Poultry probiotics market to amass huge profits as an alternative to antibiotics, Asia Pacific to be a major growth contributor

Publisher : Fractovia | Published Date : 2017-09-20Request Sample

Poultry probiotics market has witnessed phenomenal gains over the recent years, with the growing pressure regarding reducing the use of antibiotics in the food chain. With the surging demand for meat and meat products, there has been a subsequently high demand for natural growth promoters (NGPs) for livestock over the antibiotics. Basically, poultry probiotics are live microorganisms that exhibit several beneficial effects on animal health. These probiotics are usually incorporated in animal feed supplements or drinking water to prevent the growth of harmful bacteria in animals. Taking into account the growing awareness regarding animal nutrition and health, the global poultry probiotics market is slated to witness massive remuneration over the coming years. As per the statistics, the poultry probiotics industry share was valued over USD 1 billion in 2016, which vividly validates the growth potential of this business over the years to come.

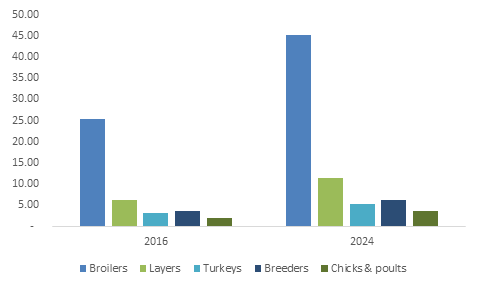

U.S. Poultry Probiotics Market Size, By Application, 2016 & 2024, (KT)

Animal feed additives industry, which is profoundly challenged by various antibiotic bans, is another important vertical leaving a profound impact on poultry probiotics market share. The developments and trends depict this business space to witness a highly competitive terrain in the coming years. To sustain in the growing competitive scenario, prominent poultry probiotics industry players are focusing on technological collaborations and acquisitions to amplify their products portfolio and expand their regional presence. The early 2017 announcement of Boehringer Ingelheim Animal Health to collaborate with Novozymes is one of such latest instances where the industry players are blending their expertise to gain a competitive advantage, in terms of product innovation, pricing strategy, and production capabilities. With the aforementioned partnership, Novozymes is set to expand its network and utilize Boehringer Ingelheim’s wide access to establish new distribution channels across the globe. Other major companies partaking in poultry probiotics industry include Chr. Hansen, Evonik, Adisseo, and Prowell.

According to Organization for Economic Co-operation and Development and the Food and Agriculture Organization, the global meat consumption is estimated to average 36.3 kg in retail weight by 2023, a 2.4 kg increase from 2013. Moreover, around 72% of the increased consumption is expected to come from poultry meat. In response to this fact, a definite growth is seen in livestock production particularly in the developing countries. Estimates claim that the meat consumption growth in the developed economies will be slower than in the developing regions. By 2023, the average intake in the developing counties will be more than double of that in the highly-established countries. Asia Pacific being one of the prime belt of emerging economies, is likely to witness a phenomenal expansion in animal health industry, which will in turn make it one of the most lucrative avenues for poultry probiotics market expansion. Rising meat consumption in India, Malaysia, China, and Indonesia are set to drive the regional poultry probiotics market size to significant heights. For the record, Asia Pacific broiler meat consumption crossed 35 million tons in 2016 and contributed to more than 50% of the global share.

The significant upsurge in protein intake among the health-conscious consumers have favored the growth of poultry meat in the developing countries. Chicken is the most affordable, versatile, nutritious, low in fat, and high-quality source of protein. Increasing broiler meat consumption, subject to the growth in protein intake and rise is per capita income is poised to bring lucrative growth avenues in China. As per the estimates, China poultry probiotics industry size is expected to surpass a valuation of USD 250 million by 2024. With countries including China, India, and U.S. betting big in terms of chicken and swine consumption, industry players are making vigorous efforts to exploit these regional opportunities. Chr. Hansen one of the world’s top three manufacturers of probiotics for animals, is actively planning to launch its products in the emerging markets. Owing to the increasing demand for antibiotic-free poultry, Chr. Hansen is all set to develop its animal nutrition portfolio in Asia Pacific poultry probiotics market. Reportedly, the company is also developing probiotics that can naturally inhabit the livestock’s gut.

The aforementioned trends and statistics vividly claims the poultry probiotics industry to be profoundly characterized by R&D investments focusing on product and regional expansion. Moreover, the increasing regulations, for instance strict norms by EU Commission and FDA, pertaining to the use of antibiotics will further boost poultry probiotics market share in the ensuing years. In terms of industry size, Global Market Insights, Inc., estimates poultry probiotics market to witness a valuation of USD 1.8 billion by 2024.