Sodium acetate market to depict robust growth potential over 2017-2024 via hefty product demand from the food processing and textile industries

Publisher : Fractovia | Published Date : 2018-02-23Request Sample

An extensively widespread application sphere can be chiefly credited for the massive commercialization scale of sodium acetate market. Having penetrated several end-use domains owing to its capability to function by turns as a buffering & pickling agent, diuretic agent, and food preservative agent, it would be apt to state that sodium acetate industry has witnessed a fairly steady progress in the last half a decade. This multimillion dollar space has also been projected to exhibit a strong growth rate in the ensuing years on account of the product’s humongous deployment potential – right from humble domestic uses to complicated industrial and chemical applications. Not to mention, numerous sodium acetate market players have been involved in crucial research and development programs to further expand the application spectrum of this business space.

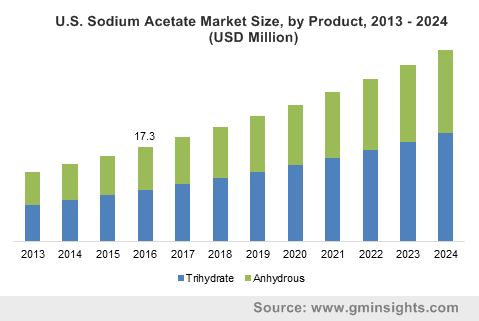

U.S. Sodium Acetate Market Size, by Product, 2013 – 2024 (USD Million)

Sodium acetate market outlook from the food processing sector

Sodium acetate boasts of excellent food preservation qualities on the grounds of which sodium acetate market has found a major foothold in the food processing domain. Predominantly used as a preservative and emulsifier in dairy products, sodium acetate is also widely used in cheese preparations such as ripened cheese, imitation cheese, processed cheese, and cheese analogues. Other dairy products that utilize sodium acetate are buttermilk, sour cream, condensed milk, whey-based drinks and yogurt. Considering that the global dairy industry is a multibillion dollar business, the use of sodium acetate as a preservative in the dairy industry is certain to lucratively propel sodium acetate market size.

Sodium acetate industry also finds a commendable growth avenue in the processed food sector on account of its increasing popularity subject to hectic lifestyles and a paradigm shift in consumer meal consumption habits. Sodium acetate is used as an acid regulator to prevent the growth of harmful bacteria in canned fruit, vegetable and meat. It is also added in preserved legumes like beans and lentils and nut spreads like peanut butter. The addition of sodium acetate during the process of canning and drying not only adds bacterial deterrent but also elongates the shelf life of the product, thus validating the extensive growth of sodium acetate market from the processed food domain.

Commercially prepared desserts like custards, confectionaries like candies and icing as well as dairy based products like ice cream and pudding are known to contain variable amounts of sodium acetate as it is a very potent emulsifier. The tangy flavor that it imparts to food items and its excellent preservative qualities have helped sodium acetate establish itself prominently in the preparation process of mustard, vinegar, sauces, broths and soups besides fat-based blends like butter and margarine. The Food and Agriculture Organization of the United Nations has also classified sodium acetate under the ‘safe’ category with no harmful side effects, further impelling the growth of sodium acetate market. Incidentally, sodium acetate industry size from the food industry was pegged at $26 million in 2016.

Sodium acetate market trends from the industrial sector

Besides being majorly used in the food industry, sodium acetate is widely used in myriad other industries such as leather, textiles, and medical. In fact, the textiles, medical & pharmaceuticals, and leather sectors account for more than 60% of sodium acetate market share. Sodium acetate is used as a neutralizing agent for sulfuric acid which is produced in the waste streams in the textile industry. The use of sodium acetate in the production of superior quality fabrics has thus augmented the growth graph of sodium acetate market from the textile sector. The chemical even acts as a mordant in the dyeing process – when aniline dyes are used, sodium acetate perpetually aids in the dyeing process by facilitating dye uptake and protecting the dye from exposure to light. Indeed, sodium acetate improves the wearing quality of fabrics by removing insoluble calcium salts, eliminates electrostatic force of cotton, and also aids in the production of long lasting fabrics. It is thus irrefutable that the chemical’s application as a pickling agent in leather chrome tanning, its role as an elastomer, and the assistance it provides in the quick and even penetration of tan during leather tanning will massively drive sodium acetate industry size in the forthcoming years.

Given that the end-use domains of this chemical compound have been witnessing a modest growth rate across the globe, sodium acetate market has indeed established its space in myriad geographies. However, it is imperative to mention that Asia Pacific has a more proliferate sodium acetate market when compared to the other economies, as the expansion of the textiles, leather, and food industries is much more prominent in this region. In 2016 alone, Asia Pacific accounted for more than 55% of the global sodium acetate industry share. In North America and Europe, however, the growth of sodium acetate industry has been observed to be moderate, with the regions accounting for 18% and 15% of sodium acetate market share respectively, in the year 2016.

In recent times, it has been observed that sodium acetate is being recognized by most regulatory bodies as an ecofriendly deicer. It is less persistent in the environment, without the corrosive drawbacks of chlorides and can prove as cost effective as sodium chloride. Despite the fact that the availability of cheaper alternatives may somewhat hinder sodium acetate industry growth, the business vertical is still estimated to register a CAGR of 7% over 2017-2024, with a target revenue anticipation of $220 million by 2024.