Innovative product launches to expedite refinery catalyst market size by 2025

Publisher : Fractovia | Latest Update: 2019-07-03 | Published Date : 2018-06-26Request Sample

The growing concerns regarding increased emissions from fossil fuel combustion is one of the pivotal driving forces of refinery catalyst market. Reportedly, the usage of fossil fuels has been increasing tremendously from last few decades, on account of which catalysts have been extensively used to refine petroleum products such as diesel, kerosene, and petrol from crude oil, which comprises sulfur as a major content in its derivative products.

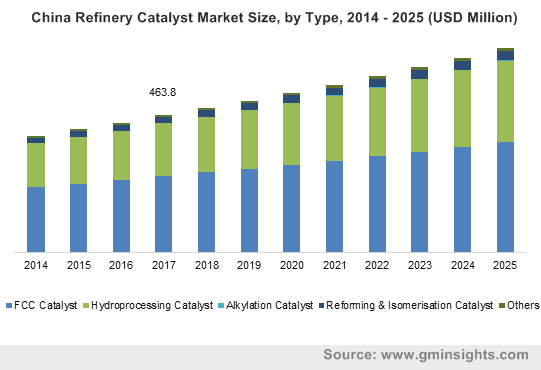

China Refinery Catalyst Market Size, by Type, 2014 – 2025 (USD Million)

Considering the impact that the extraction of sulfur from petroleum derivatives has on the environment, some of the regional governments have deployed strict regulatory norms to curb CO2 as well as SOx emissions. In order to comply with the regulatory framework, many of the giants in oil and refinery sector are looking forward to renovating the existing refinery facilities – a move that is significantly stimulating refinery catalyst industry share.

Taking into account the benefits of catalytic cracking, most of the refinery catalyst market giants have been working to commercialize the usage of various catalysts in crude oil refining processes. Collaborations in the industry seem to have prompted regional governments to support biorefineries and encourage them to invest in next-generation refinery projects.

Recently, the UK government provided funds to a leading company to develop a waste-to-sustainable jet fuel project across the nation. The jet fuel so generated is anticipated to reduce GHG emissions by a considerable percentage and result in a major reduction in the emission of particulate matter as compared to conventional jet fuels.

Considering the extensive use of zeolite materials in crude oil refining processes, the leading players in refinery catalyst industry are heavily investing in facility expansions to consolidate their market position. In addition, such strategic investments in facility expansions will also turn out to be rather opportunistic for start-up companies.

For instance, in 2017, the Japan-based specialty chemical manufacturer, Tosoh Corporation decided to commence the production of high silica zeolite at its Kemaman based facility. Apparently, this was the company’s first overseas high-silica zeolite production plant and is expected contribute to Malaysia’s economic growth, given that the operations would be undertaken by the firm’s Malaysian unit, Tosoh Advanced Materials Sdn Bhd. Considering that the demand for high-silica zeolite has been increasing tremendously of late, initiatives such as the aforementioned are likely to add a lucrative dimension to refinery catalyst market outlook.

The surging exploration and excavation activities across the globe to drill more fossil fuels is considerably encouraging players in O&G industry to build new refineries. Though the construction of new refineries has been increasing, the strict regulatory norms related to the emission control are enforcing biggies to deploy effective catalytic cracking processes before receiving the approval for the refinery.

In U.S., the division of air quality of North Dakota Department of Health (NDDH) has recently permitted Meridian Energy Group Inc., to build a refinery in Billings County in June 2018. While constructing the refinery, the company needs to follow NDDH’s Air Pollution Control Rules. In this regard, Meridian Energy Group is planning to equip the refinery with a hydrocracking unit to increase the flexibility of products and meet lower emission levels. The rapidly increasing awareness among the players in oil & gas industry about the benefits of various types of liquefaction processes is thus slated to fuel refinery catalyst market share.

As core companies continue to further their involvement in capacity expansion and regional extension, they are likely to extend their business reach across myriad geographies. The collective goal of refinery catalyst industry giants to commercialize the acceptance of their products across various biorefineries is certain to help then garner long-term returns on investments. Strongly aided by the implementation of emission control norms by several geographies, the overall refinery catalyst market will surpass revenue collection of USD 5.5 billion by the end of 2025.