Railway management systems market unveiled in terms of the competitive spectrum: global industry remuneration to surpass US$64 billion by 2024

Publisher : Fractovia | Published Date : 2019-02-01Request Sample

The commercialization potential of railway management systems market has lately been experiencing an incline, owing to the increasing adoption of digitalization and IoT in the railway industry. IoT assists the rail operators in receiving proper information about the location of the train with respect to other trains for ensuring the safety of the passengers. The technology also automatically regulates the speed of the train based on real-time information, which in turn, reduces the chances of collision. Deploying digital technologies in railways increases efficiency, safety, reliability, as well as the overall performance of the railways. Rising safety measures implemented in the railway sector would drive railway management systems market.

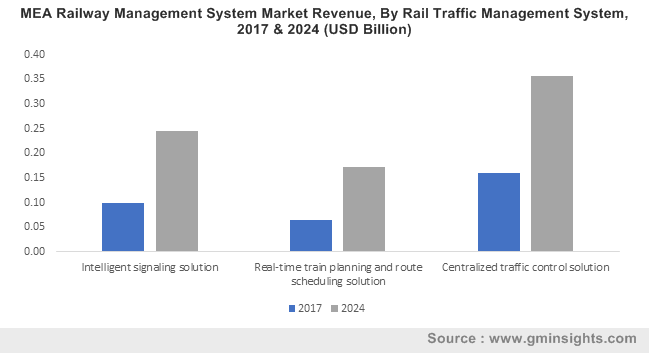

MEA Railway Management System Market Revenue, By Rail Traffic Management System, 2017 & 2024 (USD Billion)

Indeed, the growing trend of smart cities has a positive impact on this market owing to the fact that the capabilities and prominence of most smart cities revolve around the public transport networks. These systems will assist in the implementation of data and technology to improve railway mobility, sustainability and efficiency. For example, the Ministry of Indian Railways has allied with the Ministry of Urban Development to ensure smart stations’ development under the ongoing Smart Cities mission in the nation. Under this initiative, about 400 stations in the nation are currently being redeveloped with an aim of providing easier access as well as improved facilities for passengers. Such initiatives taken by government to develop the infrastructure of a country will further boost railway management systems market.

Prominent companies across this vertical have apparently been reinforcing their expertise with partnerships and collaborations to expand their regional presence. A gist of the contribution by some of the major companies in the railway management systems market has been mentioned below:

Luminator Technology & KeTech

The U.S. based global transit solutions provider Luminator Technology Group (LTG) has recently entered into a strategic partnership agreement with KeTech Systems Limited (KeTech) on industry-leading enhanced Connected Driver Advisory Systems (CDAS) and real-time Passenger Information Systems. The collaboration combined LTG’s state-of-the-art PIS systems with the leading edge expertise of KeTech in the delivery of high-accuracy, real-time passenger information. This partnership has resulted in a modular and flexible solution that provides purpose-designed, tailored solutions for new trains and upgrades the full range of existing fleets.

The collaboration finds renewed strength on the basis of the fact that the companies recognize the rapid pace of development in the context of the DfT, Passengers and Train Operators with regards to the on-train Passenger Information experience. Such efforts by leading companies in railway management solution advancement is certain to propel the growth of railway management systems market.

ABB Group

The Zurich-based provider of automation technology and heavy electrical equipment, ABB Group, has been long since manufacturing traction motors for the rail and mass transit market of North America. A couple of years ago, the firm made it to the headlines for having opened a new plant in Athens, Georgia, through which ABB planned to support more projects in North America.

Traction motors from the company are usually tailor-made based on the technical requirements of each train, along with the conditions in which the train would operate. This particular traction drive system in Georgia, which determines the control features, energy consumption and power quality of the vehicle to some extent, is one of urban rail vehicles’ core technologies. The traction motor is a crucial part of this drive system, owing to the impact it has on reliability, comfort and the economy.

ABB’s investment in North America can be attributed to the fact that the trends in the continent, since the last many years, suggest a shift towards urbanization, leading to the need for improved transit systems. With an increase in domestic content requirements, U.S. cities and governments are seeking different ways for implementing transit projects, which in tandem with the efforts of regional and overseas players, will augment railway management systems market growth.

Cisco Systems

A few years back, the American multinational technology conglomerate Cisco introduced a high-performance, ruggedized router – Cisco 5940 Embedded Services Router (ESR) – optimized for mobile as well as embedded network which requires IP routing and services. This newly launched router establishes a scalable mobile network in freight and freight rail trains, as well as first-responder vehicles.

Cisco’s position in the regional railway management systems market has been considerably strengthened since the company the 5940 ESR, specifically designed to be used harsh environments under shock and vibration conditions – typical for mobile applications in rugged terrains.

Having analyzed the efforts undertaken by prominent industry players, it is evident that the railway management systems market will record a significant growth rate over the ensuing years. The competitive spectrum of railway management systems market is also quite diverse, comprising notable companies like Amadeus, Thales, Sierra Wireless, Atos, Alstom, Siemens, Hitachi, Trimble, Toshiba, Indra, Bombardier, Huawei, Nokia, IBM, Frequentis, EKE Electronics and Ansaldo, that have been striving to bring forth new, innovative products to the mainstream. As per estimates, railway management systems market size is expected to surpass a valuation of US$64 billion by the end of 2024.