Offshore support vessel market to reach a fleet count of over 8000 by 2024, driven by the rising number of hydrocarbon reserves and O&G exploration activities

Publisher : Fractovia | Published Date : 2017-12-21Request Sample

The exponential rise in oil prices, till date, stands as a major driving force for offshore support vessel market. That said, it would be imperative to state that apart from oil prices, the increase in oil and gas exploration activities, depleting onshore fuel resources, and the increasing deep-water explorations for hydrocarbon reserves have also stimulated the offshore support vessel market. Increasing crude oil production by countries like Saudi Arabia, US, Mexico, Norway, and Brazil, coupled with governmental efforts to reduce ground water pollution due to onshore drilling, have indeed massively driven the demand for different types of offshore support vessels. Consequently, this demand has provided a boost offshore support vessel industry size, which for the record, stood at USD 40 billion in 2016.

U.S. Offshore Support Vessel Market, By Vessels, 2016 & 2024 (USD Million)

Offshore support vessel market encompasses an assortment of myriad vessel types designed to perform a plethora of tasks. Anchor handling tug supply (AHTS) vessels among these, apparently account for a major percentage of offshore support vessel industry share, in terms of demand, supply, and value, subject to the fact that the vessel is specifically demanded by oil rig operators for handling anchors, towing, and ensuring the supply of cargo, fuel, water and mud. ATHS vessels are also used for rescue and emergency response. In North America, AHTS vessels are particularly designed to handle the rough conditions of the North Sea. In 2017, the oil rig count in the U.S. has increased from 406 to 759, an 86.95% rise, that has increased the demand of AHTS vessels substantially, stimulating the overall offshore support vessel market.

Offshore support vessel market has also witnessed a growth rate that is directly proportionate to the growth of hydrocarbon market. Increasing shallow water hydrocarbon production coupled with low cost of operation and lesser technical reliabilities have stimulated the demand for hydrocarbon as a prominent fuel. According to Energy Information Administration (EIA), shallow water offshore production has increased by 64%, a direct indicator of increased requirement of shallow water fixed platforms. These fixed platforms also require to be refurbished with supplies, thus bringing offshore support vessels into play and giving a positive impetus to offshore support vessel industry. That said, deep water drilling does not remain far when it comes to analyzing offshore support vessel market trends. In 2015, oil production from deep water drilling resulted in 9.3 million barrels per day. The increasing number of deep water oil rigs indicates the profitability of this type of drilling methodology. These growing deep-water oil rigs also demand support vessels, thus providing a stimulus to offshore support vessel industry.

The necessity of fuel oil is a major factor contributing toward offshore support vessel market expansion. Lowered associated costs along with easy availability have spurred fuel oil sales, that amounted to 48.6 million metric tons in 2016. These fuels need to be efficiently transported from the rigs, which has thus stimulated the offshore support vessel industry. Furthermore, the increasing environmental concerns have also led to FLNG market depicting substantial growth, which in turn has contributed toward the expansion of offshore support vessel market. The lower costs of LNG extraction coupled with stringent government restrictions to decrease carbon emissions have led to an increase in the demand for LNG, bringing LNG extraction methodologies to the limelight. Offshore support vessel market players would certainly tap into the expanding FLNG industry size, estimated to cross 300 metric tons per annum by 2024, in terms of volume.

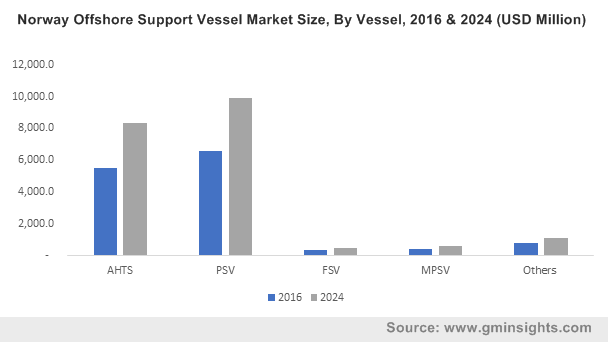

With the Gulf of Mexico witnessing 0.1 million barrels per day increase of fuel production in 2017, it goes without saying that the U.S. is a pivotal region for offshore support vessel industry growth, with a target size estimation of 1900 OSVs by 2024. Norway with its long coastline and concentration of expansive deep-water oil production projects will also contribute to the offshore support vessel market growth. Some of the world’s largest offshore oil fields are located in the Persian Gulf off the coast of the United Arab Emirates, where new research studies have been unveiling more number of oil fields. This will further prompt UAE to opt for more offshore support vessels, owing to which UAE offshore support vessel market share will register a CAGR of 4% over 2017-2024.

With the development of regasification terminals and deployment of growing number of hydrocarbon exploration platforms, offshore support vessel industy is certain to traverse along a positive growth curve. In 2018, Mexico’s National Hydrocarbon Commission will organize annual auctions for almost 2000 oil wells in the U.S. federal waters. Once these oil wells commence operation, there is no doubt that a huge fleet of offshore support vessels will be required for the upkeep of these wells that will function as a catalyst to the growth of the offshore support vessel market. Given the vast product deployment, offshore support vessel market size has been estimated to exceed USD 60 billion by 2024.