APAC vinyl acetate monomer market to emerge dominant over 2017-2024, escalating product demand from the construction and automotive sectors to augment the industry growth

Publisher : Fractovia | Published Date : 2018-04-20Request Sample

One of the principal reasons for vinyl acetate monomer market to become a multibillion dollar vertical is that the chemical is highly versatile, economically viable, and a major building block in the manufacturing process of various polymers. VAM is notoriously famous for being a key raw material in the production of polyvinyl acetate (PVA), used to manufacture adhesives, which further on, find usage across the construction, furniture, and automotive sectors. What’s more, the chemical is also a chief raw material for vinyl acetate ethylene (VAE) emulsions and polyvinyl alcohol (PVOH) – chemicals that have witnessed an expansive demand in the packaging sector, further stimulating VAM industry.

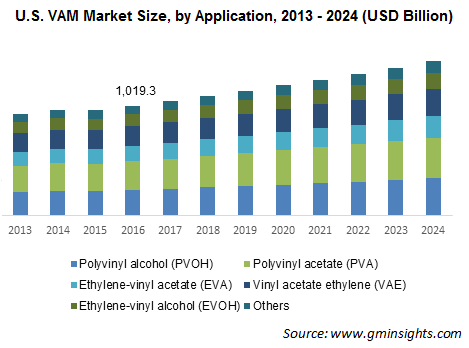

U.S. VAM Market Size, by Application, 2013 – 2024 (USD Million)

The diverse application spectrum of VAM market can be chiefly credited for its massive growth. Indeed, the demand for the chemical is also vividly coherent from the efforts that industry players have been undertaking lately. INEOS Oxide for example has recently invested in building a multimillion dollar plant in Europe owing to the brisk growth of vinyl acetate monomer market in the region. This project incidentally, is aimed at reducing the reliance of Europe on imports from deep-sea locations and for the betterment of supply reliability.

VAM’s usage for chemical production to stimulate vinyl acetate monomer market outlook

The expansion of the vinyl acetate monomer market will be largely facilitated by the demand of chemicals produced from VAM. In an era where environmental sustainability is being largely adopted, biodegradable plastics have become a major requirement across various industries, especially in food packaging. Polyvinyl alcohol is one such class of plastics that has extremely reliable credentials on the biodegradable front. Its applications are extremely diverse, ranging from films used for adult incontinence and feminine hygiene products to resin solutions used in personal care products, such as lubrication aid in eye drops and contact lens wetting solutions. A unique set of chemical, mechanical and physical properties provides PVOH resins with ample versatility, making them a potential growth avenue for VAM industry.

Polyvinyl alcohol is also used in the production of PVB resins, which has extensive applications in laminated glass. In consequence, the automotive and construction sectors have emerged as highly lucrative growth grounds for VAM market, given that laminated glass is massively used for automobile exteriors and building windows. Indeed, estimates claim vinyl acetate monomer market size from polyvinyl alcohol to register a 5% CAGR over 2017-2024.

Polyvinyl acetate is yet another profitable application avenue for vinyl acetate monomer market, given that the chemical is deployed heavily in the production of adhesives and coatings for the construction sector. PVA adhesives are manufactured via VAM polymerization and find extensive usage in binding porous materials including paper, wood, cloth and as a combiner for permeable building stone. Driven by the chemical’s expansive deployment in construction, vinyl acetate monomer market share from polyvinyl acetate is expected to surpass USD 2.5 million by 2024.

A region wise outlook of vinyl acetate monomer industry

Asia Pacific has ascended to prominence in VAM market, primarily due to the robust expansion of the construction and automotive industries sectors in the region. With the increasing application of this chemical and its derivatives in several verticals, in tandem with the efforts undertaken by leading chemical companies, APAC vinyl acetate monomer market will register a CAGR of 5.2% over 2017-2024.

Government initiatives and huge private investments in countries such as China and India are anticipated to drive the regional vinyl acetate monomer market trends. Furthermore, these nations have adopted policies to welcome foreign direct investment in the construction and automotive sectors, leading to many companies choosing APAC as a base to establish production units. This trend has further contributed toward the expansion of the regional vinyl acetate monomer industry.

Middle East & Africa is expected to hold the second position for the expansion of the vinyl acetate monomer market. The region’s progress in construction and infrastructure development has drawn the interest of several manufacturers, encouraging them to increase the production capacity of VAM in this region. For instance, Sipchem had opened a plant in Saudi Arabia for the production of ethylene vinyl acetate (EVA) which finds comprehensive applications in several industries including construction, textiles, etc.

The deployment of VAM is a causal factor for adverse health implications. That aside, the chemical is consistently under the scanner for price volatility. In consequence, these factors have had a negative impact on VAM industry trends, leading to a slightly restrained growth in the ensuing years. However, the biodegradable nature of the chemicals produced from VAM and their wide application in various end use verticals are certain to aid vinyl acetate monomer market emerge as one of the most profitable industries in the chemical space.