APAC paperboard packaging market to witness heavy gains over 2017-2024, driven by the ever-expanding F&B and pharma domains

Publisher : Fractovia | Published Date : 2017-09-27Request Sample

Metsä’s Lidloc, having made it to the headlines last month, accentuates the contemporary product evolutions prevalent in paperboard packaging market. ‘Lidloc’ has been launched by a segment of the Metsä Group, Metsä Board, and has already been presented at the Packaging Innovations Exhibition in Birmingham, UK. While experts have been pondering over Lidloc’s sudden fame, analysts claim that the product’s ultra-unique design is what has done the trick. The patented design encompasses an extension to a regular cup structure that folds and gets locked into an integrated lid, thereby eliminating the requirement for a separate plastic lid. The product has been touted to reinvent the design, production, consumption, and recycling methodologies of paperboard cups, inherently impelling the profitability landscape of paperboard packaging market from the food & beverage sector.

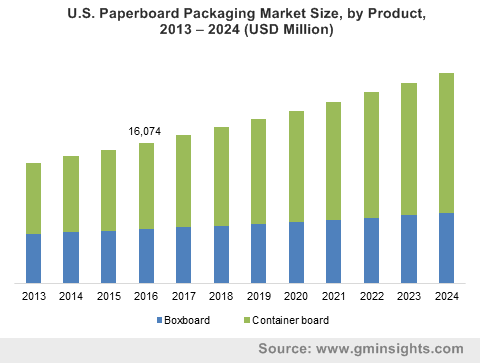

U.S. Paperboard Packaging Market Size, by Product, 2013 – 2024 (USD Million)

Despite the recent disruption of plastics, paperboard packaging still remains a top priority for major manufacturers, pertaining to the abundant availability of paperboard material and the numerous regulations governing the usage of plastics for packaging. Characterized by novel product innovations spurred by technological developments, paperboard packaging industry size has been projected to surpass a mammoth valuation of USD 240 billion by 2024.

A concise insight into APAC paperboard packaging market

Paperboard packaging industry, with its widespread gamut of applications, has had a rather appreciable record of successes across the APAC belt. One of most crucial determinants this growth can be credited to is the phenomenal expansion of the F&B, pharmaceutical, and the FMCG sectors in the region, which have been touted as the most lucrative end-use domains of paperboard packaging market. Driven by the robust economic development, rising number of industrial activities, urbanization, and changing consumer lifestyles, the Asia Pacific region has experienced quite a surge in the demand for paperboard packaging products such as bleached boards, container boards, chipboards, etc. In 2016 alone, APAC apparently held a sizable chunk of the overall paperboard packaging industry share, driven by the round-the-clock work culture necessitating an increase in the percentage of door deliveries (food, medicines, cosmetics, etc.), increasing disposable incomes, high purchase parity, and rapidly advancing technological developments in the packaging sector.

The recent predominance of Nippon Paper in APAC paperboard packaging market

Nippon Paper Industries Co., Ltd., one of the major Japan paperboard packaging industry giants, has recently been making rapid inroads in the Indian sub-continent. The company aims to take over the country’s biggest paper cup manufacturer - Plus Paper Foodpac, owned by the BK Modi Group. Although the deal valuation has not been disclosed yet, reports cite that the projected amount of the agreement bordered close to INR 100 crore.

Nippon’s foray in the India paperboard packaging market portrays the firm’s commitment toward expanding its business throughout Asia Pacific. Given that India currently, is a hub of the packaging sector, owing to the country’s expanding FMCG, F&B, and pharma domains, Nippon’s decision of acquiring an Indian subsidiary is something that would have a subsequently beneficial impact on the APAC paperboard packaging industry.

Another crucial factor that may have perhaps played a vital role in influencing Nippon’s invasion in India paperboard packaging market is the country’s exponentially expanding fast-food sector. As per estimates, India’s fast-food industry has plausibly chronicled its name in the billion-dollar space in 2016. In addition, the country is expected to be one of the key revenue pockets for the APAC fast-food sector, driven by the rising number of fast-food restaurants, rising levels of urbanization, and drastically changing consumer preferences. This would undoubtedly create a subsequently massive demand for packaging, thereby stimulating APAC paperboard packaging industry. Having recognized this potential early on, experts claim that Nippon may have wisely planned its foray in India paperboard packaging market.

Nippon Paper, somewhere in the last year, had also acquired Viet Hoa My Service Trading Production Company Ltd., one of leaders partaking in Vietnam paperboard packaging market share. The Japan mogul took over the manufacturing and marketing operations of the Vietnamese firm, acquiring a 65% stake in the deal, with an aim to consolidate its position in APAC paperboard packaging market.

The electronics and consumer goods domains, in particular, can be credited to the massive growth of APAC paperboard packaging industry in recent times. With the expansion of both the aforementioned sectors, the demand for electronic equipment, cosmetics, household items, cigarettes, etc., has escalated to an elevated level, thereby necessitating the requirement of advanced paperboard packaging techniques. This has consecutively impacted APAC paperboard packaging market share, projected to cross USD 175 billion by 2024, with a CAGR estimation of 6.5% over 2017-2024.

The latest trend proliferating paperboard packaging industry is that of smart packaging. Clearly, product quality and brand value is prioritized when it comes to packaging, on the grounds of which, paperboard carton supplier, C.W. Zumbiel Co., has recently filed a patent for a unique type of packaging crafted from paperboard blanks that were printed with electric circuits by means of conductive inks. The product is a classic instance of the path paperboard manufacturers should be traversing on, to garner widespread consumer interest and expand their current sales. In the event that other firms follow suit, it would no longer remain a surprise that paperboard packaging market is slated to undergo a series of dynamic transformations in the forthcoming seven years.