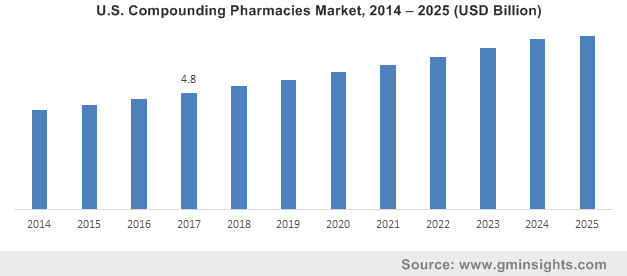

U.S. compounding pharmacies market to be characterized by a stringent regulatory landscape: regional industry valuation to cross USD 7 billion by 2025

Publisher : Fractovia | Published Date : 2018-11-22Request Sample

The rising cases of cancer, diabetes or allergies has led to a distaste for commercial medication, stimulating U.S. compounding pharmacies market growth in the recent years. Compounding generally allows licensed pharmacists to combine, mix, or alter ingredients of a drug to create a medication tailored to the needs of an individual patient. The convenience and benefits offered by such services, that go along likes of the ability to manufacture liquid doses or creating compound medications that are not produced commercially will increase the adoption of compounded drugs, further augmenting the U.S. compounding pharmacies industry size.

U.S. Compounding Pharmacies Market, 2014 – 2025 (USD Billion)

Reportedly, American pharmacies play a key role in providing compounded medications to patients. Before being mass produced, prescription drugs in the region were usually made through compounding. In the current scenario of the healthcare industry, compounding pharmacies have seamlessly emerged as a necessary aspect, due to the demand for customized prescription drugs for patients who cannot consume mass-produced medication. Such situations arise mainly when a patient suffers from an allergy to an ingredient in a mass-produced drug or requires a dosage that is not manufactured on a large scale.

Fortunately, the concept of compounding has recently gained quite some traction, thanks to modern technology, innovative techniques, and research programs, allowing more pharmacists to customize medications that meet specific patient needs more efficiently. Trained pharmacists can now personalize medication for patients who demand specific, strengths, flavors, dosage forms, and ingredients due to their allergies or other sensitivities, the rising prevalence of which would drive U.S. compounding pharmacies market.

How significant is the involvement of federal regulatory bodies in U.S. compounding pharmacies market:

Critical and fatal healthcare related infections caused due to maladministration of adulterated compounded medication may have a negative influence on the industry growth. In October 2012 for example, the United States encountered the most severe outbreak associated with contaminated compounded drugs, as a pharmacy in Massachusetts dispatched compounded drugs contaminated with fungus throughout the nation, which were later injected into patients’ joints and spines. As per reports, more than 750 people in 20 states developed fungal infections, and more than 60 people died. The U.S. FDA, since then, has been extra vigilant and rather proactive with regards to mandating norms for ensuring that contaminated compounded drugs are not circulated among the masses.

Citing yet another instance, healthcare frauds associated with compounded drugs had become rather commonplace a few years back, In 2014 and 2015 for example, the United States Postal Service incurred USD 81.8 million in excessive workers’ compensation costs for compounded medications, attributed in part to fraud. In order to avoid such frauds and ensure patient safety, the U.S. FDA undertook a multipronged approach that involved enhancing information about compounded topical pain creams, inspecting compounding facilities, seeking input from medical professionals, and inspecting operations that not registered as outsourcing facilities.

The U.S. Food and Drug Administration (FDA) also regulates almost all commercial pharmaceutical manufacturing. The organization works as a primary regulator of pharmacies, including public drug stores, in-store pharmacy counters, large chains, and specialty pharmacies. Major states now uphold laws and regulations guiding pharmacy standards and requirements, such as mandatory licenses for each facility and credentials of pharmacists and other employees. Authorities seemingly look for secure storage, recordkeeping, labeling, and safety protocols related to the authenticity, origins, expiration dates of products, chain of custody, storage, purity, and sterility in a compound pharmacy. Moreover, state rules are updated periodically, commonly under the authority of individual state Boards of Pharmacy, which operates in all the 50 U.S. states.

Pharmacists engaged in compounding are expected to follow applicable standards and regulations for the types of ingredients they compound. The FDA of course, exerts control over the integrity and safety of the drugs (deemed Active Pharmaceutical Ingredients) used in compounded measures. The U.S. Drug Enforcement Administration (DEA) is also in charge of controlled substances used in the preparation of compounded drugs.

Reportedly, of the approximately 56,000 community-based pharmacies in the United States, about 7,500 pharmacies specialize in compounding services. Compounding also takes place in hospital pharmacies and at other health care facilities. Indeed, compounding pharmacies are needed and are of a great value for the healthcare industry. The U.S. compounding pharmacies market thus, in essence, holds a lot of promise with the rising demand for personalized medicine, appropriate pain medications, and creating equivalent products in an event of drug shortage.

Compounded drugs are thus, unique pharmaceutical products formulated to meet patient requirements and are a beneficial key component in the treating special diseases. Stringent federal regulations laid down by organizations like the FDA and DEA will govern the dynamics of the U.S. compounding pharmacies market, safeguarding patients from consuming fatal or contaminated compounded medication. The ability of these pharmacies to merge certain prescriptions into a single dose or formulate liquid doses for patients will further boost the growth of U.S. compounding pharmacies market, slated to register a CAGR of 5% over 2018-2025.