APAC Synthetic Lubricants Market to gain remarkable valuation over 2016-2023, expanding automotive sector in China and India to influence the regional revenue

Publisher : Fractovia | Published Date : 2017-07-04Request Sample

Synthetic Lubricants Market has been witnessing an elevated application scope lately, subject to the remarkable growth in the automotive industry over the past few years. Fueled by the upgraded standard of living, there has been a rapid rise in the automobile sales globally. A noticeable preference toward branded cars has substantially increased the utilization of synthetic lubricants in vehicles as gearbox brake, and hydraulic fluids to reduce the wear and tear of engine components. Low additive solvency, hydrolytic stability, high viscosity index, and low-temperature fluidity are some of the unique product characteristics remarkably fueling the synthetic lubricants market demand. Another profound factor influencing synthetic lubricants market dynamics is the growing demand for natural gas across various utility domains including personal care, food and beverage, and construction.

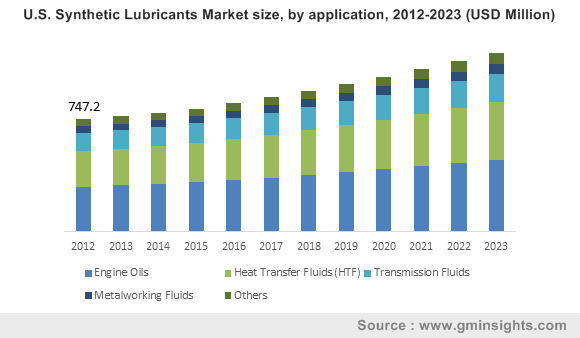

U.S. Synthetic Lubricants Market size, by application, 2012-2023 (USD Million)

Asia Pacific is observing strong growth prospects in the synthetic lubricants industry. The regional automotive industry has been charting an escalating growth since the past few years with a subsequent increase in the synthetic lubricants demand. China and India are anticipated to be the major revenue pockets driving the regional share, possibly due to the rapidly growing automotive market in both the nations. As per an estimation put together by Global Market Insights, Inc., APAC synthetic lubricants market in the next six years in slated to record 200 kilotons in terms of volume, with a CAGR projection of 4.6% over 2016-2023. Additionally, increasing product penetration across numerous manufacturing units coupled with favorable initiations by the government to increase the production base of certain manufacturing companies is expected to contribute significantly toward the regional market.

Global synthetic lubricants industry in terms of valuation will record USD 5 billion by 2023, with 4% CAGR projection over 2016-2023. In terms of volume, it is set to cross 900 kilotons over the span. Despite the fact that synthetic lubricants are of higher cost than its other mineral counterparts, the market is expected to evolve in the coming six years subject to the variety of lubricants continuously being developed to address the increasing demand from the varied end-use sectors. Top notch companies engaged in the industry are undergoing various strategic collaborations to sustain their market presence. In 2015, the market was highly concentrated with some of the renowned players covering 50% of the overall share. Castrol, Shell, Fuchs, ExxonMobil, British Petroleum, and Amsoil, are some of the big names holding a strong command over the industry.

Taking into consideration the application landscape, global synthetic lubricants industry share from HTF (heat transfer fluid) is projected to exceed billion-dollar market, accounting for USD 1.5 billion by 2023. Extensive adoption of synthetic lubricants as emulsifying and demulsifying agents for water removal in chemical plants and oil and gas sector is augmenting the industry share from this domain. Accountable for enhancing the heat transfer efficiency, heat transfer fluid application is likely to chart a profitable roadmap at an annual rate of 4% over the coming six years. Since automotive applications dominate the business landscape, engine oil procured a major portion of the synthetic lubricants industry share in 2015, covering 40% of the total volume. Superb firm protection, increased drain level, and elevated operating temperature range are some of the attributing features enhancing the market outlook.

PAO, PAG, and esters are three basic products encompassing the business landscape. With a contribution of 60% of the overall volume, PAO synthetic lubricants market led the global industry in 2015. Increasing proliferation of PAO in automobile engines is significantly driving the market demand. In addition to this, efforts taken by companies involved in the market undoubtedly is adding a different dimension, that will likely scale up the commercialization of synthetic lubricants industry. For instance, OEM recommendation in reputed brands like BMW, Volkswagen has significantly complemented the industry outlook. Speaking along the same line, Europe synthetic lubricants market is majorly influenced by the presence of numerous automotive manufacturing companies which include Mercedes, Audi, Rolls, BMW, driving substantial product demand. With Germany at the helm, Europe market is slated to exceed USD 1000 million by the end of 2023.

Changing consumer preferences for high quality, cost effective lubricants are likely to drive the synthetic lubricants market trends in future. Subject to the increasing concerns over environmental degradation, manufacturers are also striving to bring biodegradable products in the market. With several manufacturers’ venturing into novel product deployment, synthetic lubricants market will certainly widen its horizon in the coming six years.