the stroke is the fifth leading cause of death in the United States with nearly 795,000 people suffering from a stroke annually. The astoundingly mammoth prevalence is bound to generate a considerably massive demand for advanced devices, which would drive U.S. neurovascular devices industry size. In fact, U.S. accounted for nearly 85.2% of global neurovascular devices market share in 2017.

Another factor that would propel the U.S. neurovascular devices market is the rising prevalence of aneurysm in the nation. As per estimates put forth by the Brain Aneurysm Foundation, close to 6 million Americans suffer from unruptured brain aneurysm. Apparently, the risk of aneurysm rupture is said to upsurge with the increase in age. Consequently, the U.S., currently remnant of a rising geriatric population base and sophisticated healthcare infrastructure, will observe tremendous growth prospects for neurovascular devices market.

According to a recent report put forth by Centers for Disease Control and Prevention, almost 87% of the overall strokes can be categorized under ischemic strokes, which mainly occur due to obstruction of blood flow to brain. It has been found that the disease can be successfully addressed by endovascular surgical techniques which generally require advanced level neurovascular devices. With continuous development in product design in tandem with the encouraging initiatives by the government with regards to stroke management, neurovascular devices industry share from ischemic strokes therapeutics was nearly 43.2% of the overall valuation in 2017. The demand has further prompted renowned neurovascular devices market giants to brainstorm newer innovations in the business space.

Citing a relevant instance, Israeli based Rapid Medical has recently made its way to the front page with the development of two controllable interventional neurovascular devices for the treatment of stroke- a Comaneci mesh, a device for brain aneurysm treatment and Tigertriever stent retriever, for treating ischemic stroke. Reportedly, both these devices are CE-marked and are touted as major products in Europe and Israel neurovascular device markets. It is prudent to mention that Germany is a major revenue pocket for Europe, subject to the extensive prevalence of stroke in the country.

Neurovascular devices industry over the past few years has been experiencing rather a plethora of appreciable initiatives by regional players that define innumerable technological breakthroughs. These giants are highly backing on product innovations and mergers & acquisitions as the top-notch growth strategies. Say for instance, in the year 2016, Terumo Corporation, one of the globally acclaimed players in neurovascular devices market acquired U.S. based aneurysm embolization device manufacturer Sequent Medical, in a bid to enhance its product portfolio and global presence. A year before that, another prominent name in the business, Medtronic acquired Medina Medical, the famous Aneurysm device developer. The deal not only strengthened Medtronic’s portfolio in brain aneurysm treatment but also in flow diversion and clot removal sectors.

With leading giants strictly focusing on product enhancement and inorganic growth strategy, it is no more a supposition that neurovascular devices industry is on its way to carve a profitable roadmap in the years ahead. In terms of revenue, the global neurovascular devices industry is forecast to surpass USD 2.1 billion by 2024.