Smartphone technologies to drive Usage-based insurance (UBI) market

Publisher : Fractovia | Published Date : 2019-07-11Request Sample

The increasing production of automobiles coupled with rising standards of living and necessity to customize insurance premiums will drive UBI market size. On-going technological advancements along with the deployment of vehicle safety regulations have been generating new business opportunities for the industry players. Growing acceptance of smartphone based technologies and autonomous vehicles across the globe will further fuel product demand.

U.S. Usage-based Insurance (UBI) Market Revenue, By Technology, 2017 & 2024 (USD Million)

Usage-based insurance (UBI), essentially, is a type of pay as you drive (PAYD) vehicle insurance. Rather than the regular annual insurance premium, this type of insurance is charged by comparing the type of vehicle and the distance travelled along with driving behaviors and the place. It offers insurance plans with the freedom of customization and complete transparency for the charges incurred, owing to which it is highly preferred by many. The assessment of driving behaviors has allowed insurers to introduce new usage-based insurance models by evaluating the risk based on data collected from real-world driving behaviors, which has eventually fueled UBI market trends.

Usage-based insurance (UBI) market is characterized by the advancements in the technology cosmos. The integration of Internet of Things(IoT) in various automotive applications created an uptrend in the usage-based insurance (UBI) industry share. The IoT enabled telematic devices are mainly deployed inside vehicles to obtain its real-time data about acceleration, braking, cornering, speed, time, and location of the drive. UBI benefits both the insurer and driver, as it offers improved efficiency of fraud detection and better customer interactions. It creates an awareness among drivers that adoption of safe driving principles can help to lower the insurance cost.

The rising awareness of telematic technology among automakers to improve road safety will help usage-based insurance market to register a CAGR of more than 18% from commercial vehicle segment over 2018 to 2024. Eyeing the growth of the logistics sector, commercial vehicle manufacturers are widely deploying telematic solutions to provide integrated services like traffic updates, smart routing, and roadside assistance. Surging use of telematic data to review driving behavior and enforce safe driving is slated to enhance the product demand over the forecast period.

The advancement of smartphone technology with miniaturized sensors is expected to transform usage-based insurance (UBI) market trends. Earlier, most of the vehicle insurance providers used wireless devices to gather information about the vehicles’ location and drivers’ road behavior. These devices were plugged into a vehicle’s on-board diagnostics (OBD-II port). Currently though, most of them are getting replaced by smartphone telematics, through which insurance companies will be able to capture driver behaviors with the help of a smartphone.

North America will emerge as one of the most profitable grounds for usage-based insurance industry. As per estimates, the region is likely to hold a total share of 35% in UBI market by 2024. The growing automobile production in the region and rising influence of connected cars with inbuilt telematic solutions will support the regional market growth. The increasing number of well-established insurance companies will also propel market trends in the region.

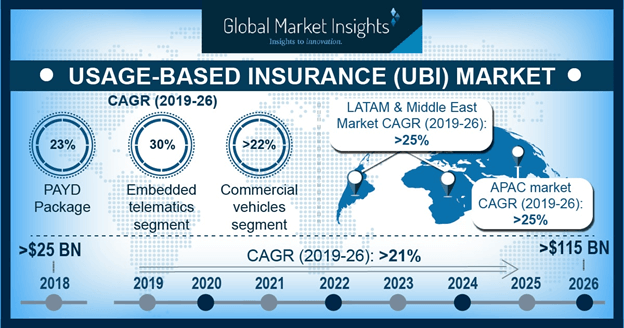

The consistent automobile production across the globe, penetration of smartphone telematics, and decreased cost of customized insurance will be some of primary factors driving usage-based insurance (UBI) industry outlook. Some of the major players in UBI market are Vodafone Automotive, Progressive, AXA, Sierra Wireless, Allstate, State Farm, Allianz, Liberty Mutual, Mapfre S.A, UnipolSai, Generali, TomTom, Octo, Metromile, Insure The Box, Danlaw, Zubie, Desjardins Group, IMS, and Cambridge Mobile Telematics. Global Market Insights, Inc., estimates that usage-based insurance (UBI) market is poised to surpass a revenue collection of USD 107 billion by 2024.