Sebacic Acid Market to attain sizeable returns from solvents application over 2017-2024, MEA to emerge as a lucrative growth ground

Publisher : Fractovia | Published Date : 2017-11-03Request Sample

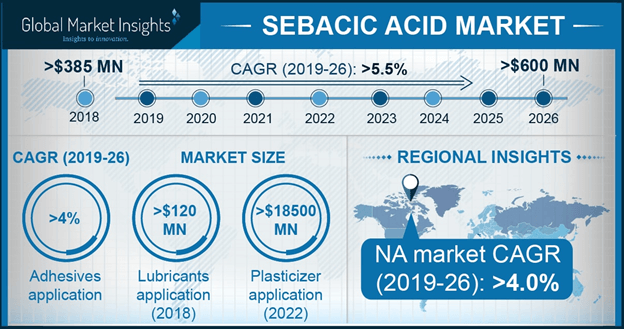

Boasting of a diversified application landscape, sebacic acid market is claimed to be one of the few opportunistic business spheres which is expanding at a significant rate in recent times. One of the rather influential driving forces behind the growth of this vertical is the robust expansion of the numerous end-use domains that have been exploiting the product on a significantly large scale. As per estimates, sebacic acid market size crossed the coveted benchmark of USD 300 million in 2016, subject to the rising consumer awareness with regards to hygiene and cleanliness. Furthermore, given the existence of a stringent regulatory framework with regards to the product usage, analysts speculate sebacic acid industry size to surpass 100 kilo tons by 2024 in terms of volume.

U.S. Sebacic Acid Market Size, By Application, 2016 & 2024 (USD Million)

Sebacic acid, which is essentially a derivate of castor oil finds extensive application in manufacturing high performance engine oil & lubricants, biodegradable packaging, solvents, aerospace polymers, plasticizers, adhesives, subsea pipe/cable coatings, bio-plastics, and anti-corrosion agents. The demand for sebacic acid in the form of solvent applications, especially from the cosmetic industry, has been witnessing a commendable surge lately. As per estimates, global cosmetics industry is projected to attain a valuation of USD 400 billion by 2024, which validates the claim that sebacic acid market share from cosmetic applications would indeed soar appreciable heights. Given the strong utilization of the product in the cosmetic sector, it has been estimated that sebacic acid market from solvent applications would witness a significant CAGR of 3.5% over 2017-2024.

The rising demand for sebacic acid and castor oil derivatives in the cosmetics and personal care, textile, automotive, and pharmaceutical industries, particularly in the economies of the Middle East & Africa and Asia Pacific have favored regional expansion of sebacic acid market. Industry analysts predict the cheap labor cost, abundant availability of raw materials, and relaxed taxation laws to be the vital factors behind huge investments from sebacic acid manufacturers in these regions. To cite an instance, the Duqm city of Oman is currently attracting massive multi-national investments for the expansion of the regional sebacic acid industry, on account of tax-free incentives from the Oman government and good port connectivity. Several Omani investors have collaborated with Indian investors to build the world’s biggest Sebacic acid plant in the Duqm. Reports state that the project has the capacity to produce around 30,000 tons of sebacic acid per annum. Oman already has a good castor oil production, however for the project, the company plans to import maximum castor oil from India. For the record, India led by Gujarat, accounts for over 70% of the global castor oil production. The Oman-India joint venture is further reported to commence the sebacic acid production by the end of 2017 and will majorly export it to the USA, Europe, China, and Japan. Considering the huge demand and robust industrial development across the Middle East, Oman and other MEA regions are expected to be the lucrative growth grounds for sebacic acid industry players over 2017-2024.

Speaking of industry players, Hengshui Jinghua, Hokoku Corp., Hope Chemical, Casda Biomaterials, and Shandong Siqiang are some of the prominent names accumulating significant sebacic acid market share. These leading players are making rigorous efforts to innovate and expand their product portfolio to gain competitive edge over other players. Furthermore, various growth strategies such as M&As, production capacity expansion, and joint ventures adopted by the market giants to strengthen their business position has led to a fair amount of consolidation in sebacic acid industry.

The rising trend of using sustainable and bio-degradable products in packaging is further expected to bring forth lucrative growth prospects for sebacic acid market in the ensuing years. Sebacic acid is widely used for producing bio-degradable packaging that are used for replacing the cancer-causing plastics. If reports are to be believed, the ban introduced on the utilization of plastics in packaging food products in several countries is expected to escalate the demand for sebacic acid based packaging, which would subsequently impact the revenue graph of sebacic acid market. In recent times, France has been one of those ambitious countries that has chronicled its name among the nations that have passed a law imposing a ban on plastics cups, plates, and cutlery. The country is promoting the use of more biologically-sourced materials, which in turn is expected to favor the growth of the regional sebacic acid market. In fact, reports claim that France sebacic acid market is expected to generate over USD 4 million by 2024 from the solvents sector.

Industry analysts predict that the shifting trend toward reducing the use of toxic and hazardous materials and the strong application scope of the product in the pharmaceutical and cosmetics sectors are the vital factors that would promote the growth of sebacic acid industry. Initiatives undertaken by governmental bodies and other authorized organizations toward bio-degradable packaging is further expected to help sebacic acid market accrue substantial revenue in the ensuing years. As per a report by Global Market Insights, Inc., sebacic acid market is forecast to hit a revenue of USD 480 million by 2024.