China pea protein market to garner lucrative proceeds by 2024, regional industry to be driven by the escalating product demand for animal feed concentrates

Publisher : Fractovia | Published Date : 2016-10-27Request Sample

Considered to be one of the most acclaimed verticals of the global nutrition space, pea protein market, in the recent years, has strongly consolidated itself as a highly lucrative business sphere. Thriving on the ongoing trends of veganism and plant-based meats, pea protein market has indeed registered an appreciable growth rate in the recent years, and is expected to gain massive impetus ahead. The extensive traction gained by this industry is rather evident from the fact that numerous food companies and meat producers are now branching out toward alternative plant meats.

U.S. Pea Protein Market Size, By Product, 2017 & 2024, (Kilo Tons)

Citing an instance validating the aforementioned, a couple of years ago, the brainchild of Stanford biochemist Patrick Brown and his team at Impossible Foods, a plant-based beef burger, made it to the headlines for looking, tasting, and smelling very similar to beef. However, the burger, which had been in the making for almost half a decade, had seemingly been made entirely from plant-based ingredients. Armed with the goal of reducing meat consumption and making the entire process of meat-based product manufacturing a little less resource-intensive, companies such as the California-based Impossible Foods have been striving to come up with suitable vegetarian meat substitutes, that is certain to propel the commercialization map of the global pea protein market.

Ever since the trend has grabbed eyeballs, the proportion of food manufacturers aiming to tap into the vegetarian meat business has only increased. Recently, Tyson Foods, the hot dog and chicken nugget maker, announced that it plans to foray into the meat substitute market. The company aims to debut a vegan protein in 2019, with the demand for vegan meats soaring high.

Speaking of the international, frenzied foray into the vegan sector, it is imperative to mention that even retail stores have been working to grab a slice of this ever-growing market. Recently, vegan brand Good Karma Foods announced that it will debut a pea protein-based dip line and a new sour cream line in two flavors. The firm aims to find ways to endorse plant-based food options that are nutritious, free of allergens, nutritious, yet delicious and creamy. It is thus rather overt that with the rising demand for vegetarian meats and the ever-expanding retail industry scrambling to capitalize on the rising popularity of veganism, the global pea protein market will gain substantial returns in the years to come.

Aided by the capability of these plant-based products to help muscle repair and deliver ample nutrition, pea proteins are often used in sport supplement applications. These products essentially comprise branched-chain amino acids that possess the ability to decrease muscle breakdown post workout sessions. They serve as a very rich source of protein for vegetarians and vegans, given that they are equipped with a similar amino acid profile as the ones in animal products. Additionally, they also possess improved assimilability as opposed to other plant products, that has helped augment the deployment of these proteins in sport nutrition packs, propelling pea protein market share from sport supplements.

As per estimates, Germany pea protein market size from sports supplement applications may register a CAGR of 11% over 2018-2024. The growth of the regional market can be aptly credited to the fact that these proteins balance blood sugar, thereby aiding in healthy weight loss, promote muscle repair, and ensure substantial neurotransmitter and immune cell production. The significance of the product deployment in sports nutrition is also rather vivid from the numerous companies that have been striving to manufacture pea protein based products for sportspersons. Citing an instance, Muscle Milk maker CytoSport, renowned for manufacturing dairy-based proteins for athletes, ventured into the plant-based nutrition channel a couple of years back, with a unique launch. Back in 2017, the company introduced a new product line called Evolve, comprising vegan, plant-based protein powders, protein bars, and shakes, sans soy, dairy ingredients, or gluten. The product had apparently been developed with non-GMO pea protein, in interesting flavors such as toasted almond, vanilla, and chocolate.

Speaking of the regional scenario, it is vital to mention that China currently stands as one of the most lucrative geographical markers for the pea protein industry. Pea proteins, with their slightly savory taste, are considered to be optimal for weight management. Additionally, they are also non-GMO and gluten-free in nature, and help enhance the protein content in animal feed concentrates without having to necessitate any alteration in the color, flavor, or aroma. Given the robust proliferation of the animal feed nutrition ingredients market in China, it comes as no surprise that these products will gain massive traction in the region in the years ahead. As a matter of fact, China pea protein concentrate market size, in the year 2017, exceeded USD 3.5 million.

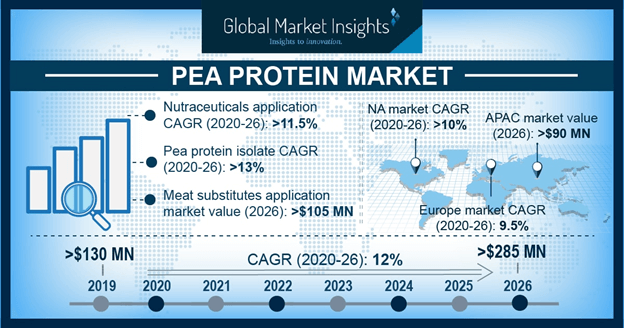

Endorsed by the ever-changing nutrition trends and the rising awareness regarding the significance of proteins in the diet, the global pea protein market is expected to traverse alongside a highly profitable growth path in the years ahead. Core companies and retail outlets have been instrumental in bringing these products to the mainstream, that would further augment the industry growth. Say for instance, just recently, Chickpea-fueled brand Banza sponsored a nation-wide roll-out of its low carb, high protein chickpea rice, comprising chickpeas, pea protein isolate, and tapioca at Whole Foods. Considering the massive popularity these products have been garnering lately, it comes as no surprise that pea protein industry size has been pegged to hit USD 160 million by 2024.