Oxygen barrier films & coatings for dry food market to procure hefty returns from baked goods applications over 2019-2025

Publisher : Fractovia | Published Date : 2019-07-26Request Sample

The global oxygen barrier films & coatings for dry food market size has, of late, been witnessing considerable growth due to the presence of myriad global firms providing product wrapping to preserve the texture, taste, and aroma of packaged food. An influx in customer preference towards packaged food due to its benefits such as convenience and more will boost the industry trends in the forecast timeframe. High disposable incomes as well as growing consumer preference towards indulgent snacks will positively influence oxygen barrier films & coatings for dry food market outlook in the coming years.

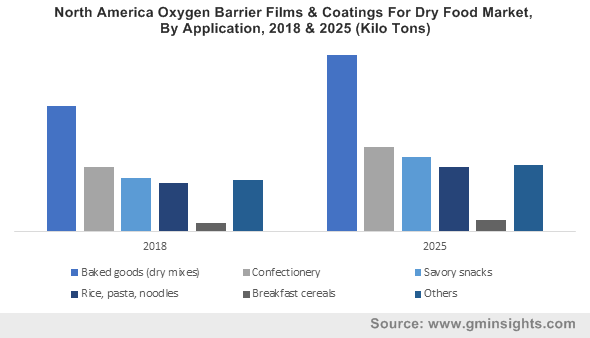

North America Oxygen Barrier Films & Coatings For Dry Food Market, By Application, 2018 & 2025 (Kilo Tons)

As customers experience a change of perspective with regards to product wrapping on account of concerns pertaining to safe consumption, numerous innovations are likely to gain ground in the packaging industry. High-performance requirements in the packaging sector – such as protection from moisture and other environmental factors have positively impacted the market growth.

Expansion of the food industry, coupled with an increased logistics facilities have made it easier for producers to transfer goods from one place to another, which would further create demand for packaging materials, propelling the overall oxygen barrier films & coatings for dry food market size.

In 2018, metallized films had held over 35% of the overall material demand. The primary reason for the same can be attributed to the aesthetic appeal of the metallized films that serve to be used for decorative purposes owing to its similarity with the aluminum foil. These films are known to offer exceptional shelf life – on account of which they are highly preferred by manufacturers. That said, they also boast of excellent oxygen resistance ability.

The oxygen barrier films & coatings for dry food market is touted to flourish mostly on the account of its broad application spectrum.

The baked goods application segment, i.e., dry mixes is expected to emerge as one of the most profitable application avenues for oxygen barrier films & coatings for dry food market. This growth could undeniably be credited towards the innovations and R&D in the bread, baking and pastry sector. The gluten-free bakery was one such innovation which is taking precedence as many people are making health-conscious decisions by avoiding gluten in their diet.

Reports claim that baked goods application segment in oxygen barrier films & coatings for dry food market will witness the highest gains over 2019-2025.

With an increase in consumer choices towards healthy bakery products, the manufacturers are seeking more efficient and sustainable packaging solutions. Deployment of oxygen barrier films & coatings materials for packaging will keep the bakery products fresh, along with extending its shelf life, which in turn will augment oxygen barrier films & coatings for dry food market trends in the predicted timeline.

As per reliable reports, the breakfast cereal application segment is estimated to depict a highly commendable growth rate in the ensuing years. The application will witness enhanced demand owing to the increasing consumer consciousness related to health benefits as well as the desire for low calorie diet. Breakfast cereal finds prominence in the infant food industry due to its high nutrition value, along with the ease in preparation. Manufacturer are witnessing high demand for breakfast cereals owing to the increasing health awareness and surge in disposable incomes. This will result in an increase in the demand for oxygen barrier films & coatings materials to maintain product crispiness, which will bolster the oxygen barrier films and coatings for dry food market in the anticipated timeline

Supported by a broad application terrain, oxygen barrier films and coatings for dry food market is expected to show a highly profitable remuneration graph in the ensuing years. Estimates claim that the valuation of oxygen barrier films & coatings for dry food market would cross a colossal $1.4B by the end of 2025.