Europe orthopedic devices market to generate a massive valuation by 2024, Germany and UK to be major revenue pockets

Publisher : Fractovia | Published Date : 2017-06-08Request Sample

The world has been witnessing an increase in the prevalence of obesity and diabetes, which is likely to spur Orthopedic devices market. A sedentary lifestyle coupled with poor diet intake, smoking trends, and lack of physical activity has led to a rise in the number of bone disorders, which will stimulate the necessity for orthopedic devices. In addition, medical research has enabled the contraption of highly advanced innovations in the field of osteology, which will boost the demand for cost-effective equipment, thereby propelling orthopedic devices industry.

Speaking of innovations, the technological advancements in global 3D printing materials market, smart implants, and robot-assisted surgeries are also expected to change the dynamics of orthopedic devices market. Of late, poor traffic mismanagement has led to an increase in the number of road accidents. With the rising number of sporting events and international games, sport injuries too, are on an incline, which will consequently lead to bone-related injuries. This is bound increase the demand for invasive surgeries, thereby stimulating orthopedic devices industry growth. The availability of bio-based implants and innovative surgical materials will also propel orthopedic devices market size, which is slated to cross USD 53 billion by 2024 with a CAGR estimation of 3% over 2017-2024, having held an initial valuation of USD 39 billion in 2016.

Europe Orthopedic Devices Market Size, By Product, 2013-2024 (USD Million)

Prominent players operating in orthopedic devices industry include ConforMIS, Medacta, DePuy Synthes, NuVasive, DJO Global, Stryker, Zimmer Biomet, Medtronic Spinal, MicroPort Scientific Corporation (Wright Medical Group), Smith & Nephew, and Globus Medical. These companies engage in growth strategies such as new product launches and innovative device development to sustain the business position Additionally, it has been observed that major device manufacturers strive to acquire other firms to enhance their product portfolio and expand their regional landscape.

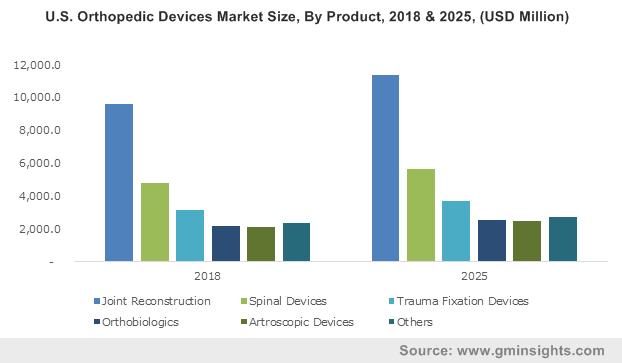

Joint reconstruction is one sphere that has observed a remarkable adoption since the last few years, subject to the rising unmet need for effective solutions regarding bone-related disorders. On these grounds, joint reconstruction orthopedic devices market is expected to grow at a rate of 3% over 2017-2024. Pertaining to the growing prevalence of osteoarthritis and osteoporosis, rising geriatric population, and technological advancements, joint reconstruction had accounted for more than 40% of the overall orthopedic devices industry in 2016 and will register considerable revenue by 2024.

The prevalence of degenerative disorders has risen considerably among the elderly population, owing to which companies have been exploring other related business spheres to enhance their product offering, especially for spinal devices. The rapid surge in the novel approaches for spine disorder treatments will stimulate spinal orthopedic devices market, slated to grow at a rate of 3.5% over 2017-2024. These devices are especially popular across the United States, subject to the growing geriatric population and highly developed healthcare infrastructure.

Speaking along the same lines, U.S. accounted for more than 90% of North America orthopedic devices industry share in 2016, having had a revenue of USD 20 billion in 2016, and is estimated to register a revenue of USD 25 billion by 2024. This growth can be credited to the rise in the number of musculoskeletal disorders and osteoarthritis and advancements in medical technology.

The presence of an excellent healthcare infrastructure and the adoption of superior medical technologies are the key drivers responsible for the growth of Europe orthopedic devices market, with UK and Germany being the key revenue contributors. UK held more than 15% of Europe orthopedic devices market share in 2016 and is expected to grow significantly over the coming years, owing to the rising prevalence of bone disorders and the presence of a huge elderly patient base.

Germany, on the other hand, held more than 20% of Europe orthopedic devices industry in 2016 and will grow lucratively over 2017-2024. This growth can be credited to the sophisticated medical infrastructure, high investments in research & development activities in the medical sector, and the adoption of high grade healthcare technologies.

A rising demand for trauma fixation devices has been observed across the emerging economies such as China, subject to the increase in the number of road accidents and sport injuries that lead to bone and spinal disorders. This is anticipated to fuel trauma orthopedic devices market, slated to cross a valuation of USD 7 billion by 2024.

China orthopedic devices industry size is estimated to grow at a rate of 12% over the forecast timeline. This is essentially due to the growing patient awareness and the ever-increasing elderly population base. Japan, on the other hand, held more than 40% of Asia Pacific orthopedic devices market share in 2016, and is expected to surpass USD 2 billion by 2024, pertaining to the adoption of advanced medical technologies and the rising incidence of bone ailments.

Orthobiologics orthopedic devices industry is estimated to surpass USD 4 billion by 2024, primarily due to the growing product demand for bone grafting surgeries.

LATAM is an emerging growth avenue for orthopedic devices market, with key contributors being Brazil and Mexico. Brazil orthopedic devices market was worth more than USD 750 million in 2016, and will expand at a lucrative rate over 2017-2024, pertaining to the improving medical facilities, rising healthcare spending, and massive investments from huge corporations in the field of orthopedics.

Mexico orthopedic devices industry size was worth more than USD 300 million in 2016. Rising occurrence of orthopedic disorders and improved healthcare facilities will stimulate the regional growth.

Orthopedic devices market is characterized by constraints such as excessive costs of implants and invasive surgeries and lack of skilled medical personnel. In addition, the lack of a reimbursement framework will also pose a threat to the market. To combat these restraints, it is essential that the prominent players of orthopedic devices industry strive to develop a range of cost-effective devices. It is also expected that the governments of various nations focus on reducing the cost of the surgical procedures and hospital stays.