Styrene butadiene latex market to amass major gains from paper processing application, China to majorly drive the global demand

Publisher : Fractovia | Published Date : 2017-12-13Request Sample

With a recorded market share of USD 7 billion in 2016, the growth map of styrene butadiene latex market, as per industry analysts, is claimed to be steady over the coming seven years. One of the chief trends that has played its card in proliferating the revenue graph of SB latex industry in the recent years is the expansion in the paper industry. The sector being one of the key end-users of SB latex market has overtly generated a substantial product demand over the years. Reports affirm the total paper and paperboard production to have witnessed a significant rise in the demand of over 370 million tons in 2009 to over 407.6 million tons in 2015. In this backdrop, SB latex is gaining increasing consideration as an emulsion polymer with excellent aging stability and abrasion resistance properties. Subject to these characteristics, SB latex is also witnessing tremendous demand from the adhesives, sealants, and paint industry. Thus, considering the large-scale deployment of SB latex in myriad application sectors, industry analysts predict the global styrene butadiene latex market share to chart out lucrative growth avenues in the ensuing years.

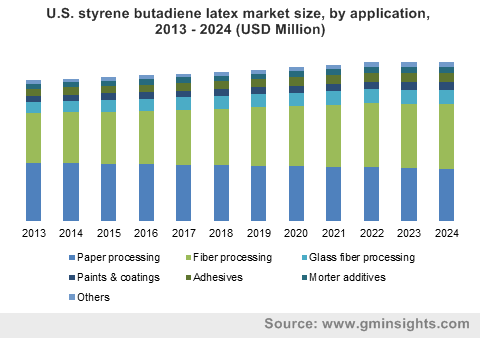

U.S. styrene butadiene latex market size, by application, 2013 - 2024 (USD Million)

Elaborating further on the scope of styrene butadiene latex market in the pulp & paper industry, the product is extensively used in paper processing as it provides opacity, image quality, gloss, brightness, and printability. Leading paper & carpet industry manufacturers are widely using SB latex as a binder for carpet backing, wood lamination, and paper coating applications. Given the massive demand for SB latex in coated paper market for printing and packaging application, analysts predict this trend to have a major impact on the revenue streams of styrene butadiene latex industry. Applications of coated paper that runs a gamut from printing magazines, catalogues, advertising flyers, packaging of containers for food and cosmetics are undeniably gaining considerable traction of late, which according to experts is attributable to the substantial growth of SB latex market.

While the growth of paper industry spans across myriad regions, reports claim China, the United States, and Japan to rank in top three largest paper manufacturing countries. According to estimates, these three regions accounted for half of the world’s total paper production. Among these, China stood as the largest producer and consumer of paper, amounting to 100 million tons in 2016. In essence, it wouldn’t be wrong to consider the tremendous paper production and consumption rate from the aforementioned regions to have a pronounced impact on the regional trends of the market.

Amid the robust & dynamic geographical expansion scenario of styrene butadiene latex market across myriad regions, the volatility of raw materials used in SB latex production is identified as a major barricade in the steady growth of the industry. Key raw materials including butadiene, styrene, and emulsifier are subject to major price fluctuations as they are downstream derivatives of crude oil. A significant impact of this trend was witnessed in North America, when BASF, a leading player in SB latex industry announced its plan to increase the price of SB latex polymers sold in the region. The company blamed the increase in energy, transportation, and raw material costs, for the price hike, that has affected the production of these materials. Similarly, in most of the other parts of the globe, margins for SB latex producers have been in the red for more than a decade, as these producers have not been able to keep up with the meteoric rise in the raw materials costs. This severe raw material pressure and uncertain economic climate have enforced the styrene butadiene latex industry players to undertake a slew of strategic collaborations and partnerships to maintain the cost margins. A significant instance of 2001 being Dow Chemical Company and Reichhold Inc.’s decision to combine their SB latex businesses into a joint venture that would help the entity to have a major hold in paper and carpet latex business.

Other than these tried-and-tested growth strategies, several industry players are also vigorously undertaking R&D activities and developing alternatives for raw materials to further restore product margins. These positive trends depict massive growth potential for SB latex industry in the years ahead. In fact, analysts estimate the extensive product demand from paper and carpet industry to act as a prevailing factor in fueling the growth of styrene butadiene latex industry in the coming years. In terms of commercialization potential, SB latex market size, as per analysts, is expected to register an annual growth rate of over 3.5% over 2017-2024.