Unexpanded perlite market to earn striking proceeds via robust application spectrum over 2018-2024, Asia Pacific to contribute substantially toward industry expansion

Publisher : Fractovia | Published Date : 2018-06-13Request Sample

The launch of ImerCare™ 190P-Scrub microspheres by Imerys SA in 2016 fittingly validates the ever-evolving application spectrum of unexpanded perlite market. The latest perlite-based product is reportedly a 100% natural substitute for plastic beads which are predominantly utilized by the cosmetics sector to manufacture face scrubs. These microspheres are being considered as ideal for face applications given the fact that they are easy to utilize and are gentle in physical exfoliation.

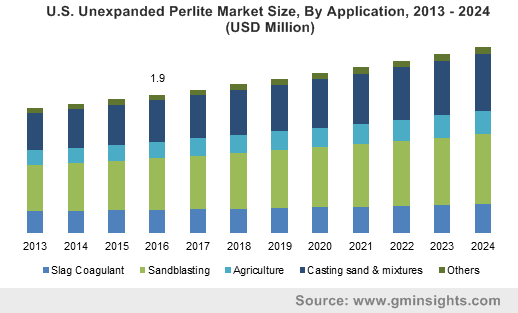

U.S. Unexpanded Perlite Market Size, By Application, 2013 - 2024 (USD Million)

Elaborating further, the new range of microspheres have been designed to extract particles with a unique spherical shape and controlled size distribution. Experts claim that with the unveiling of ImerCare mineral range of Imerys SA it is rather overt that the growth potential of unexpanded perlite industry appear highly promising as this business space has been gaining ground in new sectors such as cosmetics in the recent years. Moreover, increasing product demand from an enormous application base inclusive of casting sand & mixtures, agriculture, sandblasting, slag coagulant, and construction is likely to augment the revenue collection of unexpanded perlite market in the forthcoming years.

Asia Pacific to lead the regional growth trajectory of unexpanded perlite industry

By virtue of being the front-runner in the global construction industry, the Asia Pacific region invariably stands as one of the most lucrative terrains for the companies partaking in unexpanded perlite market. In this regard, it is prudent to state that the expansion of construction and industrial sectors across numerous emerging economies of the region such as China and India has been unprecedented over the past few decades. This has subsequently triggered massive mining operations in this region to acquire more perlite to cater the requirements accruing from the aforementioned business verticals.

Allegedly, China has been at the forefront of the global unexpanded perlite market share courtesy – the nation has discovered more than 15 mines in the year 2008 and has almost doubled the production of perlite in the last few years. Evidently, the instance of China’s extensive efforts to foster the utilization of crude perlite across numerous applications underscores the prominence of Asia Pacific region across the unexpanded perlite industry. In fact, as per a research report compiled by Global Market Insights, Inc., the Asia Pacific unexpanded perlite market is slated to record a y-o-y growth rate of 4% over the timespan of 2017-2024.

Meanwhile, it deems fit to take note of the factors that are likely to hinder the commercialization scale of unexpanded perlite market in the near future. The growing availability of numerous substitutes such as polymeric foams, barite, and diatomaceous rock is anticipated to hamper the product demand across various business verticals. In addition to this, the cost-inefficient production procedure has been emerging as the major reason that has further inhibited swift expansion of unexpanded perlite industry size.

However, it has been observed that the prominent perlite extractors have been focusing on extensive R&D activities, of late, which would certainly generate ample opportunities for the unexpanded perlite industry giants across verticals like construction, agriculture, and sandblasting among others over the ensuing years.

Of late, it has been observed that raising the prices of flagship products has emerged as one of the major strategies being adopted by prominent firms operating in unexpanded perlite market. For instance, Dicalite Management Group’s recent announcement of raising the prices of its perlite and diatomaceous earth products by up to 15% has garnered considerable attention across the business space. The price adjustment, effective from January 2018, can be viewed in the backdrop of increasing costs related to ore, packaging, logistics, transportation, and regulatory compliance.

Concurrently, it is quite imperative to mention that the unexpanded perlite market space has consolidated significantly over the past decade owing to the presence of some of the renowned names in polymers and advanced materials industry such as PVP, Dicalite Management Group, Hess Perlite, Gulf Perlite LLC, Imerys SA, Perlite-Hellas, the Schundler Company, Cornerstone Industrial Minerals Corporation, Midwest Perlite Inc, and Pratley Perlite Mining. Driven by the launch of highly customized and value-added solutions that meet a host of requirements from customers across diverse fields, the unexpanded perlite market is slated to exceed a remuneration portfolio of USD 11 million by 2024.