Recycled Battery Materials Market to register substantial gains from the automotive sector over 2019-2025, rising proliferation of EVs to propel the global industry

Publisher : Fractovia | Published Date : 2019-05-13Request Sample

Rising concerns regarding the disposal of electronic goods and batteries has catapulted the recycled battery materials market share within a span of few years, as governments are imposing stringent laws against solid waste dumping globally. Simultaneously, the demand for substances like lead, cobalt, magnesium and lithium from the industrial and auto manufacturing segments have compelled undertaking of recycling activities to obtain these minerals more cost-effectively. Shrinking of dumping grounds due to overflow of waste has especially made the re-use and recycle of electronic equipment vital for ensuring future sustainability. The battery materials recycling market is slated to experience considerable growth from the increased consumption of smartphones, consumer appliances and automobiles, as it leads to more salvageable inputs.

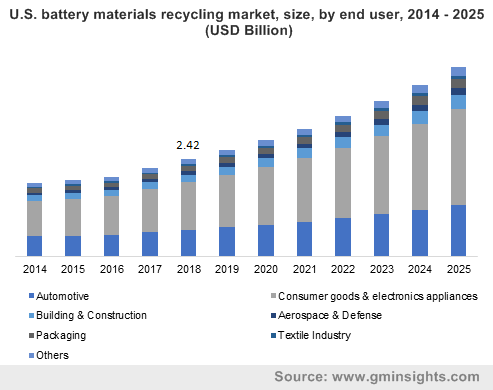

U.S. battery materials recycling market, size, by end user, 2014 – 2025 (USD Billion)

Generally, batteries can be expensive and are known to have a short life, making it imperative to find efficient methods to discard them, bringing the recycled battery materials market into the fray. The distinct metals that can be extracted from recycled batteries have considerable value in the marketplace since they are used to manufacture other products. Cobalt, for instance, had a value of $50,000 per ton in 2017, while nickel itself was valued at up to $17,000 per ton. Producers can now source a large amount of these metals from the emerging battery recycling market, slowly reducing the impact of mining activities on the environment. Defining the recent industry trends are lithium-ion batteries, which are used widely in smartphones, portable computers, storage systems and electric vehicles.

Lithium-ion (Li-ion) battery manufacturing entails high costs, mostly due to the raw materials involved and a complicated production process. However, governments and enterprises are becoming aware about the millions of Li-ion batteries that are discarded every few months, encouraging more players to join the race for extracting precious metals from them. Besides smartphones, which are one of the most bought electronic devices globally, expansion of the full-electric and hybrid electric vehicles (EVs) segment is expected to contribute tremendously towards the growth of the recycled battery materials market. Essentially, Li-ion and other batteries are used to operate EVs and the continuously rising demand for these vehicles has concurrently raised issues about their eco-friendly disposal.

Transformation of the automotive industry and its impact on the recycled battery materials market:

According to the International Energy Agency, there would be more than 100 million EVs on roads worldwide by 2030, with numerous automakers like Tesla, BMW, Daimler AG, Ford, General Motors, Toyota and Kia Motors already leading the industry change. It is also estimated that over the same period, there could be a 150% rise in the demand for cobalt and a remarkable 800% increase in the demand for manganese and nickel for the production of EV batteries. As mining these resources leads to higher greenhouse gas emissions, the recycled battery materials market would present a more economical path towards acquiring these metals from discarded batteries.

Taking a note of this potential, leading EV manufacturer Tesla has recently confirmed that it would be establishing its own facility for EV battery recycling at the company’s Gigafactory in Nevada, U.S. It will look to extract lithium, aluminium, copper, steel and cobalt from used batteries as part of a closed-loop system, where these materials will be optimized for producing new batteries. As carmakers are also held responsible for disposing used batteries at the end of life, BMW is partnering with companies like Northvolt and Umicore to build battery recycling and manufacturing plants. Reportedly, carbon emissions from battery production can be lowered by nearly 90% using recycled materials.

All in all, global recycled battery materials market is poised to gain significant proceeds from the automotive segment over the coming years, with major auto players supporting industrywide initiatives to improve EV recycling rates. Anticipated to reach a global valuation of $40 billion by 2025, the recycled battery materials market comprises of key participants such as Accurec Recycling GmbH, Call2Recycle Inc., Exide Industries, Umicore N.V. and G&P Batteries.