How will structural insulation panels (SIP) industry dynamics change with robust product innovations brought forth by notable industry stalwarts?

Publisher : Fractovia | Latest Update: 2019-02-22 | Published Date : 2018-03-29Request Sample

The global structural insulation panels market is poised to witness a significant growth curve in the upcoming years owing to the remarkable expansion of the construction sector worldwide reinforced by the rapid industrialization and urbanization. Technological advancements in commercial and residential construction projects with regards to reduced operational expenses and energy conservation will also propel SIP market in the years to come.

The industry trends are also expected to witness a dramatic incline pertaining to a sharp increase in the R&D investments, subject to a transformational shift towards energy-efficient, high-performance building components for conserving notable loss of natural resources. This has resulted in an upsurge in the demand for structural insulation panels, which in tandem with the numerous other advancements that offer modern building techniques for new commercial and residential constructions, will help augment the global structural insulation panels market size.

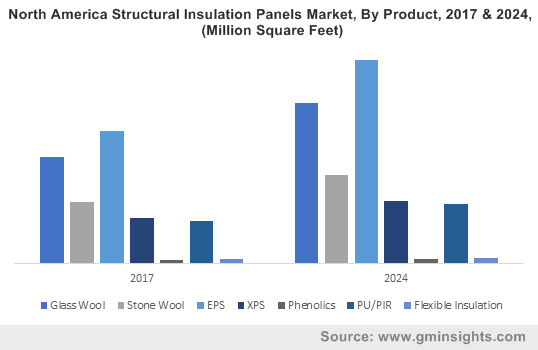

North America Structural Insulation Panels Market, By Product, 2017 & 2024, (Million Square Feet)

Another major parameter pushing the industry trends is the huge potential for new construction in Mexico, China, and South Africa, along with favorable government policies and regulations towards green buildings. It has been observed that commendable efforts by the U.S. Government and Department of Energy are also heavily pushing the best practices for energy-efficient buildings fostering the industry outlook. Various government regulations and policies to increase energy efficiency of commercial and residential buildings in a bid to prevent depletion of natural resource will further promulgate the structural insulation panels market.

For example, EU Directive 2012/27/EU for Energy Efficiency (EED) lends prime focus on improving the consumption of energy via constraining energy use in buildings as well as renovating 3% of publicly owned buildings, with an area over 250 sq. meters annually, acquired by central government.

Notable companies partaking in the SIP industry share have apparently retained focus on product innovation as well as enhancing production facilities. However, mergers & acquisitions and portfolio expansion have also remained pivotal strategies adopted by companies for enhancing their stance across this industry. A gist of the contribution by some of the major companies in the structural insulation panels market is mentioned below:

Kingspan Group

A few days ago, the Ireland based building materials firm Kingspan announced that its Kooltherm K17 insulated plasterboard has obtained a Group 1 fire rating, making it fit for using across all building classes. Though, plasterboard products are only needed to undergo small-scale testing (AS/NZS 3837), the company chose to test its product under a full scale AS ISO 9705 test for ensuring performance. Kingspan has underlined its commitment towards a program of global testing by putting its insulated plasterboard through an extreme fire test.

The Kooltherm range of Kingspan Insulation already carries Australian Made certifications, BRANZ Approval, UL Listing, FM Approval and CodeMark across their product range. Accomplishments like the aforementioned are expected to further augment the goodwill and trust factor for the company, which would in turn assist the firm enhance its position in the structural insulation panels market.

Foard Panel Inc.

Nearly a decade back, the U.S. based Foard Panel had announced that it will use Foamular(R) extruded polystyrene (XPS) foam from Owens Corning, for its XPS-core structural insulated panels. In contrast to the urethane foam, Foard's SIPs panels with XPS foam offer comparably high R-value per inch, without a disruptive odor, and twice the lengthways (transverse) load strength with double the system strength.

The XPS foam also offers thirty times higher resistance to moisture absorption as well as lower potential for mold growth, along with a thermal performance warranty of twenty years. Since then, Foard Panel has delivered a plethora of commercial and residential projects across the nation, deploying its state-of-the-art SIP portfolio. The company has also delved deep into green construction and sustainability practices in panel production, thereby upscaling its position in the overall structural insulation panels industry.

Composite Panel Building Systems

The Texas-based Composite Panel Building Systems, a few years ago, launched a fully composite SIP in order to deliver superior performance by insulating and sealing the building envelope. The C-SIP is apparently engineered with six functions, namely, superior insulation, vapor retarder, moisture barrier, exterior sheathing, structural walls, and air barrier incorporated in a single building product.

Reportedly, the energy efficient C-SIP has been designed for replacing myriad building products with a single, precision-engineered product that enables LEED and NAHB Green Building points. The product is an apt instance of how multi-functional components have been gaining precedence in the SIP industry in recent times.

It is rather overt that the commendable efforts undertaken by notable industry players would push SIP market trends in the coming years. The competitive spectrum of this industry is quite diverse, and consists of renowned companies such as Nohara Holdings, Inc., Isopan, Insulspan Inc., Foard Panel Inc., Future Building of America, ACME PANEL and Foam Laminates.