Unveiling synthetic & bio-based aniline market with reference to the end-use spectrum: Construction and automotive sectors to define the industry growth over 2017-2024

Publisher : Fractovia | Published Date : 2017-09-14Request Sample

Milliken’s recent acquisition of Keystone Aniline Corp., a prominent synthetic & bio-based aniline market player is an instance demonstrating the profound initiatives undertaken by major chemical corporations to consolidate their established business positions. The Spartanburg-based company has reportedly acquired all the assets of Keystone Aniline Corp., the Chicago-headquartered producer of dyes, pigments, and polymers. This deal is also expected to depict a considerable impact on synthetic & bio-based aniline industry, given that anilines are an indirect component used in dye and pigment production. In fact, a report compiled by Global Market Insights, Inc., states that synthetic & bio-based aniline market share from the dyes and pigments sector is slated to grow at an estimated CAGR of 5.5% over 2017-2024, having held an initial valuation of USD 950 million in 2016.

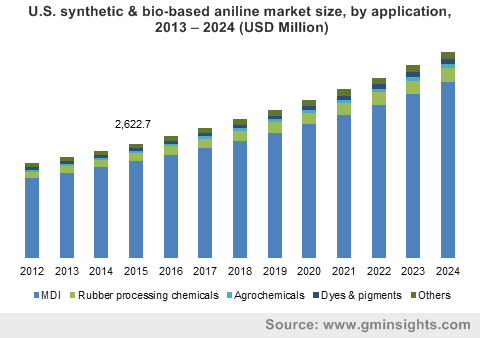

U.S. synthetic & bio-based aniline market size, by application, 2013 – 2024 (USD Million)

It is prudent to mention that aniline, chemically known as phenylamine or aminobenzene is basically manufactured via a catalyzed hydrogenation process of nitrobenzene from benzene. The chemical is essentially used in the manufacture of methylene diphenyl diisocyanate (MDI), which finds tremendous applications in polyurethane foams, that are further deployed in a plethora of end-use sectors. By extension, aniline finds applications across the transportation, construction, packaging, and automotive sectors. It therefore, goes without saying that the incredible expansion of the aforementioned sectors and the growth rate depicted by polyurethanes (PU) market will stimulate synthetic & bio-based aniline industry.

Synthetic & bio-based aniline market outlook from the construction sector

The construction sector, having accounted for more than 30% of the overall synthetic & bio-based aniline industry share in 2016, has been forecast to be the largest end-use segment encompassed by this fraternity. This comes as no surprise, given that aniline is liberally used to manufacture polyurethane foams, heavily deployed for insulation and roofing in construction. Polyurethane spray foam in fact, is also deployed heavily to resist wind uplift, provide protection against harsh weather, improve indoor air quality, and decrease the energy consumption for heating & cooling, inadvertently leading to reduced GHG emissions. Synthetic & bio-based aniline market size is further augmented by the fact that even globally, the construction sector has been predicted to depict a massive growth rate. A leading research study claims global construction industry size to surpass USD 10 trillion by 2021. In 2015, APAC alone held more than 50% of the overall construction spending, led by India, China, and Japan. Not surprisingly, APAC has been projected to account for more than 40% of the overall synthetic & bio-based aniline industry share by 2024.

Of late, the demand for green buildings has been on a rise, which is being further supported by government grants and financial schemes. The robustly expanding construction sector will thus increase the demand for PU foams, stimulating synthetic & bio-based aniline market share from the construction sector, slated to grow at a rate of 7% over 2017-2024.

Synthetic & bio-based aniline market outlook from the automotive sector

The automotive sector is another major end-use segment that defines the growth path of synthetic & bio-based aniline industry. Asia Pacific and Europe, the automotive hubs of the globe, are likely to be the most profitable revenue pockets for synthetic & bio-based aniline market. In China for instance, more than 24,400,000 cars and over 3,600,000 commercial vehicles were manufactured in 2016. Germany, in the same year, recorded a car production of more than 5,700,000 and a commercial vehicle production of more than 315,000. These statistics affirm that the surging production of automobiles worldwide will undeniably augment synthetic & bio-based aniline industry share from the automotive sector.

The extensive growth of synthetic & bio-based aniline market from the automotive sector can be attributed to the fact that polyurethane foams are heavily used for cushioning in armrests, headrests, and car seats. Furthermore, PU foams find applications as insulation in automobile bodies for protecting passengers against noise and heat, thereby increasing their demand, and subsequently stimulating synthetic & bio-based aniline industry size.

The latest trend proliferating synthetic & bio-based aniline market is unquestionably that of using natural anilines. Covestro, one of most prominent synthetic & bio-based aniline industry players has recently announced that aniline can be effectively derived from biomass. The company has collaborated with renowned research and industry participants to brainstorm a novel process in the laboratory, deploy the same in a pilot plant, and successfully manufacture bio-based aniline on an industrial scale, which it intends to commercialize soon. The accomplishment is being touted as a marked achievement in synthetic & bio-based aniline market.

The company reports that close to 5 million tons of aniline are produced globally on an annual basis, and this figure has been forecast to increase at a y-o-y rate of 5%. The synthetic & bio-based aniline market giant alone boasts of a production capacity of approximately 1 million tons. This only goes to prove that the extensive demand for this precursor across myriad end-use sectors has been depicting a robust surge – a fact that is likely to propel synthetic & bio-based aniline industry to enviable heights of success. Industry estimates are also in favor of the aforementioned declaration. Global Market Insights, Inc., reports synthetic & bio-based aniline market size to surpass a valuation of USD 19 billion by 2024.