Performance Elastomers Market to garner lucrative receipts via thermoplastic product demand, global revenue to surpass USD 14 billion by 2024

Publisher : Fractovia | Published Date : 2018-02-06Request Sample

Over the last few years, performance elastomers market share has been depicting a rather profitable growth trajectory owing to the rising preference for these elastomers across a diverse set of end-user verticals. Given the fact that performance elastomers possess very strong molecular bonds, these products are primarily deployed in components that require high levels of resistance toward tolerating highly reactive chemicals, aromatic and aliphatic hydrocarbons, exhaust systems, and extreme heat in engine blocks. Apparently, the aforementioned characteristics of plastic elastomers have predominantly led to its wide-scale utilization across a range of business domains including building and construction, food and beverages, automotive and transportation, aerospace, industrial machinery, consumer goods, and electrical & electronics. As a consequence, it would be fair to mention that the prospective growth of the end-use spectrum would invariably prove advantageous to the overall performance elastomers industry share augmentation over the estimated time frame. In fact, taking into account the latest research report of Global Market Insights, Inc., performance elastomers market is forecast to exhibit an impressive CAGR of 7.5 percent from 2017 to 2024.

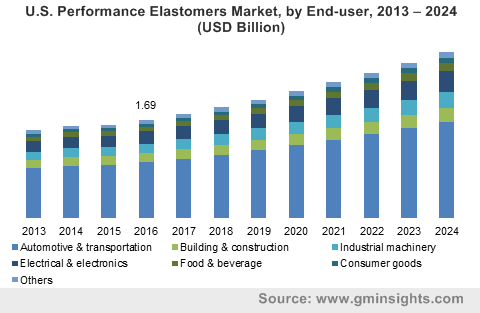

U.S. Performance Elastomers Market, by End-user, 2013 – 2024 (USD Billion)

Thermoplastic elastomers to hold sway over the product segment of performance elastomers industry

While elaborating on the future growth potential of the global performance elastomers market, it would be rather imperative to take note of the substantial contribution of one of the major products of this industry. Apparently, thermoplastic elastomers have gained immense significance over the past few years which has consequentially led this segment to dominate the overall product spectrum of the performance elastomers industry space. Below are a few instances of capacity expansion bids of the most acclaimed performance elastomers market participants which go on to demonstrate the growing prominence of thermoplastic elastomers:

- To fortify its presence in the Europe performance elastomers industry, Kraiburg TPE has officially announced to have added a new extrusion line at the firm’s headquarters for manufacturing advanced thermoplastic elastomers. The Germany-based company has been investing heavily to accentuate its existing production capacities and to further promote more research at its development center. Reportedly, the latest expansion move would take the total manufacturing volume of the firm to around 56,000 metric tons across its various facilities located in Germany, USA, and Malaysia.

- Mitsubishi Chemical Performance Polymers Co., Ltd has recently declared to have commenced the production of its cutting-edge styrenic thermoplastic elastomer, TEFABLOC™. The Thailand based subsidiary of performance elastomers market giant Mitsubishi Chemical Corporation, aims to expand its existing product offerings to meet the rising requirements of a diverse set of consumers in the nation. For the record, the company currently exports these elastomers from the US, China, Europe, and Brazil that is deployed in a number of sectors including healthcare, food packaging, electronic devices, and automobiles. Apparently, it goes without saying that the latest move of Mitsubishi Chemical Performance Polymers (Thailand) Co., ltd would strengthen its position in the Asia Pacific performance elastomers industry.

- Polymax Thermoplastic Elastomers L.L.C., a custom compounder and leading manufacturer of thermoplastic elastomers, has recently corroborated its intention to expand its annual production capacity by adding a humongous volume of 8 million pounds of elastomers. The US-based company has apparently added a new manufacturing line to augment its current pace of producing thermoplastic elastomers which include styrene-butadiene-styrene, hydrogenated rubber, alloy products, and thermoplastic polyolefin. Needless to mention, the latest expansion move is likely to assist Polymax in making swift inroads in the intensely combative US performance elastomers industry.

Considering the aforementioned factors, it is quite undeniable that the thermoplastic elastomers segment would preeminently drive the growth prospects of the global performance elastomers market over the forthcoming years. As per reliable estimates, thermoplastic elastomers apportioned over a quarter of the total revenue share of performance elastomers industry, something which goes on to underline the dominance of these elastomers over the global product spectrum of this business space. Moreover, with leading firms shifting their base toward the South East Asian topographies for the reasons of lower production cost, in conjunction with the burgeoning product requirement from the ever-growing automobile, aerospace, consumer goods and construction sectors, performance elastomers market is bound to traverse a profitable growth terrain in the ensuing years.