APAC sodium silicate market to chart out a profitable growth path over 2017-2024, massive expansion of the paper and automotive sectors to expedite the industry landscape

Publisher : Fractovia | Published Date : 2018-02-23Request Sample

The robust expansion of the automotive sector in recent years has left a humongous imprint on pivotal industry verticals. Sodium silicate market, falling under the umbrella of the specialty chemicals space, indeed forms a part of these verticals, the growth of which to a major extent, is inherently dependent on how the automotive domain fares. However, the application spectrum of sodium silicate or water glass, as it is commercially known, is rather diverse and is endowed with the scope to expand further with the onslaught of technological developments. An instance validating the authenticity of the aforementioned statement is that of Lithium Australia NL going public with its recent announcement of declaring a pivotal update on its patented chemical processing technology – the SiLeach®, which the company believes will be able to develop compounds such as caesium, sodium silicate, rubidium, and potassium sulphate. The commercialization of this technology is certain to augment the revenue graph of sodium silicate market, while also prompting other industry players to roll up their sleeves and bring forth a unique range of innovative solutions in this business space.

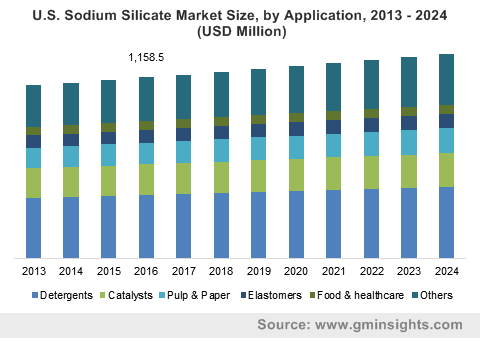

U.S. Sodium Silicate Market Size, by Application, 2013 – 2024 (USD Million)

A precise overview of Asia Pacific sodium silicate market trends

Ever since the onset of the new millennium, Asia Pacific has evolved as a highly remunerative growth avenue for a plethora of businesses, the construction and automotive sectors in particular. Aided by a favorable regulatory frame of reference, especially across the emerging economies of China and India, APAC sodium silicate industry has been forecast to be the fastest-growing regional business. The rising demand for elastomers and the expanding paper & pulp sector are indeed, pivotal driving forces responsible for the growth of this regional business. China’s paper industry, since the last many years, has observed an appreciable Y-O-Y growth rate, driven by robust investments in new technology and environmental innovation. The region’s paper production in the year 2014 was recorded at 118 million tons – a commendable accomplishment undeniably, that prompted major raw material manufacturers across the globe to invest in China’s growing paper industry. Given the extensive deployment of sodium silicate in the paper & pulp market, it is rather vivid that China sodium silicate industry will register a substantial CAGR over 2017-2024. Not to mention, China detergent segment, in 2016, covered more than 65% of the APAC sodium silicate market share with a revenue generation of USD 1200 million. The figures clearly validate the fact that the rising scope of the detergent sector in China will have a pivotal impact on the regional sodium silicate industry share, given that the product finds massive application in the production of liquid and powder detergents.

More recently, in 2017, the Chinese government, in the wake of environmental safety, introduced an initiative to ban waste paper that is used to manufacture recycled paper products. China’s move to ban waste paper imports has unexpectedly turned out to be rather profitable for India’s paper manufacturers, since Indian wood pulp has the advantage of requisite self-sourcing. In essence, rising costs of finished paper are certain to upscale the India paper & pulp sector, which in consequence would lucratively impact the regional sodium silicate market size.

The rising demand for green tires lately on account of the growing environmental concerns is indeed playing a vital role in the growth of sodium silicate market, as it has prompted silica manufacturers to invest in capacity expansions for silica-induced rubber and carbon black tires. These tires apparently reduce the tire rolling resistance and contribute to saving at least 8% of the total fuel consumption. The green tire trend seems to have caught on feverishly in sodium silicate industry, with principal players working tirelessly to expand their silica manufacturing plants. Say for example, Evonik expanded its precipitated silica capacity in Chester in 2014 by around 20000 tons. In 2018, the sodium silicate market firm plans to invest around USD 120 million for the construction of precipitated silica plant near Charleston, solely to supply silica to tire makers for green tire development. In 2016, PPG expanded its precipitated silica capacity by around 10000 tons at Lake Charles, while Solvay added 10000 tons at the Chicago Heights plant. Indeed, these capacity expansions amply testify the growing demand for low rolling-resistance tires in the automotive sector. Propelled by this humongous silica requirement from the automotive domain and the expansive growth rate of vehicle production across the continent, APAC sodium silicate market size is certain to witness an intensive upsurge by 2024.

While the revenue graph of sodium silicate industry has been forecast to be rather exponential, the business space is still characterized by certain constraints. One of the most pivotal factors that has been proving detrimental to the expansion of sodium silicate market is the product’s fluctuating costs. For nearly the last two decades, the prices of sodium silicate have been observing a major inconsistency of sorts, the repercussions of which have been felt across numerous end-use domains. In 2004, major sodium silicate market players, on the grounds of rising energy and transportation expenditure, had conveniently raised the product costs, throwing the entire ecosystem in turmoil. The year witnessed PQ Corp. raising the prices by 70 cents per cwt, National Silicates, the company’s subsidiary in Canada, raising the costs of all product grades by USD 17 per short ton, and Occidental Chemical Corp., one of the most pivotal sodium silicate industry firms, increasing the price by USD 14 per ton.

While the price fluctuations seem to have been accepted as a consistent norm in the changing phase of sodium silicate market, another major restraint faced by the contenders of this business space is the hazardous impact of the product on human health. In this regard however, a stringent regulatory landscape seems to have taken shape in order to impose certain restrictions on the manufacturing, deployment, distribution, and handling of the product.

Despite the potential jeopardy that the deployment of sodium silicate leads to, and the subsequent evolution of viable alternatives to the product, sodium silicate market has been projected to emerge as one of the most profitable verticals in the ensuing years. Indeed, the lucrative growth prospects of this business sphere can be aptly attributed to the widespread application range of this product. As on today, this inorganic chemical compound finds usage across adhesives, paper & pulp, silica gels, detergents, drilling fluids, catalysts, elastomers, paints, textiles, pottery, coatings, foundry, food, refractories, wood processing, and healthcare sectors. Evidently, sodium silicate industry size will be poised to register an extensive CAGR over 2017-2024, on the grounds of the product demand across pivotal domains. According to a reliable research report, sodium silicate market size has been forecast to surpass the 10-billion-dollar benchmark by 2024.