Well intervention market to be characterized by escalating offshore oil exploration activities, global industry to exceed USD 18 billion in valuation by 2024

Publisher : Fractovia | Published Date : 2018-11-02Request Sample

The growing preference for well intervention services considering their cost-effectiveness is certain to positively impact well intervention market share. Lately, the surging oil and gas exploration & excavation activities across the globe for fulfilling the increasing energy needs have been propelling the requirement of well intervention services on a large scale. In addition to oil excavation activities, well intervention services are required to maintain the productivity of the plant by increasing efficiency and performance and for reducing risks. In this regard, oil companies have been giving out contracts to oil and gas plant maintenance firms for enabling efficiency in activities like perforating tubing, sand control, pumping, and snubbing to improve the well's productivity.

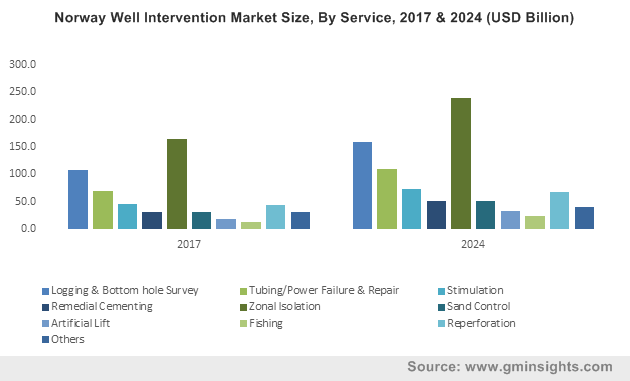

Norway Well Intervention Market Size, By Service, 2017 & 2024 (USD Billion)

Over the last few years, several companies have invested in well intervention market, given that these services hold substantial importance across the oil & gas sector. Some of them have brought forth new management services, while many others have designed and developed efficient and effective products for well intervention programs. Pertaining to the expertise offered by prominent well intervention industry players, there have been instances wherein the former have signed contracts with oil and gas companies for plant maintenance. The increasing involvement of companies in well intervention programs to improve the reservoir flow with the help of modern technology aids is poised to impel well intervention market size.

Recently, the Saudi Arabia oil company, Saudi Aramco signed a three-year contract worth 535,000 pounds with Pragma Well Technology. Through this agreement, Pragma will work with the Saudi energy company to increase the production, reduce cost, and improve oil and gas recovery by preventing the ingress of water, oil, and gas in reservoirs. Furthermore, for extending the life of wells prior to the side-tracking, it will use the thru-tubing expandable patch (TEP) involving additive manufacturing. The primary use of advanced techniques over traditional well intervention technique for enhancing the productivity of wells is thus slated to fuel well intervention market share.

Speaking along the same line, on the Norwegian continental shelf, Equinor, that operates nearly 560 subsea wells, constantly requires to maintain, repair, and enhance its production capability. In this regard, in June 2018, the Norwegian multinational energy company Equinor offered a contract to the leading provider of intervention services to the oil and gas industry – Akofs Offshore, between 2020 to 2025. During this five-year period, Akofs Offshore will carry out wireline operations at Equinor’s subsea wells, in addition to being responsible for well control package, well tractor use, and logging services. The surging number of intervention operations in oil fields across the globe will further generate new opportunities for the service providers in well intervention market. The increasing investments in subsea production for tapping a wide range of reservoirs is thus likely to stimulate well intervention industry outlook from offshore applications over the years ahead.

As of now, in the offshore wells, energy companies have been looking forward to optimizing the production in accordance with the increasing preference to achieve operational and financial targets. In this regard, for expanding the customer base, numerous players in the well intervention market have been introducing a new range of services to fulfil the changing customer requirements. Validating the aforementioned fact, in 2017, one of the renowned contributors of well intervention industry, Schlumberger launched IQ production lifecycle management services which can be used for diagnosing, monitoring, and optimizing artificial lift systems in real time. This newly developed service securely collects, transmits, analyze, and understand the data received from customers’ well to extend equipment life and improve the production efficiency. The surging use of modern technologies for maximizing field recovery of wells is slated propel well intervention industry share.

As oil companies continue to focus on cost-reduction and heavy revenue returns, the requirement for well intervention service will increase remarkably over the years ahead. Moreover, the involvement of intervention service providers in the development of flexible and unique products to accelerate productive oil recovery will also stimulate the industry growth. For the record, overall well intervention market size will grow at a CAGR of 6% over 2018-2024.