Increasing prevalence of orthopedic disorders to influence trauma fixation devices market outlook

Publisher : Fractovia | Published Date : 2019-09-04Request Sample

Rise in geriatric population and prevalence of bone degenerative diseases and traumatic bone injuries will boost trauma fixation devices market outlook over the forecast period. Increasing sports injuries are also a key driving factor behind the consumption of trauma fixation and treatment solutions. Advancing technology has helped innovate better devices for more beneficial outcomes that contribute to the growing use of medical devices. Increasing need for surgeries due to various health conditions will propel trauma fixation devices industry share.

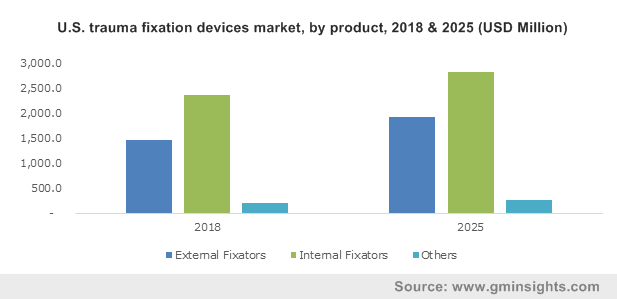

U.S. trauma fixation devices market, by product, 2018 & 2025 (USD Million)

Osteoporosis is a disorder that weakens the bones and increases the risk of spine, wrist and hip fractures that sometimes require immediate medical attention. Surging amount of people suffering from osteoporosis will significantly influence demand for products offered by trauma fixation industry. It is estimated that over 53 million people in the United States are already suffering from osteoporosis or pose a high risk of being diagnosed with one owing to their low bone mass.

One in every two women in the U.S. and one in four men aged 50 and above are predicted to experience broken bones because of osteoporosis in their lifetime, while it could be fatal for some, others would be forced into nursing homes later on. Renowned foundations are initiating partnerships with hospitals in order to launch more orthopedic institutions that help meet the medical need for patients with fractures and require fixation devices, outline potential opportunities for trauma fixation devices market.

Car accidents account for around US$242 billion in economic costs annually in the U.S. where nearly 20-50 million people are injured or disabled in road accidents globally. Injury and death due to traffic accidents are critical health problems in a developing country as well. Reportedly, 90% of disability has been caused by road traffic injuries. Maxillofacial injuries are found to be among the leading traumatic wounds worldwide, in addition to substantial occurrence of head and neck injuries. These factors are poised to expand trauma fixation devices market size considerably.

Upper extremity factures have been on a surge and according to a study encompassing over a period of ten years, 54.4% of increase in the upper extremity fractures had been treated with internal fixation and patients over the age of 55 years were among the people most treated with internal fixation devices. A tremendous amount of cases were performed at the freestanding surgical centers than hospital-based facilities. The U.S. accounts for 18 million emergency room visits due to upper extremity injuries every year, suggesting remarkable prospects for internal trauma fixation devices industry size.

Sports injuries have been a major cause for the utilization of trauma fixation devices needed to treat various parts of the patients. According to a report, an estimated 8.6 million recreation and sports related injuries occurred every year from 2011 to 2014 in the U.S, that showed a rate of 34.1 cases per 1000 people aged 5 years and above. 20% of those injuries occurred due to fractures and games like basketball and football account a notable portion of these cases. The surging rate of sports-related fractures are driving North America trauma fixation devices market trends.

U.S. trauma fixation devices market size was valued at USD 4.0 billion in the year 2018 owing to prevalence of sports-related injuries, growing geriatric population and other key factors. The country has an advanced healthcare infrastructure along with favorable health insurance schemes help improve access to crucial medical devices. Recently, the FDA gave a clearance to aap Implantate AG for its LOQTEQ VA foot plates 2.5, a kind of peek trauma plates that enable corrections of malposition in the midfoot area and more flexible treatment of fractures.

Owing to continuous innovations in the field of medical devices and rising occurrence of various orthopedic diseases and injuries will fuel the demand for trauma treatment options. Key players offering trauma fixation devices for the increase patient base include Smith & Nephew, Stryker Corporation, Wright Medical Group N.V. and Integra LifeSciences. Reports estimate that global trauma fixation devices market will surpass annual valuation of USD 9.5 billion by 2025.