Reprocessed medical devices market to be governed by a strict regulatory frame of reference, the prevailing necessity for eliminating hazardous medical waste to drive the industry growth

Publisher : Fractovia | Published Date : 2018-02-15Request Sample

The realm of reprocessed medical devices market has observed a transformation shift in the last decade, with medical device reuse having garnered the tag of being one of the most iconic supply chain cost reduction strategies. In an era riddled with myriad disorders demanding the need for highly sophisticated healthcare infrastructure, medical care expenditure has been soaring tremendous heights lately – an issue that has been brought to the notice of globally famed regulatory organizations. Say for instance, in 1960, healthcare expenditure in the U.S. amounted to around USD 27.2 billion, contributing to 5% of the nation’s GDP. In contrast, in 2015, medical care costs amounted to a mammoth USD 3.2 trillion, accounting for nearly 18% of the country’s GDP. The urgent need to mitigate these costs has led to the inception of reprocessed medical devices industry, as companies strive to reuse components without compromising on the quality or value and provide excellent care via smart resource deployment.

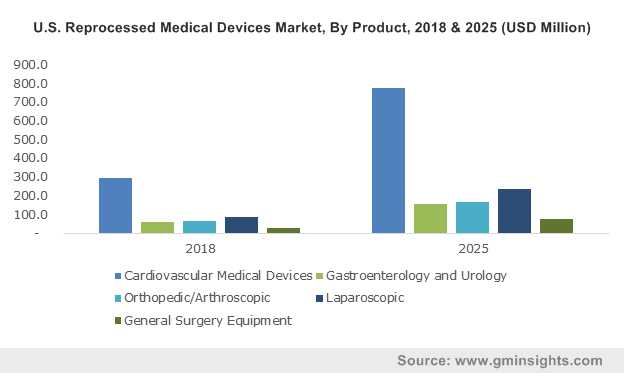

U.S. Reprocessed Medical Devices Market, By Product, 2013 – 2024 (USD Million)

Tracing reprocessed medical devices market journey: From then to now

The evolution of reprocessed medical devices market can be traced back to the 1960s, ever since reusing and recycling medical components had been on the radar of the medical device life cycle. Back then, components were manufactured from ceramics, stainless steel, and numerous other durable material that were strong enough to withstand sterilization. In the 21st century however, plastics have gained traction as a go-to material, demanding the need for improved sterilization techniques focusing on safety, thereby leading to the process of recycling. This has created a viable growth ground for companies partaking in reprocessed medical devices industry share, that have been keeping this business space afloat, promising end-use domains to enable cost savings and increase bottom lines.

While the necessity for repurposing these devices five decades ago is a tad bit inscrutable, the reason for conducting this procedure is rather vivid as on today. A reliable estimate compiled a few years back claims that reprocessed medical devices are 50% cheaper than new devices. A survey of 3,000 hospitals conducted the same year depicts that close to USD 150 million was saved due to these devices. These statistics provide ample evidence to affirm that cost savings in healthcare is the mainstream factor responsible for the growth of reprocessed medical devices market.

How the accumulation of medical waste has led to reprocessed medical devices market expansion

A major-league matter of contention that regulatory agencies have been facing of late, is the ever-increasing proportion of medical waste accumulated from operating rooms and hospitals. The release of discarded diagnostic samples, bandages, swabs, disposable medical devices, needles, syringes, disposable scalpels, contaminated drugs and vaccine, and the like has indeed been endangering the safety of the posing environment. In consequence, this has led to the acute necessity of recycling this waste, providing a massive growth avenue for reprocessed medical devices industry.

Enumerated below are a couple of shocking estimates that validate how the rising percentage of medical waste is likely to emerge as a key driving force for reprocessed medical devices market:

- Around 85% of non-hazardous waste and 15% of highly hazardous waste is released by hospitals on an annual basis.

- Close to 16 billion injections are administered globally, however, not all of them are properly disposed.

- On a per hospital bed-per day basis, low income nations generate an average of 0.2 kg of waste, while high-income nations generate approximately 0.5 kg of hazardous waste.

These statistics provide testimony to the fact that the globe is awash with a colossal proportion of medical waste, which if not recycled pronto, is likely to result in environmental degradation. In a bid to reduce medical waste and lower waste clearance costs, companies partaking in reprocessed medical devices market share have been working toward encouraging mass adoption of such components. Indeed, it is certain that the extensive proportion of hospital waste would encourage recycling on a tremendously huge scale, augmenting the commercialization potential of reprocessed medical devices industry.

An in-depth insight into the regulatory landscape monitoring U.S. reprocessed medical devices market

In response to the increasing sustainability trends and the landfill pollution caused due to medical waste, in conjunction with the ever-rising healthcare expenditure, authorized bodies have come up with a stringent set of norms, making reprocessed medical devices market one of the most regulatory-driven business spaces. In fact, reprocessed medical devices industry has been governed by a regulatory framework right since the 1980s, when medical wastes had begun to pile up on streets and beaches. In consequence, the MWTA - a 2-year federal program was proposed in 1988, in which the EPA was directed to propagate regulations on medical waste management.

After the MWTA expired in 1991, U.S. states, taking cue from the guidance proposed under the program, began formulating their own regulatory norms, providing a viable backing for reprocessed medical devices industry players. In 1997, the EPA formulated strict emission standards for medical waste incinerators, driven by concerns over hazardous air quality impacting human health. As recently as 2013, EPA’s Office of Air Quality Planning & Standards reviews the HMIWI (Hospital Medical Infectious Waste Incinerator) standards as and when required. In essence, U.S. reprocessed medical devices industry outlook is undoubtedly driven by a strict regulatory frame of reference. The rising cases of chronic diseases and the increasing incidences of minimally invasive surgeries further play their part to contribute toward the expansion of U.S. reprocessed medical devices industry, making the United States one of the most profitable growth avenues for prospective investors.

The FDA is inherently involved in making sure no medical devices are incorrectly reprocessed and sold, thus ensuring patient safety. Ergo, every product launched by prominent reprocessed medical devices industry firms is minutely scrutinized and monitored by the FDA and other regulatory agencies to avoid any plausible aftermath that may potentially endanger the future of the entire healthcare fraternity. Recently for instance, the FDA cleared the next generation reusable Cryoplasty Inflation Device by NuCryo Vascular LLC. In fact, the company has even received official approval to sell the existing and next-gen model of the device in the U.S. reprocessed medical devices industry, which is expected to extensively lower procedural costs and increase product sales.

While reprocessed medical devices industry is being speculated to still be in its nascent stages of development, it is indeed irrefutable that this business sphere will continue to demonstrate an exponential growth graph in the ensuing years. Indeed, the increasing deployment of reused devices such as surgical forceps, cardiac stabilization & positioning devices, balloon inflation devices, endoscopes, etc., has been forecast to lead to a tremendous amount of savings in the future, which would help impel reprocessed medical devices industry share. Not to mention, the cost savings obtained from reprocessing, in all plausibility, would be used to make further investments in medical R&D programs, enhanced patient care, and novel treatment methodologies. The prospect of garnering additional benefits with reprocessing and adding commendable value to the medical ecosystem would further pave the way for the growth of reprocessed medical devices market.

Incidentally, reprocessed medical devices industry chronicled its name in the billion-dollar revenue consortium in the year 2016. However, driven by the growing cases of chronic conditions, extensive medical costs, surgical site infection risk, and rising hospital waste, the growth map of reprocessed medical devices industry has witnessed a massive upsurge in recent years. A report by Global Market Insights, Inc., claims reprocessed medical devices market size to cross USD 3 billion by 2024 – a humongous 2-billion-dollar upswing from the recorded valuation in 2016.