3 application-oriented trends impacting global wax market size over 2017-2024

Publisher : Fractovia | Latest Update: 2019-08-23 | Published Date : 2018-02-23Request Sample

Global wax market has been experiencing notable growth over the last couple of decades owing to distinct uses of wax as a base in several industrial product offerings. The market is primarily driven by rapidly growing cosmetic segment, along with the automobile sector which deploys wax in adhesive production.

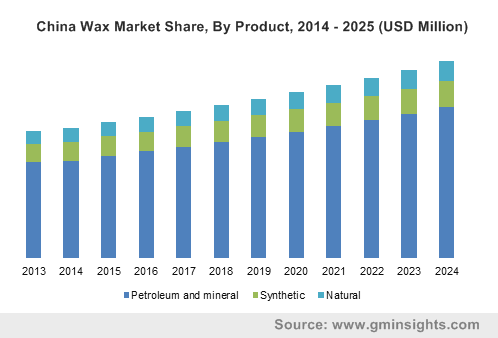

China Wax Market Share, By Product, 2014 - 2025 (USD Million)

The robust automobile sector is gradually steering wax industry given the demand for adhesives as well as wax coatings, as the product protects vehicles from scratches, reduces the cost of maintenance and repairs and also protects the paint.

In the year 2017, total number of vehicles sold in EU was estimated at 15.2 million. The automotive sector in Europe has a critical multiplier effect on the economy, which is important for other upstream industries in the region such as chemicals, steel and textiles. The cumulative turnover generated by automobile sector contributes to around 7% of EU’s GDP. The enhanced automobile sector will certainly push the demand for wax-based products, outlining wax market trends.

Below are some key factors expected to drive the industrial consumption of wax over the coming years:

Rising demand for cosmetics in Asia Pacific

Wax industry share is depicting immense momentum in Asia Pacific owing to a strong manufacturing base of cosmetic in countries such as China, India and Korea. Wax is widely used in cosmetics as a thickening agent, with soothing and protective qualities that provide stability to skin care products and cosmetics, boosting their consistency and viscosity.

Wax may be used in different forms in the cosmetics industry, such as natural wax, floral wax, hydrogenated oil and other forms.

Cosmetic industry in Asia has witnessed a burgeoning demand and the Korean cosmetic market has been gaining worldwide popularity. Apparently, the fascination in Korean cosmetics is growing on account of the enhanced innovations in the industry. In 2016, the market size of the cosmetic industry in Korea was recorded at USD 8.5 billion making it the eighth largest cosmetics market in the world.

With cosmetics application recording an amplified growth in developing countries, there is considerable scope for the expansion of APAC wax market in the years ahead.

Steady consumption of candles worldwide

Rising disposable income has led to a higher spending capacity for people, stimulating the purchase of candles for various types as decorations, festive occasions and other applications. Utilization of candles across different situations around the world is one of the major factors fueling global wax market outlook.

According to the National Candles Association, U.S., candle manufacturers offer over 1000 to 2000 varieties of candles in the country. Additionally, over 35% of the candle sales are recorded during the Christmas season. In order to meet the inclining demand for candles in the U.S., over 1 billion pounds of wax is required every year. Evidently, the production requirement for candles is anticipated to positively influence the U.S. wax industry size.

Similarly, rising use of candles is also observed in Japan. Japanese candles or Warosuku are considerable different from the ones usually found in other places. They wick is hand coated with wax, layer by layer until the candle is complete. Another method consists of pouring wax into a wooden mold that holds the wick. Ethnic and traditional behaviors around the globe will undoubtedly define the consumption graph of candles worldwide.

Expanding product deployment in the food and beverage sector

Growth of the food and beverage sector to meet the exponential demand globally is driving the packaging industry. Enhanced purchasing power and a change in consumer lifestyle has triggered the evolution of food and beverage trends, with more people opting for on-the-go food items. With, changing consumer preferences the packaging segment has seen alterations in terms of materials used and according to a report, over 90% of the shoppers in Europe prefer paper-based packaging.

Wax paper is a widely used product to facilitate packaging of food products. Wax papers are considered to be eco-friendly and they do not stick to edible items, besides having controllable tear characteristics. They are considered to be a biodegradable packaging material, apparently fulfilling the 90% relative biodegradability requirement of EN. Furthermore, these wax by-products are also recyclable making them an ideal packaging material approved by regulatory authorities.

Innovation in the food packaging segment along with favorable characteristics of wax paper will provide substantial impetus to global wax market forecast. As per estimates, wax market size will cross USD 10 billion by 2024.