Purging Compound Market to garner appreciable gains from automotive application, Asia Pacific to witness robust growth prospects

Publisher : Fractovia | Published Date : 2017-11-24Request Sample

Strongly characterized by the shifting preferences toward efficient product manufacturing, purging compound market stands to gain commendable proceeds over the coming years. The potential use of purging compounds in packaging, custom moldings, electronics, and automotive industry to reduce machine downtime, cleaning costs, and raw material wastage are the compelling factors that have prompted manufactures to keenly embrace these compounds. Reportedly, these purging compounds are extensively used in injection molding process for eliminating air bubbles, un-melted resins, foreign contaminants, and degraded residues from the machine barrels. Analysts predict these factors to remarkably accentuate the product consumption, which by extension will favor purging compound industry growth. Reports reveal the overall purging compound market size to be worth over USD 300 million in 2016.

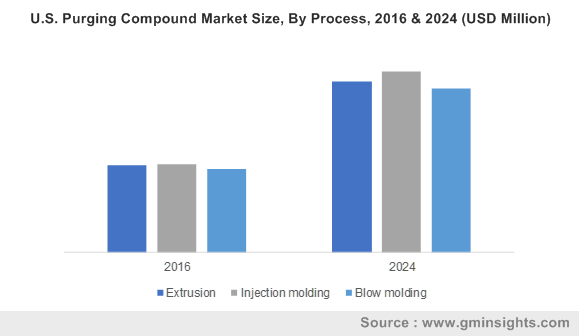

U.S. Purging Compound Market Size, By Process, 2016 & 2024 (USD Million)

Considering the myriad advantages that purging compounds provide to enhance the overall efficiency, it is widely being used in automotive, custom molding, consumer goods, and healthcare sectors. The use of lightweight and sustainable plastic materials in the form of equipment, fasteners, and film components in the aforementioned application arenas has overtly fortified the demand for purging compounds. The increasing use of polymers in manufacturing lightweight and sturdy vehicles has positively favored the growth of purging compound market. In fact, reports claim that the overall automotive industry accounted for over 20% of the global purging compound industry share in 2016. According to experts, the initiatives taken by automakers to enhance the safety features especially with regards to the rising population of senior drivers, is enlisted as an important factor leading to purging compound industry expansion. For the record, these safety structures including the likes of safety belt designs and handles comprises plastics and polymer compounds, that require purging compounds in their production chain. Considering the massive product penetration in the automotive sector, analysts estimates purging compound market to generate more than USD 120 million in revenue by 2024 from this application.

Speaking of the robust expansion of the automotive industry, Asia Pacific, owing to its escalating vehicle production, is poised to become a rewarding hotbed for purging compound market. It is noteworthy to mention that the Southeast Asian nations and the rapidly developing economies including China and India are the major drivers of the proliferating auto sale in APAC belt. Moreover, the rapid industrialization trend is deemed to be another profound factor favoring APAC purging compound industry share. Other than automotive sector, the continent has also been increasingly witnessing robust expansion of industries including construction, chemicals, food & beverage, and petrochemicals, which is acting as a prominent factor in tantalizing extensive purging compound demand. Plastic processing machinery, on account of being an integral vertical of the aforementioned end-use sectors is certain to perpetually escalate the purging compound market demand in the region. Add to this, the soaring demand for extruders and injection molding across these application fraternities will further fuel the regional growth. As per the estimates, Asia Pacific purging compound industry is anticipated to register an annual growth rate of 7% over 2017-2024.

Apart from APAC, North America has also been touted to be one of the most potential regions driving purging compound industry share. Reports claim North America purging compound market to have had a valuation of over USD 100 million in 2016, chiefly because of the high demand for plastics processing equipment in the region. On account of the growing use of commercial purging compounds, the regional industry players are focusing on design and development of products that would boost the productivity of plastic molding operations. For instance, in 2016, Dyna-Purge, a leading division of Shuman Plastics Inc., introduced a compound, dubbed as Dyna-Purge A, for effective polypropylene color transition. Reportedly, the innovative purging product combines key properties of both the chemical and mechanical purging systems that can prove beneficial in breaking down the color contamination and improving part quality.

Speaking of the prominent companies expanding their reach in the global purging compound industry, Velox GmbH (Hamburg, Germany) is a major leader that has recently developed a new purging compound, CleanPlus Express, for extrusion lines. The compound helps accelerate material & color changes as well as flush out old deposits. Moreover, the compound is also used to enable trouble-free start-up and machinery shutdowns. The company in 2016, also introduced a new purging compound that can save as much as 50% of time and money compared to other purging products. These instances of product developments bear testimony to the fact that technological innovations spanning across the myriad application arenas is a vital factor impacting purging compound industry growth globally. In terms of commercialization, Global Market Insights, Inc., forecasts purging compound market to surpass a valuation of USD 600 million by 2024.