Satellite launch vehicle (SLV) market to accrue highly lucrative proceeds from commercial launch activities over 2018-2024, Europe to emerge as a prominent revenue ground

Publisher : Fractovia | Published Date : 2018-09-21Request Sample

The satellite launch vehicle (SLV) market has exhibited consistent growth prospects owing to remarkable developments in monitoring, imaging and communication technologies that are integrated within different satellites. The irrefutable significance of features like weather monitoring, forecasting climate changes and preventing losses from natural calamities have sustained the global satellite industry with a large number of these man-made objects being launched into orbit each year. The ability of satellites to provide uninterrupted communication services over a widespread area has also influenced the segment, tremendously boosting the satellite launch vehicle industry development. Upcoming satellite programs in regions like Europe will create additional demand for SLVs over the coming years, presenting lucrative opportunities for the satellite launch vehicle market.

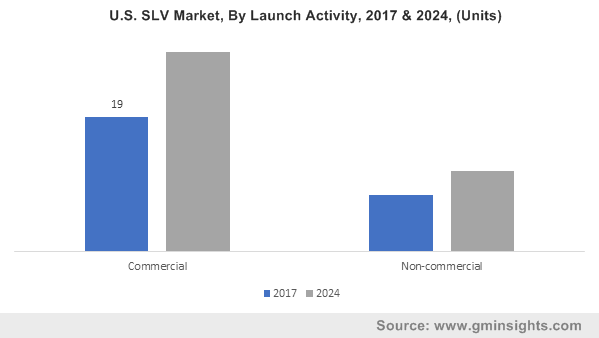

U.S. SLV Market, By Launch Activity, 2017 & 2024, (Units)

According to recent figures provided by UNOOSA, a total of 4,635 satellites were orbiting the earth as of January 2018, with a record 357 satellites launched in 2017 itself. However, it is reported that only 37.5% of these satellites are currently active, indicating the high probability of new satellites to be put into space and the prospective benefits that exist for the satellite launch vehicle industry. Majority of these satellites are for communication or earth observation and it is noted that most of the European countries operate at least one satellite. Russia boasts of owing nearly 142 satellites itself, with industry reports suggesting that the country has a number of satellite programs in the works. France, after launching its first satellite in 1965, has also emerged as a prominent name in the global satellite launch vehicle market.

To elaborate, French multinational company Arianespace, the world’s first provider of commercial launch services, had launched the heaviest ever payload into Geosynchronous Transfer Orbit (GTO) in June 2017, transporting a combined weight of 9,968 Kgs of the Eutelsat 172B and ViaSat 2 satellites. Signifying a major contribution by France towards the consolidated satellite launch vehicle industry, the launch proved the capabilities of efficient and advanced SLVs in making vital technology services available from hundreds of kilometers above the earths surface. Even space organizations from other countries extensively employ the services of Arianespace to launch satellites at costs they can afford, instead of putting in time and resources to build specific SLV themselves.

The Indian Space Research Organization (ISRO) recently confirmed that it has opted for the services of Arianespace for launching its GSAT-30 and GSAT-31 communication satellites, which are to replace other operating satellites used for providing crucial national services. The satellites, scheduled to be launched near 2018 end in separate missions from the Guiana Space center, will be the 23rd and 24th ISRO satellites put into the orbit by Arianespace. The strong partnership displayed between ISRO and the French company represent the profitable relations of the Europe satellite launch vehicle market with rest of the world, including the developing economies. The existence of several telecommunication satellite programs in the U.K. and other European countries will further generate substantial revenues for the commercial satellite launch vehicle industry.

It was observed that by the end of 2017, the maximum number of active satellites in the orbit were for commercial use and a vast number of these are for earth monitoring, communication or navigation purposes. Telecom giants utilize satellite networks to transmit digital services such as television channels or even high-speed internet facilities, while the rapid propagation of smartphones with GPS function has escalated the need for appropriately positioned GEO satellites or satellite constellations for ensuring the delivery of navigation services. The increased requirement of communication or navigation satellites will propel the satellite launch vehicle market valuation from the commercial segment. The growing demand for connectivity and smart technology in vehicles has also augmented the adoption of navigation systems based on satellite GPS.

In June, the European Commission had disclosed its plan to spend nearly USD 18.6 billion from the year 2021 to 2027 for expanding the regions space capabilities, with the funds being allocated to a satellite navigations systems program, earth observation program and to develop associated security components. The EU aims to develop these systems to help its industries get at the forefront of various technology sectors like the IoT and automated driving, securing a prolific future for the satellite launch vehicle market.

With other countries developing massive satellite projects to provide a critical platform of various commercial services, the global satellite launch vehicle market is expected to surpass USD 2.4 billion in remunerations by 2024. Eurockot, Boeing Space and Communications, ARCA Space, Lockheed Martin, Northrop Grumman Corporation, Indian Space Research Organization (ISRO) and Bristol Spaceplanes, are some prominent names in the competitive spectrum of satellite launch vehicle industry.