Patient handling equipment market to witness a double-digit growth rate over 2018-2024, U.S. touted to be a prominent regional pocket

Publisher : Fractovia | Published Date : 2018-10-23Request Sample

The competitive spectrum of patient handling equipment market has lately been undergoing a massive change with regards to product differentiation, subject to the fact that these biggies have been making appreciative efforts to provide a considerably better experience for caregivers and medical personnel. The deployment of technology advancements in emergency medical services for improving the quality of patient care is thus likely to enhance healthcare infrastructure, which would, by extension, have a commendable impact on patient handling equipment industry.

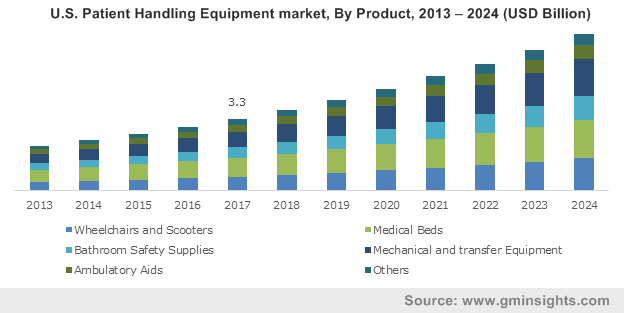

U.S. Patient Handling Equipment market, By Product, 2013 – 2024 (USD Billion)

Recently, one of the major ambulance manufacturers, Crestline Coach made it to the headlines for implementing different design aspects to develop a smart ambulance. The deployment of real-time instruments in ambulances will help improve hospital efficiency by meticulously serving the patients in emergency cases. The utilization of technology among medical equipment manufacturers is thus one of the driving factors of employee safety enhancement and patients care, which will stimulate patient handling equipment industry share over the years ahead. Moreover, for enhancing the mobility of patients, renowned players in patient handling equipment market are maximizing the functionality of hoists and lifts as well. For instance, the England based medical equipment manufacturer, Innova care Concepts has created an innovative hoist tracking system to transfer patients from one room to other – a product that may have a considerable impact on patient handling equipment market.

In order to encourage the research community and manufacturers in patient handling equipment market, most of the regional governments have been observed to have undertaken significant initiatives. For instance, the Director General of the Ghana Health Service, Dr. Anthony Nsiah Asare has challenged engineers in the biomedical sector to innovate new products and repair equipment to reduce wastage in the healthcare sector, which would have a considerable impact on the regional patient handling equipment market share. The Ghana government is also looking forward to deploying regulatory norms to promote biomedical engineering practices over the coming years, which will further drive patient handling equipment industry outlook.

The rise in the population of patients suffering from mobility issues has had a positive impact on the product demand. For instance, one of the medical surveys carried out across United States in 2014 claimed that more than 30% people suffered from obesity problems then. The U.S. Census has also reported that one out of every five people may be disabled due to communicative, mental, and physical impairment. In addition, the exponentially growing elderly population across U.S. is also likely to boost the regional patient handling equipment industry size. According to Global Market Insights, Inc., the U.S. dominated the overall North America patient handling equipment industry in 2017, with a valuation of USD 3,264.8 million.

Patients with mobility problems usually require lift chairs, motorized scooters, and wheelchairs for mobility. The increasing usage of transportation equipment to move patients around hospitals, between floors, and through corridors will thus influence patient handling equipment industry trends.

The FGI (Facility Guidelines Institute) has introduced new guidelines to curb risks associated with patient handling mainly in hospitals. Infrastructural design strategies and safety protocols have been suggested within those guidelines, which will significantly augment patient handling equipment industry. Some of the FGI measures mentioned in the subsection of the Patient Handling and Movement Assessments are mentioned as follows. It is prudent to state that these guidelines have left a substantial impact on U.S. patient handling equipment market, which is likely to hold a major chunk of the global share by 2024.

- Reduce the transition between floors

- Make available mobility medical equipment such as walkers, lifts, repositioning aids, and transfer devices to the patients by keeping it near to the patient room.

In order to follow these measures, many hospitals are investing heavily in infrastructure renovation. As the risks associated with patient falls increase, the need for monitoring patients and improving healthcare architecture also observes a rise, by extension, driving the patient handling equipment industry trends. In the future, the design solutions will encourage patient mobility by decreasing the number of patient falls. In Florida, for instance, the Tampa General Hospital has deployed two trained lift operator teams, so that caregivers can totally focus on their patients.

With the increasing deployment of advanced technologies such as GPS tracking, electronic health records, smart alarms, and alert systems in hospitals and healthcare institutions, it goes without saying that nurses and caregivers would need to educate themselves regarding the working of these technologies for efficient work output. In this regard, some of the prominent players in patient handling equipment market including Getinge Group, Stryker Corporation, and Hill-Rom are organizing training programs to ensure the safety of both patients and caregivers. Trained caregivers will help enhance patient care resulting in effective treatment facilities and a greater proportion of saved lives. Moreover, the Occupational Safety and Health Administration has also published guidelines for nurses to educate them about lifting devices and mechanical equipment. The growing implementation of several technical updates in medical equipment is thus forecast to boost patient handling equipment market size, which will surpass a revenue collection of more than USD 23 billion by the end of 2024.