U.S. Industrial Hearing Protection Market from oil and gas application to witness remarkable proceeds over 2017-24, strong regulatory framework to outline the industry landscape

Publisher : Fractovia | Published Date : 2017-10-27Request Sample

U.S. industrial hearing protection market outlook has undergone an enterprising change over the past few years. Safety measures have become an integral axiom in all manufacturing domains, subject to the stringent regulatory norms enforced by renowned organizations like OSHA, NIOSH regarding workplace protection. Companies engaged in U.S. industrial hearing protection industry, of late, have been inclining toward strategic collaborations in a bid to develop cost effective, sustainable, innovative products.

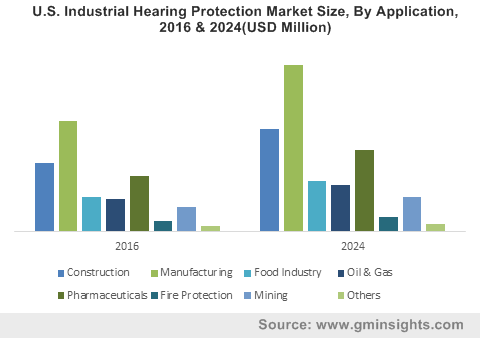

U.S. Industrial Hearing Protection Market Size, By Application, 2016 & 2024(USD Million)

The recent partnership of Elvex Corporation and Europe based Delta Plus Group can be an apt instance backing the aforementioned fact. Elaborating further, Elvex Corporation, a leading name in U.S. industrial hearing protection market, that had inked a strategic agreement with Delta Plus Group in the year 2015, has reportedly brought mutual benefits to both the organizations. As per reliable sources, through this deal, Delta Plus has strengthened its personal protective equipment portfolio by leveraging Elvex’s amazingly innovative hearing protective product range for industrial workers. Tapping on Delta Plus’s extensive customer base in personal protective equipment market, Elvex Corporation, on the other hand, has further carved a profitable road map in U.S. industrial hearing protection industry.

Another important factor that investors must take into consideration is the changing trends of personal protective equipment deployment in U.S., which is overtly leaving a perpetual impact on U.S. industrial hearing protection market dynamics. U.S., being one of the most urbanized nations across the world, is claimed to be a major consumer of personal protective equipment globally. Estimates claim U.S personal protective equipment market to exceed a valuation of USD 21 billion by 2023, which itself is a prominent proof documenting the growth curve of U.S industrial hearing protection industry in the ensuing years. If experts are to be relied on, U.S. industrial hearing protection market size is anticipated to record a revenue over USD 650 million by 2024.

Regulatory overview of U.S. industrial hearing protection industry

- The NIOSH (The National Institute for Occupational Safety and Health) recommends that industrial workers at no condition should be exposed to a noise level above 85 dBA for more than eight hours, as it may result in occupational noise induced permanent hearing loss. As per the suggestion, there should be 3 dBA exchange rates to maintain the balance between noise level and exposure time. Reportedly, every surge by 3 dBA doubles the amount of noise and halves the suggested exposure time.

- The Bureau of Labor Statistics declares that occupational hearing loss stands as one of the most commonly recorded illness in industrial workplace, particularly in manufacturing units. The survey further claims that unfortunately, out of 59,100 cases, almost 17,700 issues are related to occupational hearing disorders. Pertaining to this, most of the accident-prone enterprises in the U.S. have mandated usage of protective hearing equipment at workplace, substantially influencing the U.S. industrial hearing protection market share.

- A recent report put forth by OSHA depicts that nearly twenty-two million American workers are exposed to potentially damaging noise each year. In fact, U.S. industrial sectors incurred a loss of USD 1.5 million in the form of penalties for workers suffering from hearing loss. These statistics vividly underline the potential opportunities for U.S. industrial hearing protection market in the coming years.

The affirmation of analysts about the humongous application scope of U.S. industrial hearing protection industry is true indeed. As per the reports, oil & gas sector has been a profound driver of the industry’s application matrix over the recent years, subject to the fact that this particular business sphere is more prone to hazardous environment. As per estimates, presently over 36 million Americans are employed in oil & gas and mining industry. The fact that these workers are continuously exposed to hazardous environment, OSHA has imposed certain strict guidelines to mandate workplace safety procedures, which is one of the chief factors fueling U.S. industrial hearing protection market share. In addition, technological advancements in oil extraction techniques coupled with recent recovery in shale oil & gas reserves has further played a critical role in augmenting the overall regional demand. Global Market Insights, Inc., forecasts U.S. industrial hearing protection industry size from oil & gas application to surpass USD 55 million by 2024.

U.S. industrial hearing protection market has indeed come a long way, far more than anticipated. The extensive business penetration across manufacturing, oil & gas, chemical sector further puts supplementary evidence that the marketplace is here to sustain in the coming years. The business space, as claimed by analysts, is pretty consolidated with the participation of renowned biggies like 3M, Elvex, Honeywell, MSA Safety, David Clark Company and Starkey. These companies are readily adopting contemporary growth tactics to strengthen their business dominance, in addition to giving other contenders a competitive advantage. With spreading awareness regarding workplace safety coupled with a scrutinized regulatory groundwork, U.S. industrial hearing protection industry is sure to witness tremendous recognition in the years ahead, with a projected market size of 350 million units by 2024.