APAC rapid strength concrete market to register the highest CAGR over 2017-2024, large scale infrastructure projects across India and Indonesia to augment the regional industry growth

Publisher : Fractovia | Published Date : 2018-02-06Request Sample

Sika Corp’s yesteryear takeover of Butterfield Color is symptomatic of the fierce tug-of-war prevalent in rapid strength concrete market. Given that the competitive spectrum of this business space is moderately fragmented, industry giants are seen to be proactively engaged in numerous synergies in order to consolidate their business position, as is depicted by Sika’s acquisition. The firm’s takeover bid of Butterfield Color, a US-based company specializing in the production of decorative concrete floor systems and products, is expected to accelerate Sika’s already strong position in rapid strength concrete industry. Furthermore, Butterfield Color’s concrete product range will aid Sika to bring forth a rather comprehensive range of concrete solutions for contractors in the North America construction sector. It is also imperative to mention that Sika has perpetually recognized the high-rising potential for varied concrete products – prior to its latest takeover, the firm had also bought L.M. Scofield, one of the most prominent global suppliers of decorative concrete. Strengthening its product portfolio and expertise vis strategic collaborations, Sika seems to be on the path of firmly empowering its stance in global rapid strength concrete market.

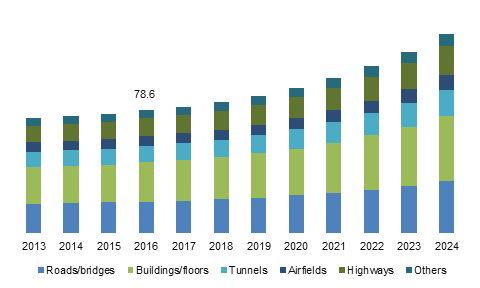

U.S. Rapid Strength Concrete Market Size, By Application, 2013 – 2024 (USD Billion)

Sika’s acquisition also paints a vivid picture of the fact that the construction domain will undeniably be the chief driving force of rapid strength concrete market. The presumption does not exactly come as a surprise, given that the last decade has witnessed the construction sector registering an escalating growth rate. As per estimates, the global construction industry size, apparently having been pegged at approximately more than USD 8 trillion in 2015, is anticipated to cross at least USD 10 trillion by 2020 – a factor that would extensively fuel rapid strength concrete industry outlook. Driven by massive spending on construction and infrastructural development across the residential and commercial arenas, the demand for unconventional concrete is expected to go several notches high, consequently impelling rapid strength concrete market share. This ascent in demand can be credited to the product’s exclusive feature to develop high resistance within just a few hours post construction, enabling early removal of the formwork and subsequently speeding up the construction process at lowered costs. Fueled by its quick-setting nature, it is used to construct walls, slabs, beams, panels, columns, and numerous other construction components, and is increasingly preferred over conventional concrete, boosting rapid strength concrete market trends.

Outlining the impact of APAC construction industry growth on rapid strength concrete market expansion

The Asia Pacific has lately depicted a spectacular growth rate in the construction cosmos, driven by the escalating number of infrastructural development projects such as roads, highways, bridges, tunnels, etc., impelling the regional rapid strength concrete market share. Recent entrants in this thriving business space apart from Indian, China, and Japan, are that of Indonesia and Singapore – estimates claim that both the regions have depicted an appreciable growth in the construction industry. A yesteryear report in fact, claims that Indonesia is one of Asia’s largest construction markets – approximately 30 infrastructure projects, inclusive of ports, railway links, public transport networks, and toll roads, adding up to a valuation of close to USD 68 billion, have been planned by the Indonesian government to be completed by 2019. Unrefutably, the region has emerged to be one of the largest consumers of concrete material and products, majorly stimulating APAC rapid strength concrete industry size.

India on the other hand, has emerged to be one of the most lucrative consumers of concrete products, given the vast expanse of the region’s construction sector, which has overtly augmented the commercialization potential of India rapid strength concrete market. Recently, for instance, a 250-million-dollar loan agreement had been finalized between the Manila-based Asian Development Bank (ADB) and the Indian government, as a part of a construction initiative to build 6,254 km of all-weather roads across the rural terrains of Chhattisgarh, West Bengal, Assam, Odisha, and Madhya Pradesh, under the Rural Roads Program. Another instance validating the stability of the region’s construction industry is that of JMC Projects, an arm of the Kalpataru Power Transmission, bagging construction contracts for one residential and two commercial projects in South India, worth INR 448 crore, alongside one industrial and two residential projects in East and North India, worth INR 303 crore. Undeniably, India will emerge to be one of the most profitable avenues for APAC rapid strength concrete market, fueled by the plethora of construction projects in the country.

Driven by the far-reaching scope of its construction sector, in tandem with a supportive regulatory framework in place, APAC rapid strength concrete industry size is projected to register the highest CAGR over 2017-2024.

The robust deployment of concrete and environmental hazards: A Catch-22 situation hindering the smooth progress of rapid strength concrete market

One of the principal restraints of rapid strength concrete industry is the fact that concrete production leads to a massive carbon footprint. As per estimates, concrete manufacturing contributes around 5% toward anthropogenic global carbon dioxide production, pertaining to the fact that it is used in heavy quantities across the global construction sector. Currently, more than 2 billion tons of concrete are being manufactured annually, and the number is projected to increase to four times its value by 2050, from what it was in 1990. However, it is imperative to state that concrete production, as on today, is more pivotal than ever, given the vast expanse of the global construction industry, that seems to be growing at an unprecedented growth rate on account of the rapidly increasing worldwide populace. The circumstance seems to have given rise to a typical catch-22 situation, forcing rapid strength concrete market players to devise newer products, integrated with suitable add-ons, that would reduce carbon footprints in the atmosphere.

In response to the aforementioned conundrum, companies partaking in global rapid strength concrete industry have been striving to develop green concrete via CSA cement. Developed in China in the 1970s, calcium sulfoaluminate (CSA) cements, apart from being perpetually stronger and quick-setting than Portland cements, possess the advantage of being greener than their traditional counterparts. In fact, concrete manufactured completely from CSA is apparently 2 to 6 times greener than ordinary Portland cement. In consequence, rapid strength concrete market players have been planning to deploy CSA-infused concrete on a large scale, thereby aiming to reduce carbon emissions.

It is prudent to mention that companies have also been attempting to develop new concrete additives to manufacture a stronger concrete product that would help reduce CO2 emissions, thereby successfully eliminating this particular constraint hampering the growth of rapid strength concrete industry. Driven by the efforts undertaken by renowned giants such as Sika Corporation, BASF, CTS Cements, Boral Limited, Perimeter Concrete, Aggregate Industries, and Tarmac to innovate varied concrete products, rapid strength concrete market is likely to observe extensive growth in the ensuing years. With the increasing percentage of urbanization and industrialization and the rapid rise in the construction of dockyards, highways, tunnels and airports across the globe, rapid strength concrete industry trends are certain to observe a change of dynamics over 2017-2024.