Offshore wind market to surpass USD 60 billion-dollar benchmark by 2024, China and India to emerge as the foremost growth pockets

Publisher : Fractovia | Published Date : 2018-08-16Request Sample

The ongoing global transition toward renewable energy sources has proved to be a prominent breakthrough for the offshore wind market stakeholders. The rapid maturation being observed in the technology of wind turbines has resulted in offshore wind taking shape as a mainstream energy source globally over the past few years. According to the statistics published in 2017 by the Global Wind Energy Council (GWEC), an international trade association for the wind power sector, the total installed capacity of offshore wind energy across 17 major geographies around the world stood at 18.8 GW. A record 4.3 GW of new offshore wind capacity was added to this total in the same year which translates to a staggering y-o-y growth rate of 95 percent. Apparently, these statistics are a testimony to the fact that offshore wind industry is slated to flourish at an exceptional pace in the times to come.

UK Offshore Wind Energy Market Size, By Component, 2017 & 2024 (USD Million)

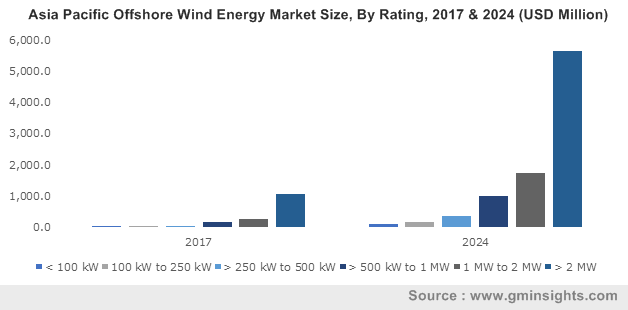

The adoption of Sustainable Development Goals at the UN in 2015 and the subsequent formalization of Paris Climate Accord has compelled almost every economically-dominant nation to profoundly transform the conventional methodologies of power generation and energy storage systems. Especially, the industrially progressive and rapidly emerging economies in Asia have been increasingly focusing on numerous renewable energy sources such as solar, wind, and tidal power. Enumerated below is a brief overview of how Asian nations have been emerging as one of the principal growth terrains for the global offshore wind market over the recent years:

China Offshore wind Market Trends

Regarded as the world’s biggest emitter of greenhouse gases, China is facing a giant task of transitioning into a green economy and live up to the Paris agreement on climate change. The Asian powerhouse aims to exceed a total of 210 GW of on-grid wind power capacity by the end of 2020. Out of which, the offshore wind is anticipated to surpass the installed capacity of 5 GW – a factor that has eventually boosted the growth prospects of offshore wind energy market in the nation. The total installed wind power capacity in the nation reached 169 GW and the offshore installation registered an excellent increase of more than 60 percent in 2017, as per the data released by the Chinese Wind Energy Association.

Owing to the aforementioned statistics and the construction of several wind energy projects that are currently in the pipeline, the nation was placed at the third position globally in terms of offshore wind capacity at the end of 2017 by the Global Wind Energy Council. Consequentially, it is quite prudent to state that China is one of the most prominent revenue pockets for the international firms partaking in offshore wind industry.

India Offshore wind Market Trends

Registering one of the fastest GDP growth rates globally in the recent years, India has been proactive in embracing offshore wind energy and incorporating the same in its power generation portfolio. The nation has apparently set itself an ambitious target of generating 175 GW of power through renewable energy sources by 2022. In order to achieve the same, the Ministry for Power and New & Renewable Energy of India has recently announced a short-term goal of installing up to 5 GW of offshore wind capacity by 2022. The government aims to achieve an offshore wind capacity of a humongous 30 GW by 2030 which would fortify its position in the offshore wind industry in the upcoming years.

Concurrently, high costs of solar equipment and growing electricity prices have been instrumental in boosting the growth prospects of offshore wind energy market in India. Endowed with an enormous coastline of 7,517 km, the country has an estimated offshore wind power potential of 127 GW mostly off the coasts of Maharashtra, Gujarat, and Tamil Nadu, according to trusted reports. Taking the first major step towards constructing offshore wind projects on a large scale, the National Institute of Wind Energy has recently sought expressions of interest from international wind energy firms to build an offshore wind project in the Gulf of Khambat, off the coast of Gujarat. With an installed capacity of around 1 GW, the project is anticipated to optimistically impact the offshore wind energy industry trends in the nation.

Essentially driven by the deployment of technologically advanced wind turbines with tremendous output and growing investor confidence, the offshore wind market is poised to expand at an enormous pace in the forthcoming years. In fact, as per a research study compiled by Global Market Insights, Inc., the commercialization portfolio of the overall offshore wind industry is estimated to surpass a stunning USD 60 billion by 2024.