Tempered Glass Market to register a massive growth rate over 2017-2024, fueled by extensive product demand from the construction and automotive sectors

Publisher : Fractovia | Published Date : 2018-01-16Request Sample

The last few decades have witnessed tempered glass market experiencing a gradual but commendable growth, which can be credited to the fact that the product finds massive applications across the construction, automotive, and electronics sectors. In fact, the deployment of this product across these expanding domains has been so commendable, that tempered glass industry size was pegged at a USD 24.5 billion in 2016. The sales graph of the market has particularly observed an upsurge across the emerging economies like China, Brazil, India and Malaysia, where the construction industry has been reigning supreme since the last few years. It is however, also prudent to mention that this product is used home appliances, cookware and furniture, owing to which tempered glass market share is likely to observe substantial growth over 2017-2024.

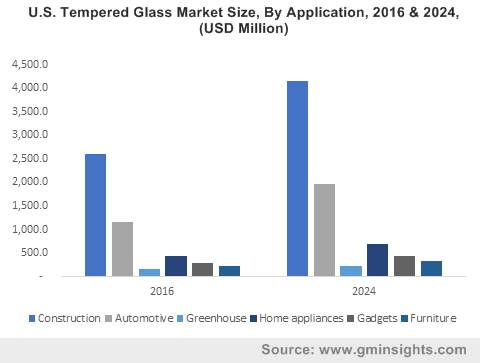

U.S. Tempered Glass Market Size, By Application, 2016 & 2024, (USD Million)

On account of the fact that this product possesses high strength and resistance to extreme temperatures, tempered glass market has generated substantial revenue from the automobile sector. Indeed, the automotive domain has been deemed to be one of the largest contributors of the industry, primarily attesting to the fact that this product possesses superior strength and shatter resistance. This property is particularly important, since tempered glass tends to fall in small granular pieces when shattered - deemed rather harmless as compared to traditional plate glass that tends to form jagged edges. On these grounds, another pivotal avenue that has emerged as a major end-use domain for tempered glass market is the construction industry.

Tempered glass is extensively used in the construction of modern buildings, especially the ones in the commercial sector. Estimates cite that tempered glass industry size from the commercial construction sector is projected to cross USD 12.5 billion by 2024. Notably, this product is also used in the construction of greenhouses. Greenhouses in fact, exclusively use tempered glass due to their availability in multiple pane sizes that help greenhouses function more effectively. In both commercial buildings and greenhouses, tempered glass helps in reflecting heat and withstands the contraction and expansion of the structures better than ordinary glass. Undeniably, the product, having established its supremacy as an indispensable material, has witnessed an increase in demand, thereby impacting the commercialization potential of the market.

Speaking of the application landscape, it would be impossible to not mention that small-scale end-use domains, such as cookware and gadgets, also contribute toward the growth of tempered glass market. Driven by its superior resistance to extreme temperatures and minimal chance of breakage, tempered glass has become a preferred material for baking and storage utensils. The product is extensively used in the manufacturing of homeware appliances like the microwave, refrigerator, washing machine, etc. On these grounds, it has been forecast that the industry size from home appliances will grow at a rate of 5% over 2017-2024. Gadgets like laptops, tablets and smartphones on the other hand, that come with tempered glass like Gorilla glass are more in demand, a factor that is encouraging more manufacturers and consumers to prefer tempered glass for their gadgets. These shifting trends are likely to impact tempered glass market revenue from gadgets over the years ahead. Aftermarket sales of tempered glass for smartphones and tablets are also expected to capture a substantial share of industry revenue over 2017-2024.

It is imperative to mention that the emerging economies have been substantially lucrative contributors of tempered glass market. China and Brazil, specifically, have been touted to be profitable growth grounds for the market over 2017-2024. As per estimates, China tempered glass industry size has been forecast to exceed USD 4.5 billion by 2024, owing to the product’s widespread application in the construction, automobile and electronics industry. The New-Type Urbanization Plan in China that is aiming at decarbonizing the Chinese cities will also lead to increased use of tempered glass in the urban and commercial areas of the nation. Brazil, driven by the country’s surging economic development and increased consumption of electronic items such as microwaves, refrigerators and washing machines, is predicted to register a CAGR of 5.6% over 2017-2024.

The deployment of toughed glass has been considerably increasing across myriad sectors in the developed as well as developing nations. These end-use domains, particularly the construction and furniture industries, have also been forecast to witness an exponential growth rate over the ensuing years, which would help augment the market size. As companies strive to brainstorm novel products as per consumer demand that would find utilization in a plethora of business spheres, tempered glass market size would witness a massive increase. In fact, estimates claim tempered glass industry size to be stand at an appreciable USD 40 billion by 2024.