China to amass a huge share in APAC rare earth metals market over 2017-2024, strict regulations to control illegal mining activities to impel the regional expansion

Publisher : Fractovia | Published Date : 2018-01-12Request Sample

In an era that has witnessed technology reigning sovereign across myriad verticals, rare earth metals market has attained renewed prominence, on the premise of the fact that these metals play a crucial role in the fields of computer networks, consumer electronics, clean energy, environmental mitigation, and more. Having identified the potential benefits provided by these metals and understood their supposed lack of demand and supply and confined availability in very few regions, numerous countries have been attempting to invest millions in order to increase their mining operations and unearth rare earth metals. Merely last year for instance, Iluka Resources, an Australian mining company with a substantial share in the regional rare earth metals industry, has invested more than USD 3 million (approximately AUD 4 million) for mining titanium-zirconium deposits in North Kazakhstan and Kostanai. Through this project, the company has officially penetrated Kazakhstan rare earth metals market and even aims to construct a rare earth metal processing plant in the next few months, post this project.

U.S. rare earth metals market size, by application, 2013 - 2024 (USD Million)

The supremacy of China in global rare earth metals market

While the United States, back in the duration between the 1960s to the 1980s, stood as the global leader in rare earth metals market, as on the advent of the new millennium, China rules the roost, having emerged as the pivotal source of rare earth oxides and magnets. As per the 2000 United States Geological Survey, China has been the producer of more than 90% of rare earth metals across the globe and stands tall in APAC rare earth metals industry as far as product consumption, demand, and supply are concerned. The monopoly had been brought to light when in 2000, the country extensively reduced export quotas of rare earth metals sans plausible explanations. Nonetheless, studies report that even today, China is the sole manufacturer of rare earths, especially lanthanum, neodymium, and yttrium – metals that find mammoth applications in superconductors, computer discs, microphones, headphones, camera lenses, color televisions, and other consumer goods, high-powered, pulsed infrared lasers for the defense industry, and rheumatoid arthritis medicines, and surgical supplies, and cancer treatment drugs across the medical care domain. Even as on 2017, China has been reported to be the sole producer of 90% to 95% of rare earths, enabling the country to maintain its continued sovereignty in global rare earth metals market.

Recently, tabloids were hit with the announcement of the largest rare earth new material industrial park in China to be constructed at Baotou, the Inner Mongolia autonomous region, essentially brought to focus on account of the numerous technological innovations and a considerable deal of support from the ‘Made in China 2025’ scheme. The park would cover 0.45 square kilometers comprising purified rare earth metal materials and would have an annual output of 30,000 metric tons, and has been touted to be the biggest purified rare earth materials area in the world. A project of this stature depicts the extent of China’s participation in global rare earth metals market, and the level of government commitment toward augmenting the nation’s rare earth metals industry outlook. As per estimates in fact, Baotou has been the recipient of humongous developments in China rare earth metals market, having witnessed more than 70 upgrading projects with governmental funding. Furthermore, statistics claim the Baotou rare earth industrial reserve to be worth 43.5 million tons, covering more than 83.5% of the overall reserve in China. It therefore, comes as no surprise that China will continue to remain the prime producer, consumer, and exporter of rare earths. A report by Global Market Insights, Inc., states China rare earth metals market share has been forecast to grow at a CAGR of 9% over 2017-2024.

How policy changes could affect rare earth metals market trends in China and other geographies

There have been major changes in the domestic policies of China recently, which have no doubt, have had transformational implications on China rare earth metals industry. The ‘Made in China 2025’ policy enacted in March 2017 listed down a catalog of regulations that targets the manufacturing of highly valued downstream goods as opposed to manufacturing products from polluting industries, that has led to technology and energy companies wanting to domestically source nearly 80% of their refined minerals by 2025. With increased in-house consumption, Chinese exports are likely to be affected, indirectly impacting rare earth metals market share across numerous other topographies. Furthermore, Chinese manufacturers would deploy rare earth magnets in wind turbines, EVs, etc., forcing non-Chinese companies to seek rare earths from alternative sources. Amidst the backdrop of this potentially austere scenario, Australia has been forecast to emerge as the next raw material hub for global rare earth materials industry. Nonetheless, while China’s policy changes and regulatory inspections may cause slight fluctuations in the commercialization potential of global rare earth metals market, China will continue to remain one of the most remunerative regions for this business vertical. Owing to the efforts of companies wanting to establish bases outside of China and maintain trade balance, Japan and Canada have also emerged as profitable growth grounds for rare earth metals market.

In recent times, subject to fact that metals may someday meet their extinction, companies have been adopting the strategy of element recovery. Rare earths especially, qualify for complete recovery, considering their significance in numerous industries and the possible chaos that would erupt in the event of their unavailability. In this regard, a startup in rare earth metals industry, REEcycle, based in Houston, has come up with a chemical recycling technology designed to extract rare earths – in this case, specifically dysprosium and neodymium from magnets. In the months ahead, the company plans to bring forth a full-fledged system that would extract magnets from used electronic components and recover close to 95% of rare earths. REEcycle also aims to convert the system into an e-scrap processing facility that would enable the technology to be globally commercialized and would unleash a potentially lucrative revenue stream for rare earth metals market players.

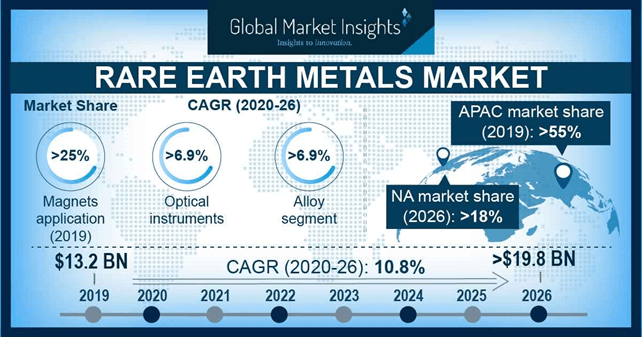

It is prudent to mention that rare earth recovery mechanisms are receiving widespread governmental attention. In the last three years, REEcycle’s technology has apparently received a funding of USD 1.4 million. As the demand for these metals surges infinite boundaries, most of the rare earth metals market players would be willing to either invest in recovery technologies, or establish themselves as sole proprietors through innovative R&D activities that would help roll out similar such systems. With numerous companies earnestly tapping the unexplored mining areas beyond the standard regions and striving to exploit technology to the fullest, in conjunction with the establishment of a stringent regulatory framework that would terminate illegal mining activities, rare earth metals market size is certain to surpass USD 20 billion by 2024, as per a reliable forecast.