Oil and Gas Analytics Market Outlook: Increasing petroleum product demand along with growing digitization to augment the industry growth

Publisher : Fractovia | Published Date : 2017-01-27Request Sample

Oil and Gas Analytics market size estimated at USD 4 billion in 2015, is expected to be driven by its wide applications in exploration & drilling, storage optimization, asset performance, refining, and fleet. Moreover, rise in the number of oil and gas exploration activities across the globe will boost the global market trends over the coming years. Furthermore, the growing popularity of digital technology among the oil & gas firms has enhanced the workforce & cost efficiency and this in turn has fueled the oil& gas analytics industry size. Oil and gas analytics market growth is expected to be catalyzed by the firms which are expanding their refining capacities to fulfill the heavy demand for petroleum. For instance, ExxonMobil has decided to expand the refining capacity of its refinery at Texas in U.S. to 40,000 barrels by 2018. As per Global Market Insights, Inc., research study “Oil and Gas Analytics Industry share is expected to hit USD 21 billion by 2024.”

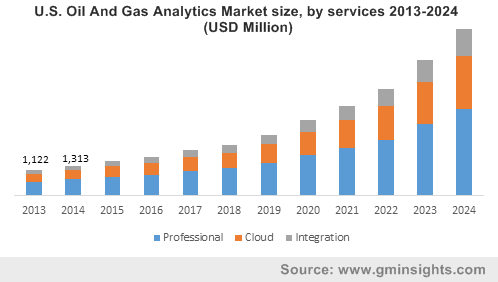

U.S. Oil And Gas Analytics Market size, by services 2013-2024 (USD Million)

Oil and gas analytics help the industries in real-time decision making process, improves productivity, and minimizes operation costs. It also assists the industries in finding the root cause of the production loss through data analysis. Furthermore, the availability of huge volumes of data in oil & gas industry is expected to boost the oil and gas analytics industry size over the coming seven years. In addition to this, oil & gas analytics market share will also witness a considerable surge, owing to the high drilling as well as lower crude oil costs globally.

Hosted oil & gas analytics market is projected to gain significant popularity over 2016-2024

Taking into consideration the deployment trends, oil and gas analytics are installed via on premise and hosted deployments. On premise oil & gas analytics deployment industry size is expected to witness a substantial growth over the next few years. Hosted deployment will grow at a rate of 20% over the coming seven years, driven by increased productivity and cost efficiency. Bakken Shale exploration & production unit has deployed hosting for oil & gas sector.

Based on the services the global oil and gas analytics market is segmented into cloud services, professional services, and integrated services. Integrated services segment is expected to contribute significantly towards the overall industry revenue over 2016-2024.

Geographically, Norway exploration and drilling analytics market which was valued at USD 50 million in 2015, is expected to contribute significantly towards Europe oil and gas analytics market share over the coming years. Rising acceptance of digital technology to minimize operating and production costs is expected to influence the regional growth.

Asia Pacific oil and gas analytics industry size is expected to observe a high surge, owing to rise in number of refineries along with capacity expansion. India is expected to contribute substantially towards the regional share. In October 2016, Indian Oil Corporation had decided to increase the capacity of Panipat refinery by 25 million metric tons each year by investing USD 2.3 billion.

Expanding exploration and production activities are projected to drive the North America oil and gas analytics market revenue growth over the next few years. U.S. is expected to be the key regional revenue pocket.

MEA oil and gas analytics industry is expected to grow significantly over the coming seven years due to abundance of natural resources. Angola is anticipated to drive the regional revenue growth.

Industry players will try to increase their revenue through strategic alliances, R& D investments, and product innovations. Major market participants include Accenture, Cognizant, Drilling info Incorporation, Cisco Systems, Oracle, Tableau Software, IBM, Teradata, Hitachi Limited, Inc., Deloitte, Microsoft, SAP SE, Capgemini, TIBCO Software Incorporation, SAS Institute Incorporation, and Hewlett Packard Enterprise Development LP.