An overview of oxygen cylinders and concentrators market with respect to the application spectrum: Aerospace to emerge as a profitable growth avenue

Publisher : Fractovia | Published Date : 2017-10-26Request Sample

CAIRE Inc., the Georgia-based company that constitutes the competitive spectrum of U.S. oxygen cylinders and concentrators market, has officially announced the launch of the SAROS™ 15 oxygen concentrator, specifically designed for combat casualty care. An enhanced, state-of-the-art version of its predecessor, the SAROS™ launched in 2011, the SAROS™ 15 was in particular, developed for the U.S. Air Force to generate close to 15 LPM oxygen. Experts have already been raving about the product, claiming it to disrupt the conventional product landscape of oxygen cylinders and concentrators industry. The product may specifically garner mass popularity on its home ground, given that the U.S. military and defense sector is in dire need of highly effective oxygen supply systems for ground-based defense medical assemblages, field hospitals, en route medical care, tactical combat casualty care, and casualty evacuation. Furthermore, the region houses a massive percentage of the elderly populace susceptible to respiratory disorders, which would further necessitate the requirement of fixed and portable oxygen systems, thereby impelling the regional oxygen cylinders and concentrators market share. Driven by the surging ongoing demand for these products from the medical, automotive, aerospace, and manufacturing sectors, oxygen cylinders and concentrators market share was pegged at USD 2 billion in the year 2016.

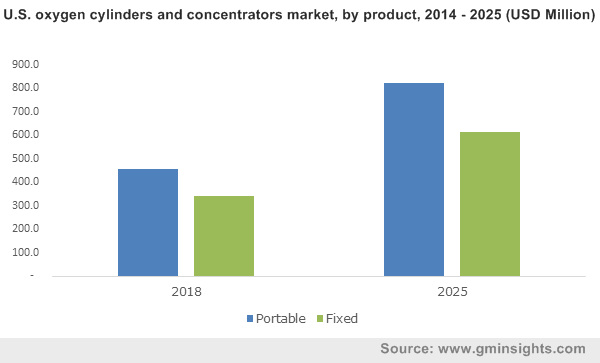

U.S. Oxygen Cylinders and Concentrators Market size, By Product, 2013-2024 (USD Million)

Unveiling oxygen cylinders and concentrators industry trends from the healthcare domain

The healthcare sector is unquestionably, one of the most lucrative application arenas for oxygen cylinders and concentrators market. The rising percentage of a geriatric population base vulnerable to potential respiratory disorders such as asthma and COPD is bound to generate a considerably massive demand for these products, which would most certainly push oxygen cylinders and concentrators industry growth. As per a report by the WHO, close to 65 million people suffer from COPD (chronic obstructive pulmonary disease) currently. In 2005 alone, more than 3 million people were reported to have died due to COPD. WHO also reports that an astonishing 90% of COPD deaths are prevalent in the low-income and middle-income countries. The astoundingly mammoth prevalence of COPD has prompted manufacturers to come up with state-of-the-art oxygen systems, thus creating a lucrative avenue for oxygen cylinders and concentrators market. As per estimates, COPD is likely to emerge as the third leading cause of deaths globally by 2030, thus validating the claims that oxygen cylinders and concentrators market from healthcare applications is slated to witness dynamic transformations in terms of sales and volume.

Healthcare applications, as per reports, accounted for the largest share of the overall oxygen cylinders and concentrators market revenue in 2016, driven by the escalating patient pool suffering from chronic hypoxemia, sleep apnea, pulmonary edema, and COPD. Besides being deployed for these diseases, oxygen concentrators also find massive applications in surgical procedures, especially in cases of severe fatalities that require prompt hospitalization. Often times, in such unfortunate situations, there have been instances where oxygen cylinder supply has ceased to be delivered. The recent Gorakhpur tragedy in India is an apt instance of the same. The precedent served as a pivotal lesson for the entire healthcare fraternity, pressurizing regional manufacturers to increase oxygen cylinder production. It is expected that manufacturers at the global level would also take cue from the incident, which would substantially increase the sales graph of oxygen cylinders and concentrators market from healthcare applications.

Unveiling oxygen cylinders and concentrators industry trends from the aerospace sector

The aerospace domain has surprisingly evolved as a rather pivotal application segment for oxygen cylinders and concentrators market. According to the Federal Aviation Regulations Part 91.211, using supplemental oxygen at a cabin pressure altitude of more than 12,500 feet while flying for more than 30 minutes, is a mandate. Pilots at a cabin altitude of over 14,000 feet in fact, have to use oxygen at all times, while beyond, 15,000 feet, every passenger in the plane must be provided with supplementary oxygen. In the light of this scenario, companies have been attempting to launch unique products that can be used in commercial and military aircraft. For instance, Philips Respironics, a division of Royal Philips, recently declared the launch of its SimplyGo Mini portable oxygen concentrator (POC) that adheres to all the FAA (Federal Aviation Administration) requirements for in-flight usage of POCs.

Of late, there has been a considerable rise in the number of aircrafts that are designed to accommodate exclusive, all-round ICU facilities, which have consequently necessitated the requirement of POCs. Experts claim that a broader spectrum of airline options have emerged lately, in a scenario where in-flight medical care facilities are prioritized. In effect, this has led to a substantially escalating demand for compatible oxygen systems, which would certainly augment oxygen cylinders and concentrators market share from aerospace applications. Furthermore, this paradigm shift would challenge companies to bring about a change in their product landscape, which would further stimulate oxygen cylinders and concentrators market trends from the aerospace domain. For instance, Inogen, one of pivotal participants of oxygen cylinders and concentrators market, recently received the EC Certificate for its novel POC – the Inogen One G4. The product has been approved for sale, pronto, and has been suitably designed to be used for long-distance travel as well, apart from home therapy.

It is noteworthy to mention that another lucrative end-use domain making its mark in oxygen cylinders and concentrators industry is that of adventure activities. Inclusive of arduous ventures such as trekking, mountaineering, scuba diving, undersea diving, etc., this sector demands portable oxygen systems on a humongous scale, pertaining to the lack of oxygen in the environment amidst which these activities are performed. The rising percentage of people opting for such adventure sports would subsequently necessitate the requirement of unique, efficiently designed oxygen systems, thereby impelling the overall oxygen cylinders and concentrators market outlook.

One of key constraints of this business space can be rightly attributed to product storage. Inefficient oxygen system storage is likely to cause a dent in oxygen cylinders and concentrators industry share in the ensuing years, given that improper storage leads to product wastage and other potential hazards. Companies however, have been conducting significant initiatives to combat the same, by means of introducing portable devices that are rather user-friendly and convenient to store. Driven by the appreciable developments on the product front, in tandem with the widespread application landscape, oxygen cylinders and concentrators market size has been forecast to cross USD 4.5 billion by 2024, as per a report compiled by Global Market Insights, Inc.