Polyvinyl butyral (PVB) market to witness commendable gains from automotive applications over 2017-2024, governmental renewable energy strategies to push product demand

Publisher : Fractovia | Published Date : 2018-01-09Request Sample

Considering the huge requirement of PVB for the automotive, construction, and solar equipment, major giants in polyvinyl butyral (PVB) market have been involved in conducting lucrative mergers and acquisitions of late. For instance, recently, a renowned behemoth in PVB industry, Kuraray Co., Ltd has acquired Calgon Carbon Corporation for approximately USD 1.1 billion. Through this acquisition, Kuraray will strengthen its role toward development of sustainable and environmentally friendly products. The recyclability, improved adhesiveness, and eco-friendly properties of PVB have attracted many such companies such as Kuraray to invest in PVB market. In fact, the deployment of PVB for various applications such as coatings, lamination, glazing, and binding has been increasing remarkably in recent times, which in response has led to a major surge in polyvinyl butyral market share.

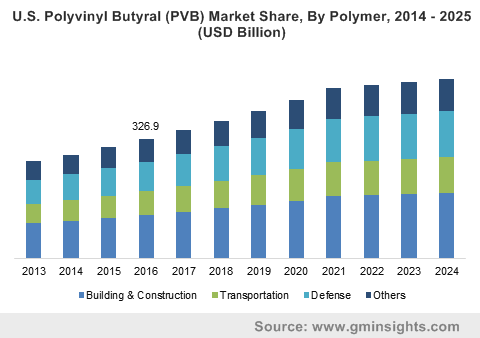

U.S. polyvinyl butyral (PVB) market size, by end-user, 2013 - 2024 (USD Million)

Rapid industrialization and urbanization have led to a rise in pollution levels and landfills pertaining to the increasing wastage from urban and industrial processes. Taking into account the hazardous impact of non-recyclable waste products on the environment as well as on human health, several regulatory bodies and energy management organizations have taken initiatives to promote the usage of recyclable raw material to manufacture various end-use products such as glasses, paints, primers, and adhesives. For instance, the ADEME, the French Environment and Energy Management Agency, has continuously been making efforts to encourage people to adopt renewable energy facilities. In addition, it has decided to implement 100% recycled plastic manufacturing plants by 2025, for the purpose of which it has selected about 135 waste management projects. Among these, Swallowtail will recycle household flexible plastic packaging, Funx will recycle agricultural bags, and HPI will recover PVB used in automotive windshields, which is certain to impel polyvinyl butyral industry outlook.

The increasing demand for automobiles has favorably impacted polyvinyl butyral market size, owing to the escalating use of PVB in automotive windshields. In this regard, it is prudent to mention that one of the well-known behemoths in polyvinyl butyral (PVB) market, Eastman, has been investing heavily in product portfolio enhancement for laminated safety glasses. In addition, it is also focusing on research and development activities to check the effect of several changes in the physical and chemical properties of PVB to generate various types of resin grades. The Eastman Chemical Company also developed a solution for automotive and architectural applications with the launch of Saflex® polyvinyl butyral, which enhances the displaying capability of automotive glass.

Speaking about product advancements, it is noteworthy to state that leading manufacturers of specialty polymers are constantly working on optimizing the properties of PVB. For instance, the pioneering participant in polyvinyl butyral market, Kuraray Europe GmbH is continually striving to develop innovative applications of PVB in domains such as ceramic laminates, laminates for metal films, thermoplastic prepregs, fiberglass laminates, and lightweight construction. Besides, the growing adoption of electric vehicles mainly across European countries and China, owing to the increasing deployment of regulatory norms about energy efficiency along with increasing awareness regarding carbon dioxide emissions from vehicles, has also been augmenting polyvinyl butyral industry outlook.

Currently, most of the end users are primarily depending on fossil fuel resources to fulfill their energy needs, however, depleting fossil fuel resources have brought about a paradigm shift in the mindset of the masses with regards to energy use. Taking into account the importance of renewable energy sources, many of the governments and regulatory bodies have implemented favorable rules and regulations to encourage people for renewable energy deployment. Nowadays, in solar cells, PVB is prominently used as an encapsulation material by replacing ethylene-vinyl-acetate (EVA), since, when compared to EVA, PVB provides long-term and reliable protection for solar cells from external disturbances. The increasing deployment of solar cells across various countries is thus likely to push polyvinyl butyral market. In this regard, even the shifting trends toward implementation of smart city programs will have a positive impact on PVB market share, owing to the development of energy efficient infrastructure.

Taking into account growing importance for PVB, pivotal players in polyvinyl butyral industry are constantly focusing on the successful execution of business expansion strategies. The changing trends toward the escalating use of laminated glass in architecture along with growing requirement of high-quality products are likely to open up new opportunities for the biggies in PVB market over the years ahead. As per statistics, PVB industry size has been forecast to be pegged at USD 3.9 billion by 2024.