APAC to lead roofing underlayment market landscape over 2017-2024, massive renovation projects to characterize the industry growth

Publisher : Fractovia | Published Date : 2017-10-16Request Sample

The Tyvek® Protec™ underlays portfolio launched in 2016 garnered quite some repute in roofing underlayment market, and has been touted to emerge as one of the most innovative products introduced by DuPont Protection Solutions. The latest innovation in the bunch was introduced at the 2017 International Roofing Expo held at Las Vegas in March 2017, and by all means, offers characteristics similar to its predecessors – the Tyvek® Protec™ 120; Tyvek® Protec™ 160 and Tyvek® Protec™ 200. Endowed with exceptional features such as durability, UV resistance, warranty protection, high quality, and strength, the Tyvek® Protec™ falls under one of the most unique roofing underlays that can be used in the construction arena. The product portfolio has presented quite a challenge for other players in roofing underlayment industry, as it has been deemed suitable to be used for high-grade re-roofing projects or new roof constructions, given its embossed patterns, improved grip, and smooth installation convenience. The launch of Tyvek® Protec™ seems to have considerably strengthened DuPont’s position in roofing underlayment market, which, as per estimates, accumulated a valuation of close to USD 29 billion in 2016.

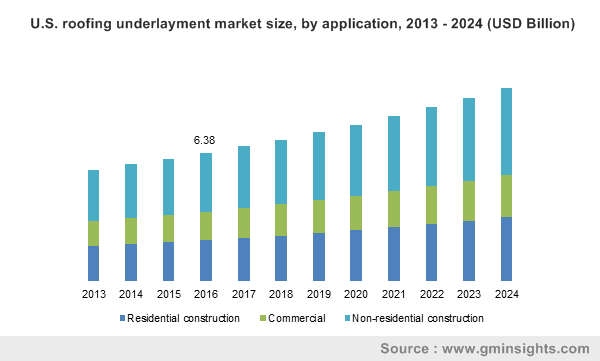

U.S. roofing underlayment market size, by application, 2013 - 2024 (USD Billion)

The application spectrum of roofing underlayment industry comprises residential, non-residential, and commercial construction. The diversity in home construction pertaining to increasing consumer demands, while adhering to weather conditions while roof fixing, has led construction companies to brainstorm unique roofing underlays through massive research and development programs. Atlas Roofing, one of the most prominent roofing underlayment market players, setting a precedent, has proudly launched the HP42" shingle format this year, one of the most exclusive roofing products formulated by their research and development team. The HP42" reportedly offers roofing contractors the advantage of a rather quick installation procedure, which would result in substantial time and effort reduction. Furthermore, the HP42" format proudly holds the reputation of being one of the largest shingles manufactured in the United States so far, on the grounds of which it has been forecast to garner critical acclaim in roofing underlayment industry.

An insight into Asia Pacific roofing underlayment market: a potential hotbed for investors

The Asia Pacific zone has been touted to be one of the most remunerative geographies for roofing underlayment industry. This presumption can rightly be attributed to the continent’s humongous construction sector, which seems to be expanding by the day. As per estimates, Asia Pacific dominated the overall roofing underlayment market share in 2016, boasting of a revenue beyond USD 11 billion, pertaining to the massive number of construction projects across the region. The robust industrialization and urbanization trends across the continent have led to a mammoth surge in the number of housing and office building constructions, the result of which has led to a considerable stir in roofing underlayment industry.

Beside domestic projects, another significant factor that has propelled the regional roofing underlayment market is the influx of foreign direct investments in the construction sector of the continent. The countries in APAC have been attracting international investors of late, given that the region has emerged as one of the most lucrative growth avenues in recent years, subject to extensive government funding for huge infrastructure projects and the ever-growing populace demanding eco-friendly, modern, luxurious housing on a large scale. Pertaining to the same, APAC has been forecast to dominate the overall roofing underlayment industry over 2017-2024, both, in terms of volume and value. The ongoing developments in the thriving construction sector in the region bear testimony to the aforementioned forecast.

The Hebei Construction Group recently announced its plans to boost its construction capacity by five times the current capacity, to meet the surging demand for infrastructural development from the government-aided Xiong’an New Area. The newly constructed prefabricated buildings are expected to be more environment friendly than the conventional ones, and are likely to demand the requirement of numerous roofing components, inherently impacting the roofing underlayment market trends. Furthermore, the Chinese turf has also witnessed mainland developer LVGEM acquiring the Wharf Group for USD 1.2 billion – in an agreement that has been touted to be one of biggest real estate pacts on the Asian grounds. Evidently, this goes to prove that upcoming construction projects are liable toward contributing much to the APAC roofing underlayment industry share.

Globally, the escalating construction domain will continue to remain one of the principal driving forces of roofing underlayment market. Getting into the intricacies of this business space though, clarifies that there are a lot more factors pertaining to building construction and infrastructure development that are inherently responsible for augmenting the profitability landscape of roofing underlayment industry. Commercial construction for instance, specifically demands the installation of flame and water-resistant underlays, especially in homes with metallic or tiled roofs, diversifying the application landscape of roofing underlayment market. The stringent norms enforced with regards to environmental safety, especially across the geographies of North America and Europe, have been projected to prompt the regional populace to go in for renovation projects to render homes environment friendly, which would have a considerable impact on roofing underlayment industry, given the extensive prevalence of re-roofing activities.

In essence, despite being a crucial vertical falling under the umbrella of the construction arena, roofing underlayment market has emerged as quite a niche sphere, demanding the introduction of newer, state-of-the-art roofing techniques. In consequence, construction companies have been responding positively, investing heavily in R&D activities to launch highly innovative underlays. Backed by substantial construction and renovation projects, in addition to the ever-changing demands by the modern-day consumer, roofing underlayment industry outlook may witness dynamic transformations in the ensuing years. According to a reliable research study, roofing underlayment market size has been forecast to surpass USD 45 billion by 2024.